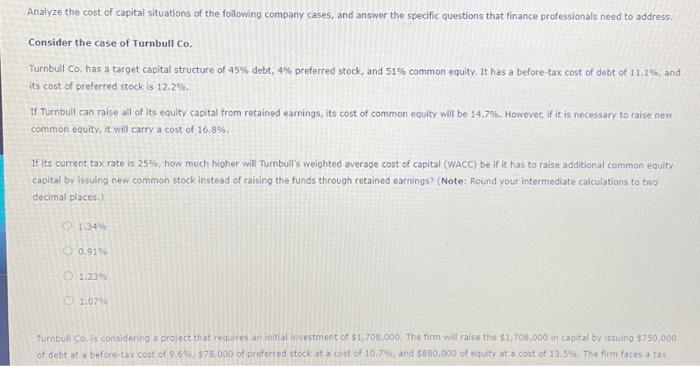

analyze the cost of capital situation of the following company cases, and answer specific questions that finance professionals need to address. consider the case of Turnbull company.

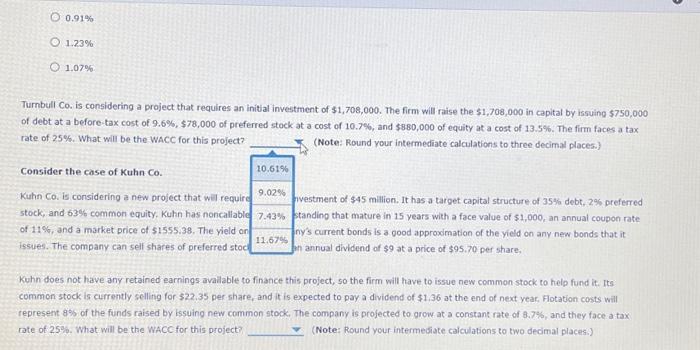

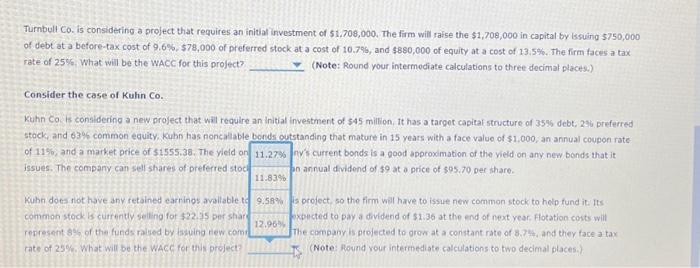

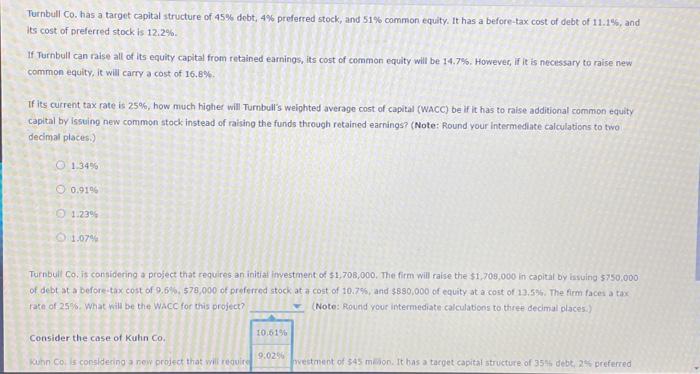

Turnbull Co. has a target capital structure of 45% debt; 4% preferred stock, and 51% common equity. It has a before-tax cost of debt of 11.15 , and its cost of preferred stock is 12,2%. If Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 14.7\%s. However, if it is necessary to raise new common equity, it will carry a cost of 16,8%. If its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WAcC) be if it has to raise additional common equity capital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two decimal places. Turnbuli Co, is considering a project that requires an initiai investment of $1,708,000, The firm will raise the $1,709,000 in capital by issuing 5750,000 of debt at a before-tax cost of 9,6%,578,000 of preferred stock at a cost of 10.7%, and $880,000 of equity at a cost of 13,5%. The firm facei a tax tate of 25%, What will be the WAcC for this project? (Note: Round youe intermediate calculabons to three decimal olaces.) Consider the case of Kutin Co. Wuhn Co is considering a new prodect that wili reguirs vestment of 345 majon. It bas a target capital structure of 35% debt, 24 preferred 0.914%1.23%1.07% Turnbull Co. is considering a project that requires an initial investment of $1,708,000. The firm will raise the $1,708,000 in capital by issuing $750,000 of debt at a before-tax cost of 9.6%,$78,000 of preferred stock at a cost of 10.7%, and $8.80,000 of equity at a cost of 13.5%. The firm faces a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co. is considering a new project that wil require 9.02% mestment of $45 million. It has a target capital structure of 35% debt, 2% preferred stock, and 63% common equity. Kuhn has noncallable 7.43% standino that mature in 15 years with a face value of $1,000, an annual coupon rate of 11%, and a market price of 51555.38 . The yield on 11.67% ny's current bonds is a good approximation of the yield on any new bonds that it issues. The company can sell shares of preferred stoci Kuhn does not have any retained earnings avalable to finance this project, so the firm will have to issue new common stock to help fund it. Its common stock is currently selling for $22,35 per share, and it is expected to pay a dividend of $1,36 at the end of next year, Flotation costs will represent 8% of the funds raised by lssuing new common stock. The company is projected to grow at a constant rate- of 8.7%, and they face a tax rate of 25%. What will be the WACC for this project? (Note: Round your intermediate calculations to two decimal places.) Tumbult Co. is considering a project that requires an initial investment of $1,708,000, The firm will ra5e the $1,708,000 in capital by lssuing $750,000 of debt at a before-tax cost of 9.6%,$78,000 of preferred stock at a cost of 10.799, and 5880,000 of equity at a cost of 13.5%. The firm faces a tax rate of 25%. What will be the wacc for this project (Note: Round your intermediate calculations to three decimal places.) Consider the case of Kuhn Co. Kuhn Co is consldering a new project that wil require an initial investment of 545 milion, tt has a target capital structure of 35% debt, 236 preferred stock, and 63%6 common equity. Kubn has noncallable bonds cotstanding that mature in 15 years with a face value of $1,000, an annual coupon rate of 11%6, and a market price of 51555.36 . The yield on 11.27% nv's current bonds is a good approximation of the yield on any new bonds that it issues. The compary can sell shares of preferred stoc. 11.83% on annual dividend of 59 at a price of 595.70 per share. Kuhn does riot have any retained carrings avallable to 9.58% is oroject, so the firm wer have to issue new common stock to help fund it. Its. common stock is currently seling for $22.45 per shard 12.96% pxpected to pay a dividend of 51.36 at the end of next year. Flotation conts will restesent 8% of the funds ralsed by isuing hew comt The company is projected to grow at a conatant rate of 8.7 .ad, and they face a tax rate of 25%. What wil be the WACC for tivis project? (Note: Rovnd vour intermediate calculations to two decimal places.) Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address. Consider the case of Turnbull co. Turnbull co. has a target capital structure of 45% debt, 4% preferred stock, and 51% common equity, It has a before-tax cost of debt of 11.1%, and its cost of preferred stock is 12.2%. If Tumbull can raise all of its equity capital from retained earnings, its cost of common equity will be 14.7\%. However, if it is necessary to raise new common equity, it will carry a cost of 16.8%. If its current tax rate is 25%, how much higher will Turnbull's weighted aversge cost of capital (WACC) be if it has to raise additional common equity cpital by Issulig new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two decimal places.) 134% 0.91% 1.230 1.075 Tursbun Co. is considenng a project that reacices an inivat investment of $1,708,000. The firm will raise the $1,704,000 in capital by is54ing $750,000 of debt at a before-tax cost or 9.6%5,578,000 of preferred stock at a cost of 10.7 , and 5860.000 of equity at a cont of 13.54 . The firm faces a tax