Question

Analyze the events chronologically, one transaction at a time, beginning with the transaction on the 1st. For each transaction that follows the transaction on the

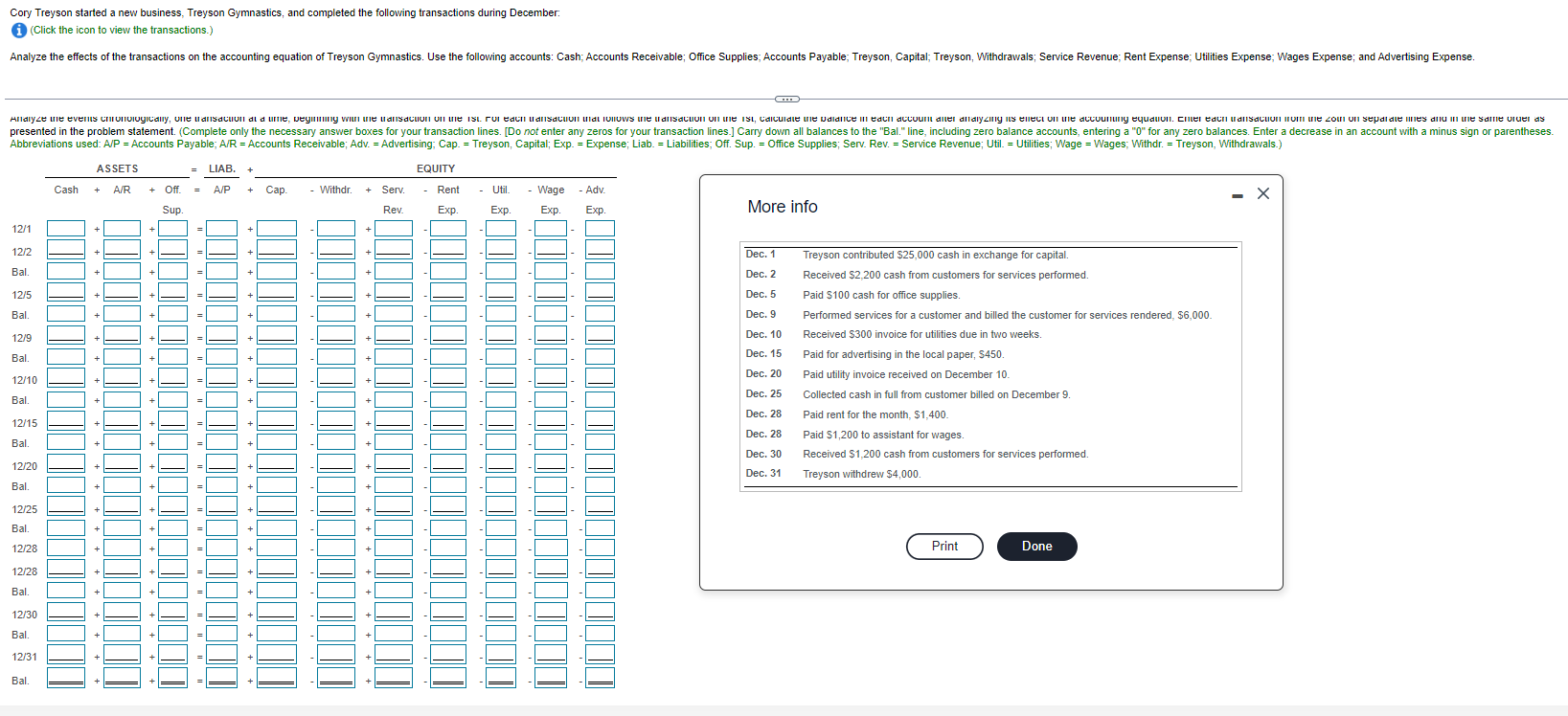

Analyze the events chronologically, one transaction at a time, beginning with the transaction on the 1st. For each transaction that follows the transaction on the 1st, calculate the balance in each account after analyzing its effect on the accounting equation. Enter each transaction from the 28th on separate lines and in the same order as presented in the problem statement. (Complete only the necessary answer boxes for your transaction lines. [Do not enter any zeros for your transaction lines.] Carry down all balances to the "Bal." line, including zero balance accounts, entering a "0" for any zero balances. Enter a decrease in an account with a minus sign or parentheses. Abbreviations used: A/P = Accounts Payable; A/R = Accounts Receivable; Adv. = Advertising; Cap. =Treyson, Capital; Exp. = Expense; Liab. = Liabilities; Off. Sup. = Office Supplies; Serv. Rev. = Service Revenue; Util. = Utilities; Wage = Wages; Withdr. =Treyson, Withdrawals.)

Please help with these questions, thank you!

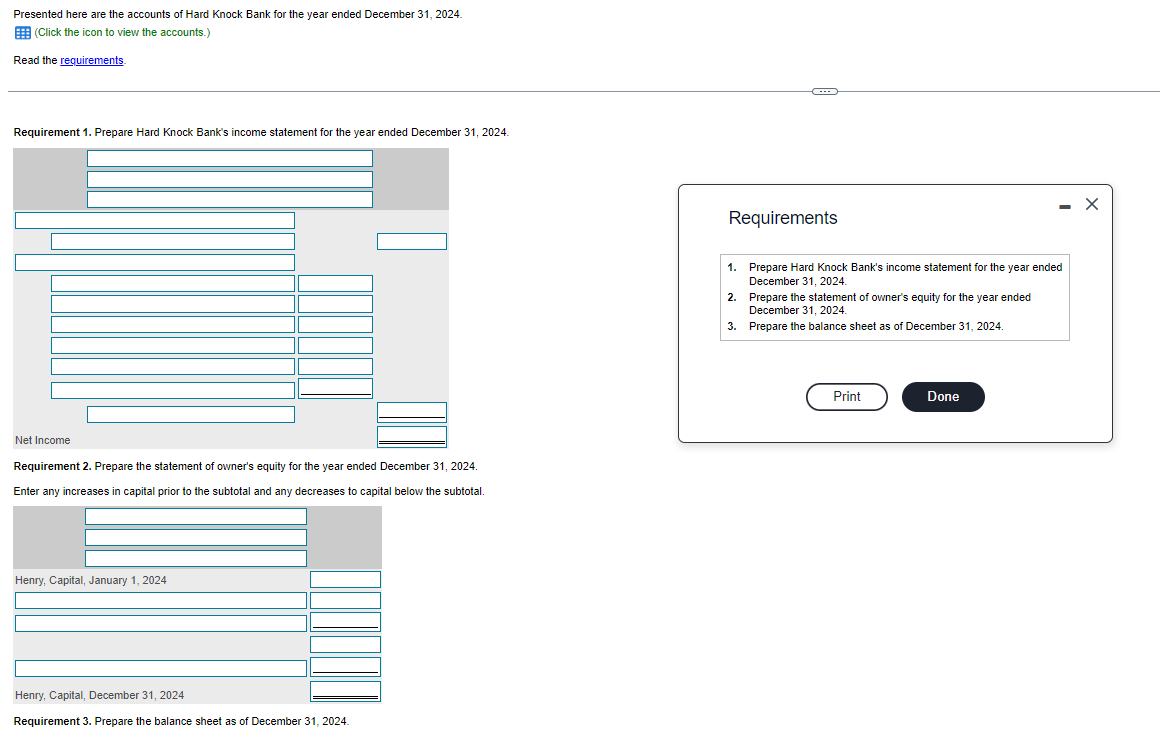

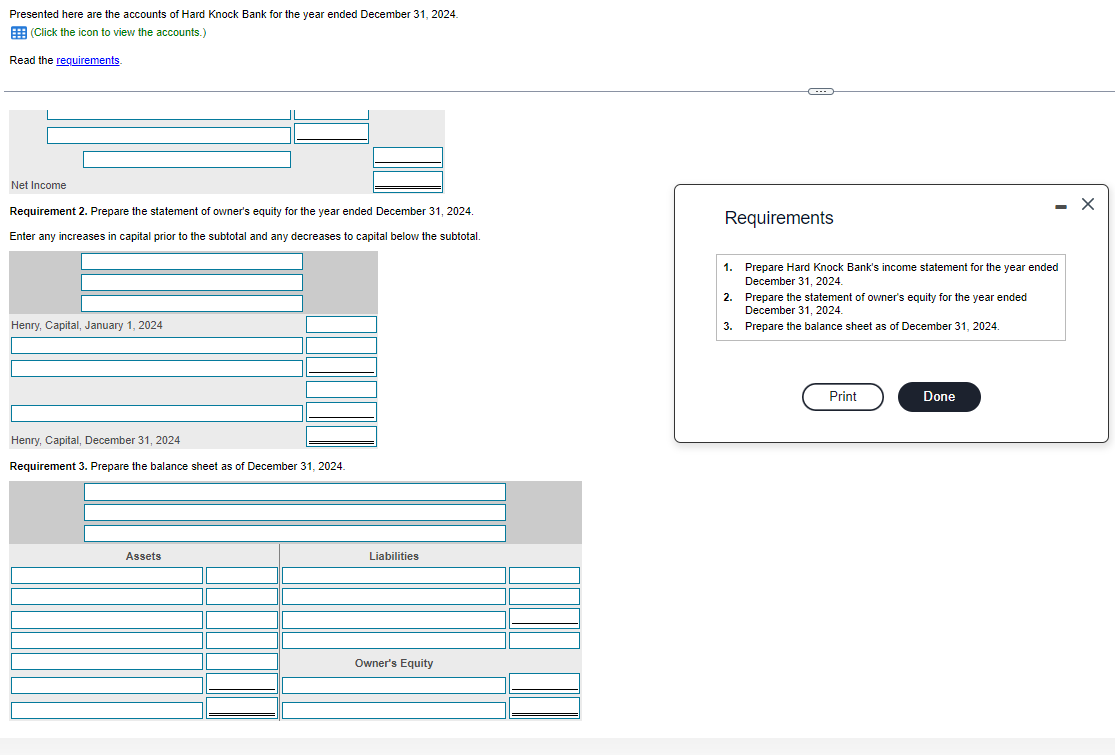

Cory Treyson started a new business, Treyson Gymnastics, and completed the following transactions during December: (Click the icon to view the transactions.) More info Dec. 1 Treyson contributed $25,000 cash in exchange for capital. Dec. 2 Received $2,200 cash from customers for services performed. Dec. 5 Paid $100 cash for office supplies. Dec. 9 Performed services for a customer and billed the customer for services rendered, $6,000 Dec. 10 Received $300 invoice for utilities due in two veeks. Dec. 15 Paid for advertising in the local paper, $450. Dec. 20 Paid utility invoice received on December 10 . Dec. 25 Collected cash in full from customer billed on December 9 . Dec. 28 Paid rent for the month, $1,400. Dec. 28 Paid $1,200 to assistant for wages. Dec. 30 Received $1,200 cash from customers for services performed. Dec. 31 Treyson withdrew $4,000. Presented here are the accounts of Hard Knock Bank for the year ended December 31, 2024. (Click the icon to view the accounts.) Read the Recuuirement 1. Prenare Hard Knock Rank's income statement for the vear ended Der.ember 31, 2024. Requirement 2. Prepare the statement of owner's equity for the year ended December 31, 2024. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Presented here are the accounts of Hard Knock Bank for the year ended December 31, 2024 . (Click the icon to view the accounts.) Read the Requirement 2. Prepare the statement of owner's equity for the year ended December 31, 2024. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Requirements 1. Prepare Hard Knock Bank's income statement for the year ended December 31, 2024. 2. Prepare the statement of owner's equity for the year ended December 31, 2024. 3. Prepare the balance sheet as of December 31, 2024 . Cory Treyson started a new business, Treyson Gymnastics, and completed the following transactions during December: (Click the icon to view the transactions.) More info Dec. 1 Treyson contributed $25,000 cash in exchange for capital. Dec. 2 Received $2,200 cash from customers for services performed. Dec. 5 Paid $100 cash for office supplies. Dec. 9 Performed services for a customer and billed the customer for services rendered, $6,000 Dec. 10 Received $300 invoice for utilities due in two veeks. Dec. 15 Paid for advertising in the local paper, $450. Dec. 20 Paid utility invoice received on December 10 . Dec. 25 Collected cash in full from customer billed on December 9 . Dec. 28 Paid rent for the month, $1,400. Dec. 28 Paid $1,200 to assistant for wages. Dec. 30 Received $1,200 cash from customers for services performed. Dec. 31 Treyson withdrew $4,000. Presented here are the accounts of Hard Knock Bank for the year ended December 31, 2024. (Click the icon to view the accounts.) Read the Recuuirement 1. Prenare Hard Knock Rank's income statement for the vear ended Der.ember 31, 2024. Requirement 2. Prepare the statement of owner's equity for the year ended December 31, 2024. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Presented here are the accounts of Hard Knock Bank for the year ended December 31, 2024 . (Click the icon to view the accounts.) Read the Requirement 2. Prepare the statement of owner's equity for the year ended December 31, 2024. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. Requirements 1. Prepare Hard Knock Bank's income statement for the year ended December 31, 2024. 2. Prepare the statement of owner's equity for the year ended December 31, 2024. 3. Prepare the balance sheet as of December 31, 2024Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started