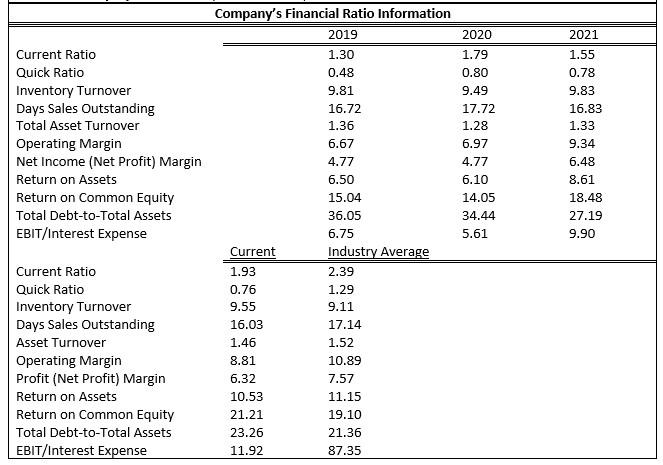

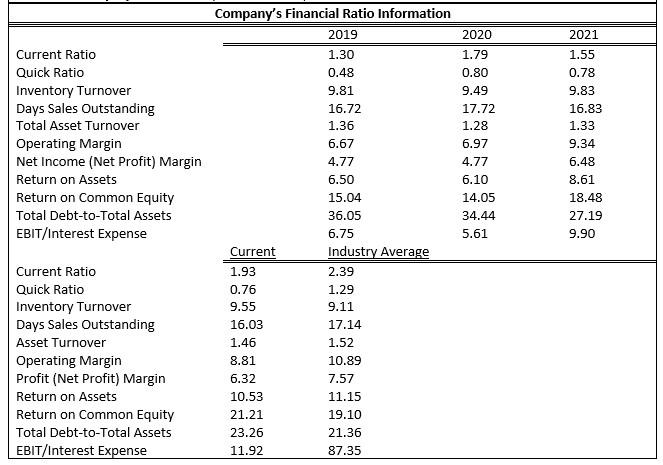

Analyze the financial performance of Tyson Foods using the following financial ratios. Company Basics Company Name: Tyson Foods Inc. Ticker: TSN Basic Description: Tyson Foods, Inc. produces, distributes, and markets chicken, beef, pork, prepared foods, and related allied products. The Company's products are marketed and sold to national and regional grocery retailers, regional grocery wholesalers, meat distributors, warehouse club stores, military commissaries, and industrial food processing companies. Headquarters: Springdale, Arizona Number of Employees: 137,000 (as of 10/02/21) Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Total Asset Turnover Operating Margin Net Income (Net Profit) Margin Return on Assets Return on Common Equity Total Debt-to-Total Assets EBIT/Interest Expense Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Asset Turnover Operating Margin Profit (Net Profit) Margin Return on Assets Return on Common Equity Total Debt-to-Total Assets EBIT/Interest Expense Company's Financial Ratio Information 2019 1.30 0.48 9.81 16.72 1.36 6.67 4.77 6.50 15.04 36.05 6.75 Industry Average 2.39 1.29 9.11 17.14 1.52 10.89 7.57 11.15 19.10 21.36 87.35 Current 1.93 0.76 9.55 16.03 1.46 8.81 6.32 10.53 21.21 23.26 11.92 2020 1.79 0.80 9.49 17.72 1.28 6.97 4.77 6.10 14.05 34.44 5.61 2021 1.55 0.78 9.83 16.83 1.33 9.34 6.48 8.61 18.48 27.19 9.90 1. Provide an overview of the company and its line of business. 2. Use benchmarking and time series analysis to find the company's liquidity. asset management, debt, and profitability. Provide the P/E ratio for your company and offers a judgement on whether the stock is undervalued. overvalued or fairly valued. 3. Is the future of this company growth or decline? Why? Analyze the financial performance of Tyson Foods using the following financial ratios. Company Basics Company Name: Tyson Foods Inc. Ticker: TSN Basic Description: Tyson Foods, Inc. produces, distributes, and markets chicken, beef, pork, prepared foods, and related allied products. The Company's products are marketed and sold to national and regional grocery retailers, regional grocery wholesalers, meat distributors, warehouse club stores, military commissaries, and industrial food processing companies. Headquarters: Springdale, Arizona Number of Employees: 137,000 (as of 10/02/21) Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Total Asset Turnover Operating Margin Net Income (Net Profit) Margin Return on Assets Return on Common Equity Total Debt-to-Total Assets EBIT/Interest Expense Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Asset Turnover Operating Margin Profit (Net Profit) Margin Return on Assets Return on Common Equity Total Debt-to-Total Assets EBIT/Interest Expense Company's Financial Ratio Information 2019 1.30 0.48 9.81 16.72 1.36 6.67 4.77 6.50 15.04 36.05 6.75 Industry Average 2.39 1.29 9.11 17.14 1.52 10.89 7.57 11.15 19.10 21.36 87.35 Current 1.93 0.76 9.55 16.03 1.46 8.81 6.32 10.53 21.21 23.26 11.92 2020 1.79 0.80 9.49 17.72 1.28 6.97 4.77 6.10 14.05 34.44 5.61 2021 1.55 0.78 9.83 16.83 1.33 9.34 6.48 8.61 18.48 27.19 9.90 1. Provide an overview of the company and its line of business. 2. Use benchmarking and time series analysis to find the company's liquidity. asset management, debt, and profitability. Provide the P/E ratio for your company and offers a judgement on whether the stock is undervalued. overvalued or fairly valued. 3. Is the future of this company growth or decline? Why