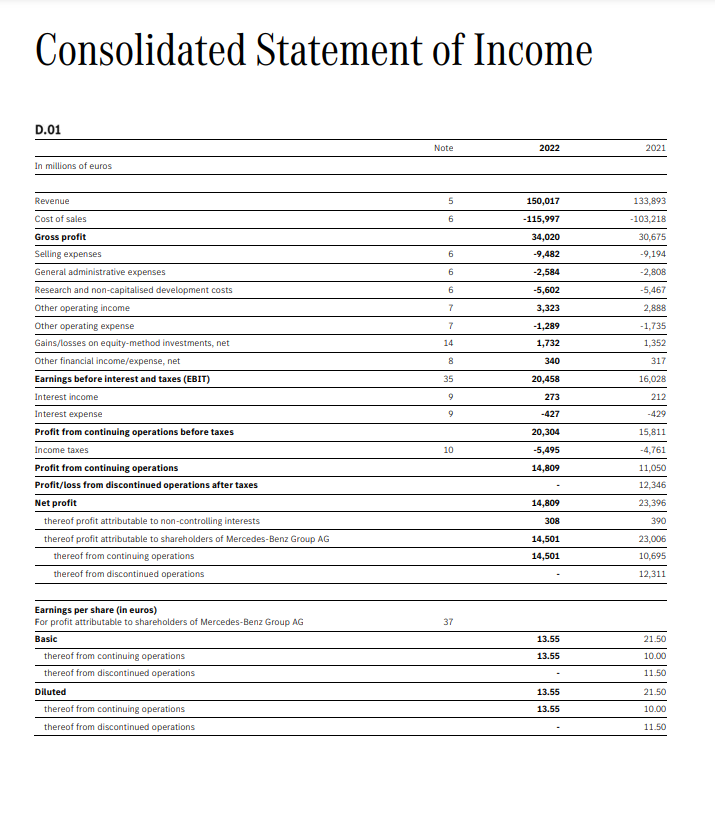

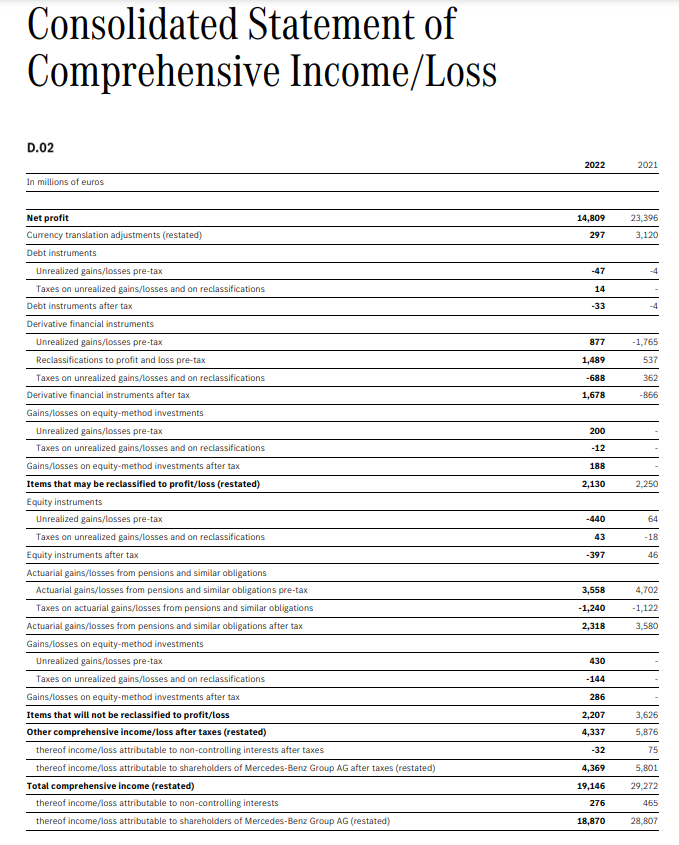

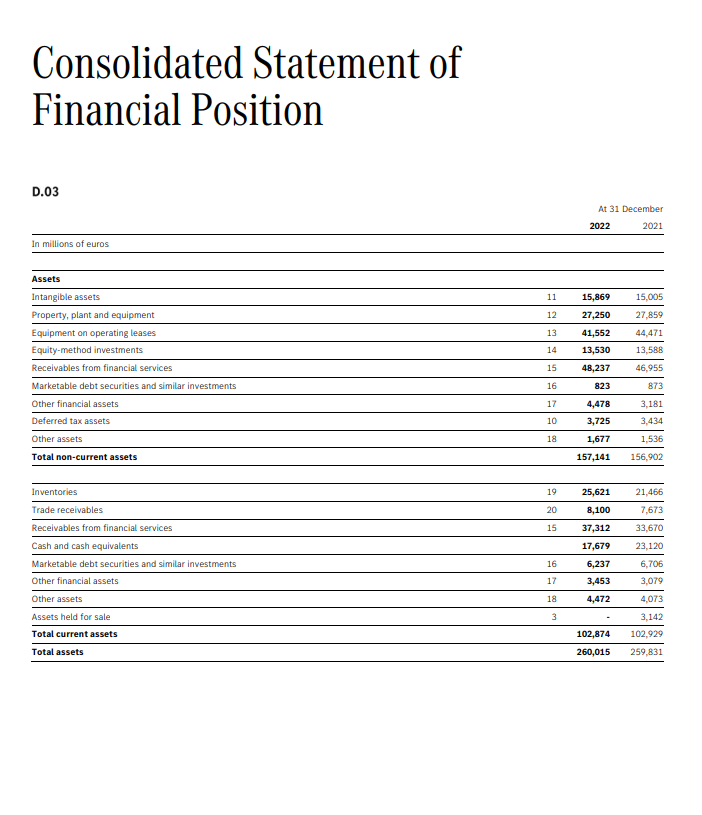

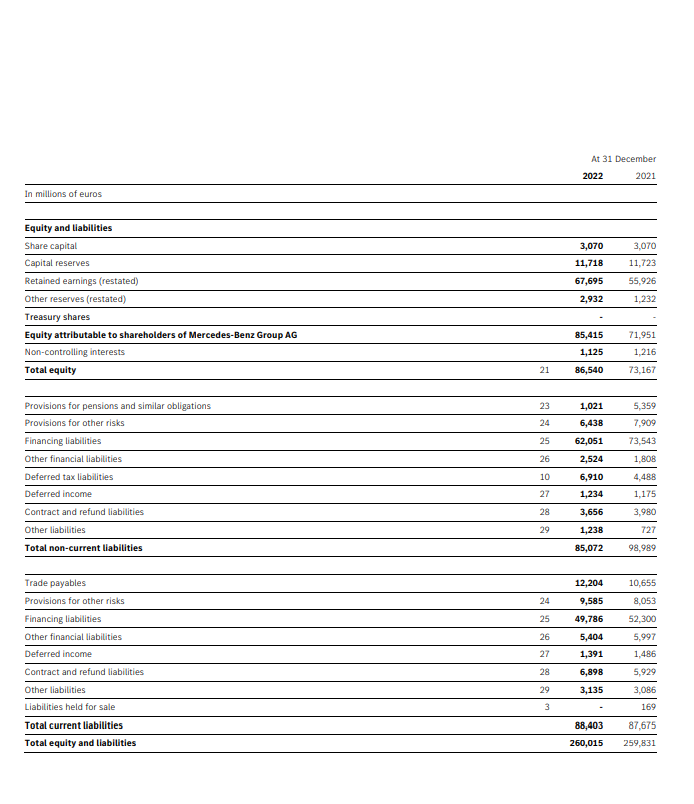

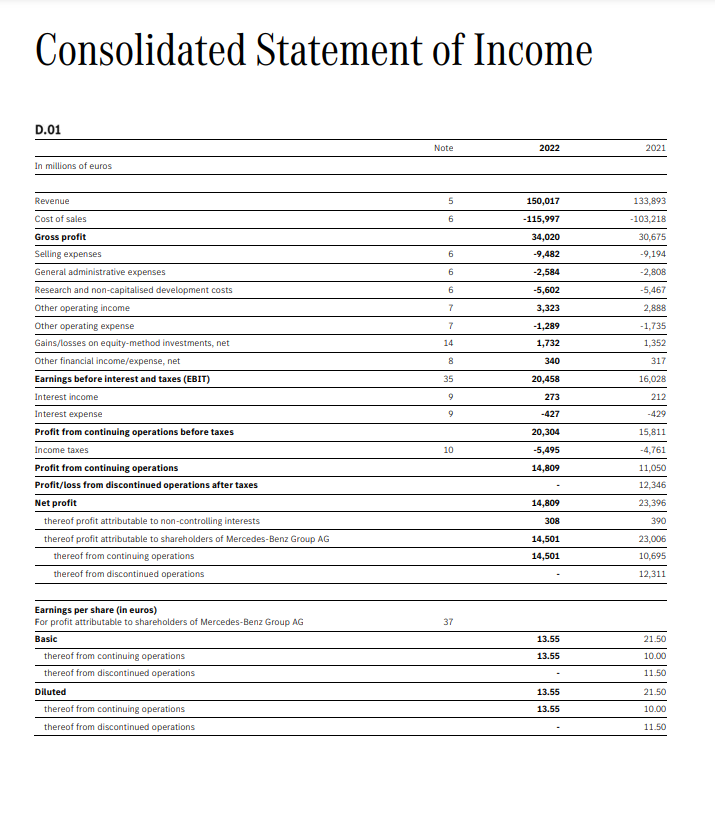

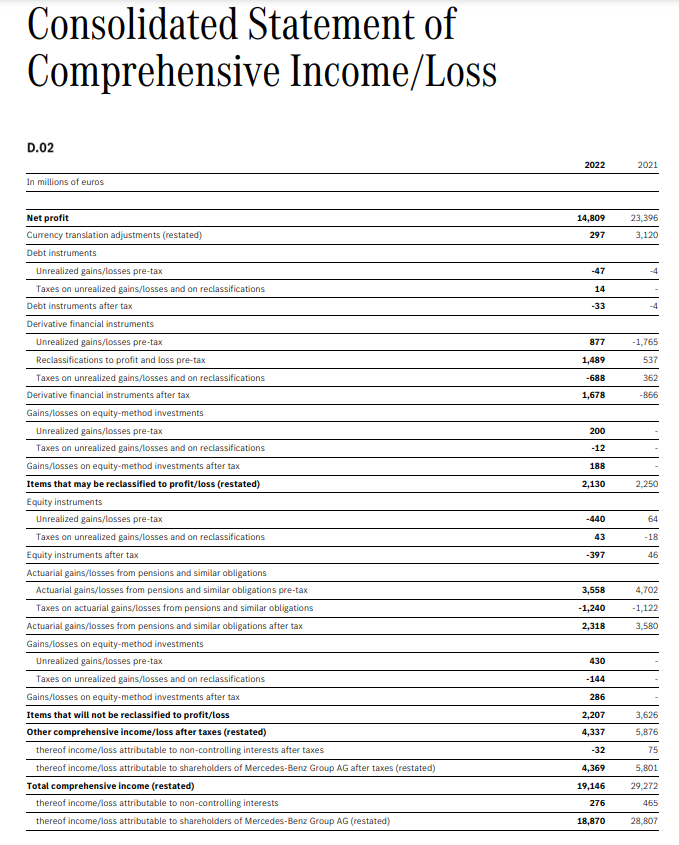

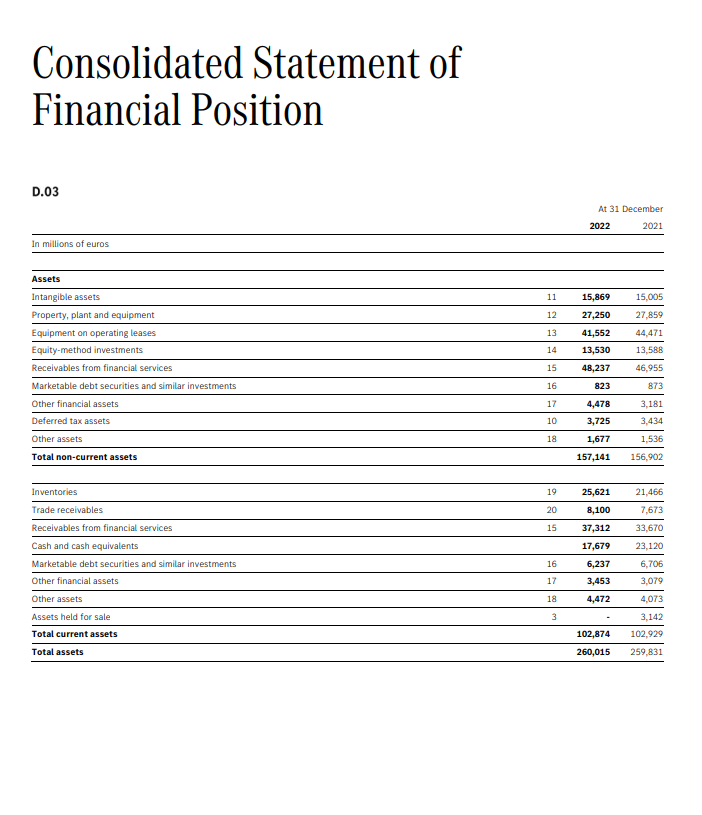

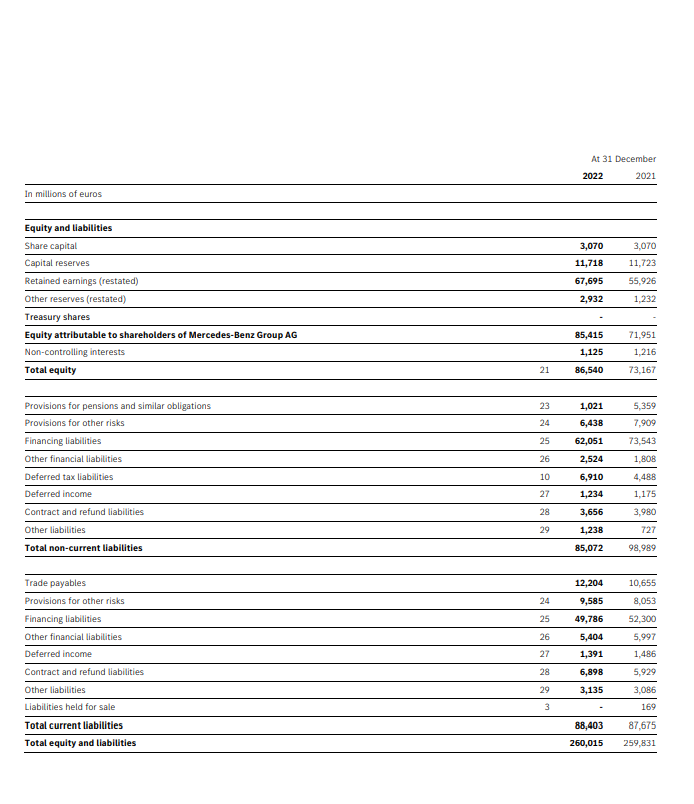

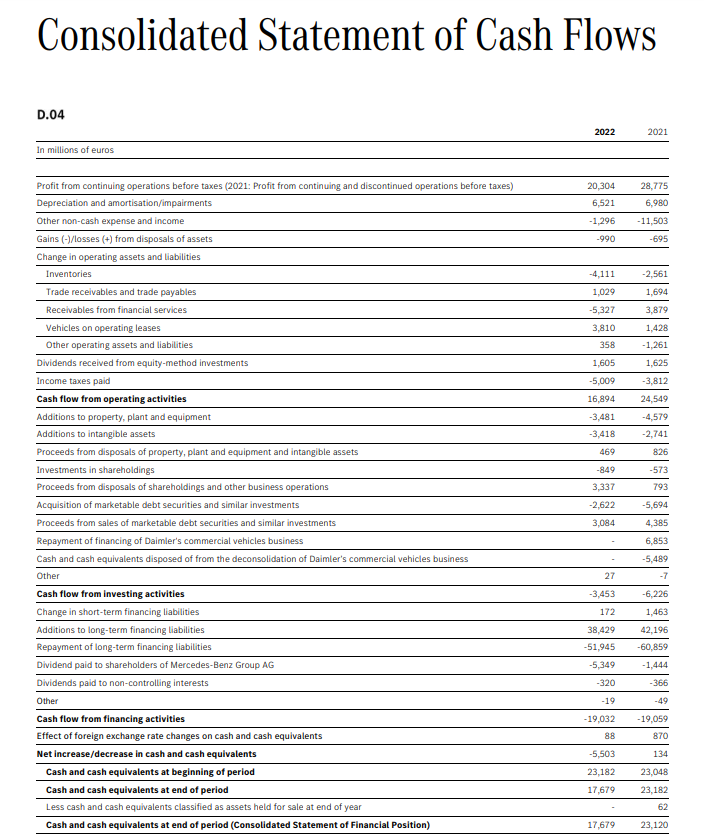

Analyze the financial statements of Mercedes Daimler, provide detailed assumptions (always justify why you take a specific assumption), and answer to the following questions: Make estimates of total variable and fixed costs (1), contribution margin (1) and contribution margin ratio (1); Calculate the break-even point (1), the time when the break-even point is reached (1) (which month of the year), and the margin of safety (1); Calculate the degree of operating leverage, financial leverage and co,mbined leverage (1); Provide a general assessment of the risk of the firm on the basis of this CVP (cost volume profit) analysis (2).

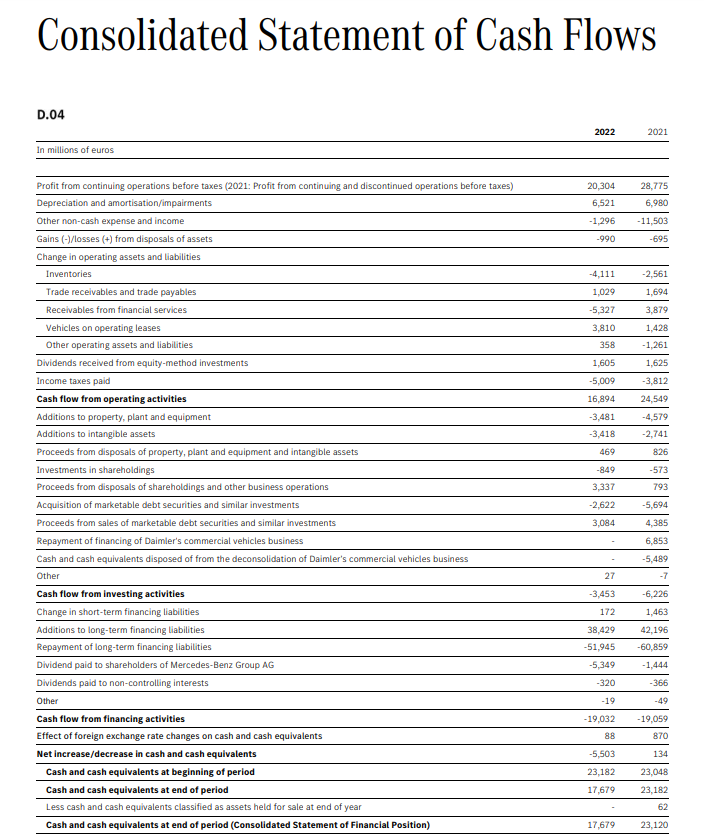

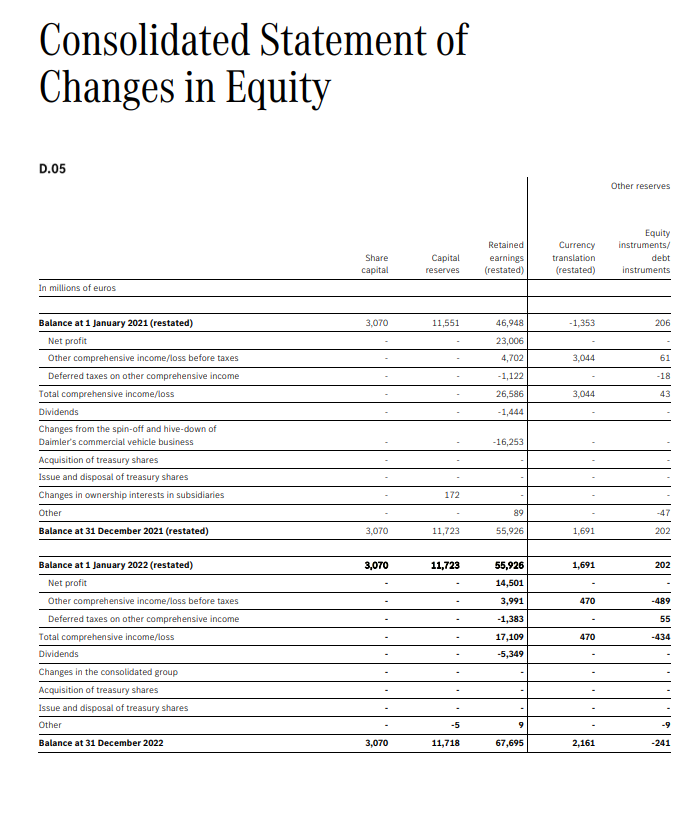

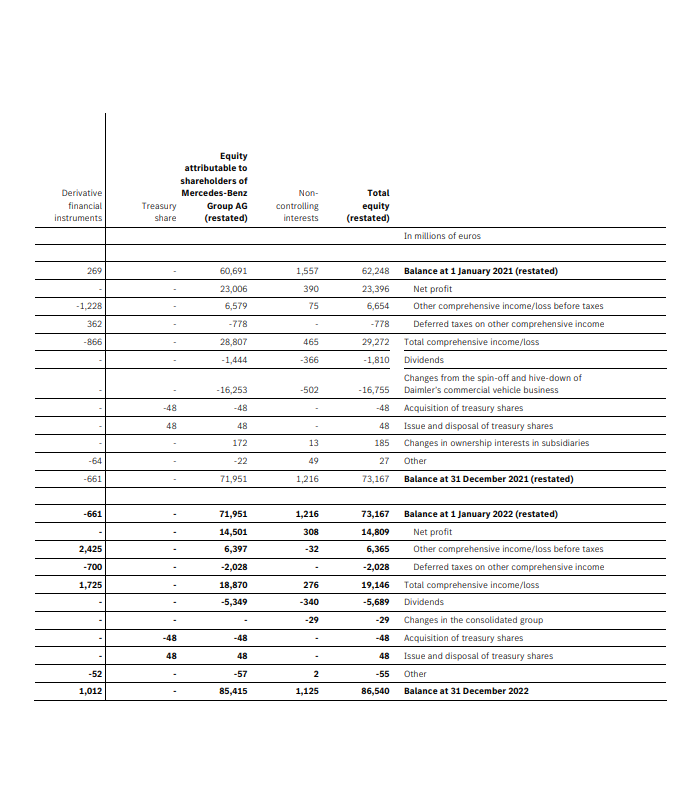

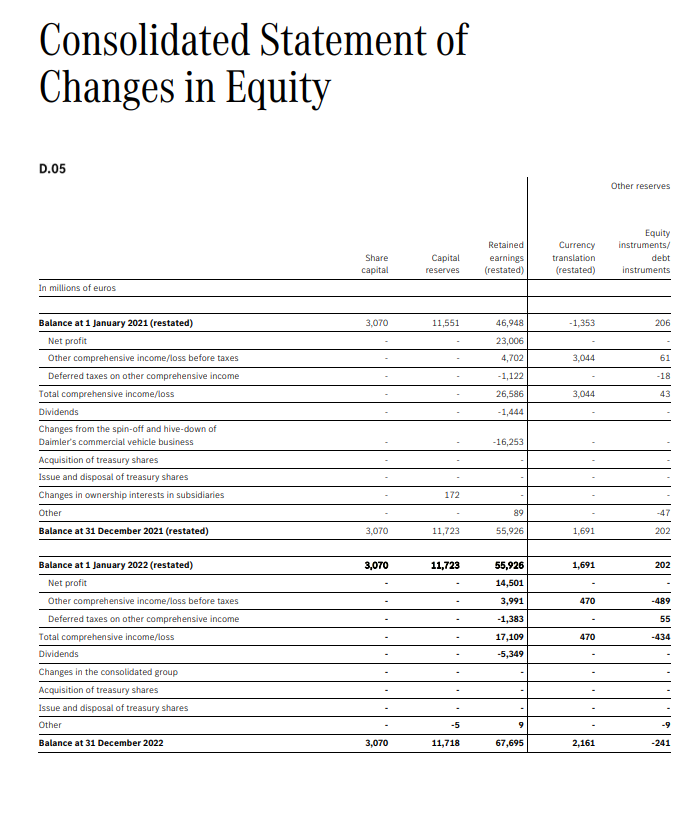

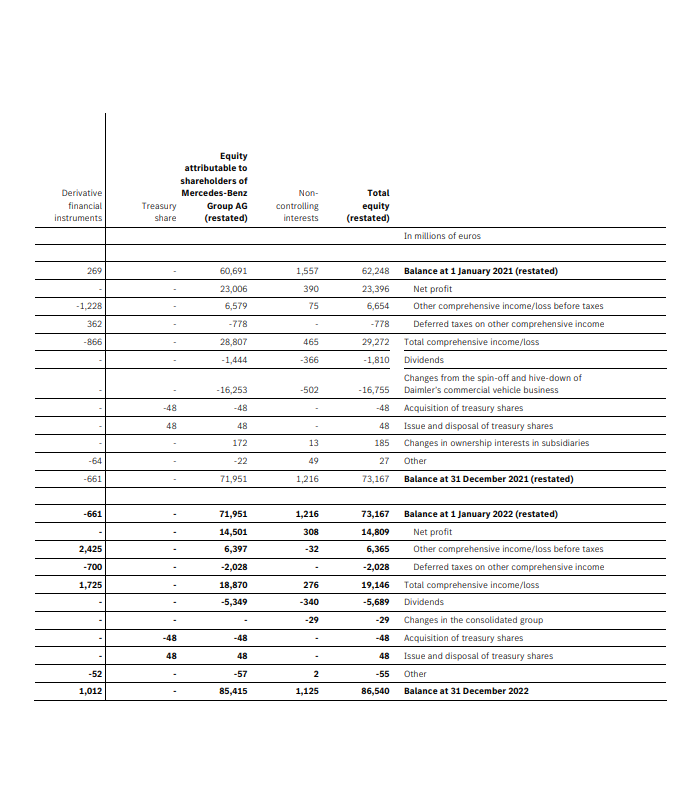

Consolidated Statement of Comprehensive Income/Loss \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{\begin{tabular}{r} Derivative \\ financial \\ instruments \\ \end{tabular}} & \multirow[t]{2}{*}{\begin{tabular}{r} Treasury \\ share \\ \end{tabular}} & \begin{tabular}{r} Equity \\ ributable to \\ reholders of \\ cedes-Benz \\ Group AG \\ (restated) \end{tabular} & \multirow[t]{2}{*}{\begin{tabular}{r} Non- \\ controlling \\ interests \end{tabular}} & \multirow[t]{2}{*}{\begin{tabular}{r} Total \\ equity \\ (restated) \end{tabular}} & \\ \hline & & \multicolumn{2}{|c|}{ In millions of euros } & & \\ \hline 269 & - & 60,691 & 1,557 & 62,248 & Balance at 1 January 2021 (restated) \\ \hline- & - & 23,006 & 390 & 23,396 & Net profit \\ \hline1,228 & - & 6,579 & 75 & 6,654 & Other comprehensive income/loss before taxes \\ \hline 362 & - & -778 & - & -778 & Deferred taxes on other comprehensive income \\ \hline-866 & - & 28,807 & 465 & 29,272 & Total comprehensive income/loss \\ \hline- & - & 1,444 & -366 & 1,810 & Dividends \\ \hline- & - & 16,253 & -502 & 16,755 & \begin{tabular}{l} Changes from the spin-off and hive-down of \\ Daimler's commercial vehicle business \end{tabular} \\ \hline- & -48 & -48 & - & -48 & Acquisition of treasury shares \\ \hline- & 48 & 48 & - & 48 & Issue and disposal of treasury shares \\ \hline- & - & 172 & 13 & 185 & Changes in ownership interests in subsidiaries \\ \hline-64 & - & -22 & 49 & 27 & Other \\ \hline-661 & - & 71,951 & 1,216 & 73,167 & Balance at 31 December 2021 (restated) \\ \hline-661 & - & 71,951 & 1,216 & 73,167 & Balance at 1 January 2022 (restated) \\ \hline - & - & 14,501 & 308 & 14,809 & Net profit \\ \hline 2,425 & - & 6,397 & -32 & 6,365 & Other comprehensive income/loss before taxes \\ \hline-700 & - & 2,028 & - & 2,028 & Deferred taxes on other comprehensive income \\ \hline 1,725 & - & 18,870 & 276 & 19,146 & Total comprehensive income/loss \\ \hline- & - & 5,349 & -340 & 5,689 & Dividends \\ \hline- & - & - & -29 & -29 & Changes in the consolidated group \\ \hline- & -48 & -48 & - & -48 & Acquisition of treasury shares \\ \hline- & 48 & 48 & - & 48 & Issue and disposal of treasury shares \\ \hline-52 & - & -57 & 2 & -55 & Other \\ \hline 1,012 & - & 85,415 & 1,125 & 86,540 & Balance at 31 December 2022 \\ \hline \end{tabular} Consolidated Statement of Cash Flows Consolidated Statement of Income Consolidated Statement of Financial Position Consolidated Statement of Comprehensive Income/Loss \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{\begin{tabular}{r} Derivative \\ financial \\ instruments \\ \end{tabular}} & \multirow[t]{2}{*}{\begin{tabular}{r} Treasury \\ share \\ \end{tabular}} & \begin{tabular}{r} Equity \\ ributable to \\ reholders of \\ cedes-Benz \\ Group AG \\ (restated) \end{tabular} & \multirow[t]{2}{*}{\begin{tabular}{r} Non- \\ controlling \\ interests \end{tabular}} & \multirow[t]{2}{*}{\begin{tabular}{r} Total \\ equity \\ (restated) \end{tabular}} & \\ \hline & & \multicolumn{2}{|c|}{ In millions of euros } & & \\ \hline 269 & - & 60,691 & 1,557 & 62,248 & Balance at 1 January 2021 (restated) \\ \hline- & - & 23,006 & 390 & 23,396 & Net profit \\ \hline1,228 & - & 6,579 & 75 & 6,654 & Other comprehensive income/loss before taxes \\ \hline 362 & - & -778 & - & -778 & Deferred taxes on other comprehensive income \\ \hline-866 & - & 28,807 & 465 & 29,272 & Total comprehensive income/loss \\ \hline- & - & 1,444 & -366 & 1,810 & Dividends \\ \hline- & - & 16,253 & -502 & 16,755 & \begin{tabular}{l} Changes from the spin-off and hive-down of \\ Daimler's commercial vehicle business \end{tabular} \\ \hline- & -48 & -48 & - & -48 & Acquisition of treasury shares \\ \hline- & 48 & 48 & - & 48 & Issue and disposal of treasury shares \\ \hline- & - & 172 & 13 & 185 & Changes in ownership interests in subsidiaries \\ \hline-64 & - & -22 & 49 & 27 & Other \\ \hline-661 & - & 71,951 & 1,216 & 73,167 & Balance at 31 December 2021 (restated) \\ \hline-661 & - & 71,951 & 1,216 & 73,167 & Balance at 1 January 2022 (restated) \\ \hline - & - & 14,501 & 308 & 14,809 & Net profit \\ \hline 2,425 & - & 6,397 & -32 & 6,365 & Other comprehensive income/loss before taxes \\ \hline-700 & - & 2,028 & - & 2,028 & Deferred taxes on other comprehensive income \\ \hline 1,725 & - & 18,870 & 276 & 19,146 & Total comprehensive income/loss \\ \hline- & - & 5,349 & -340 & 5,689 & Dividends \\ \hline- & - & - & -29 & -29 & Changes in the consolidated group \\ \hline- & -48 & -48 & - & -48 & Acquisition of treasury shares \\ \hline- & 48 & 48 & - & 48 & Issue and disposal of treasury shares \\ \hline-52 & - & -57 & 2 & -55 & Other \\ \hline 1,012 & - & 85,415 & 1,125 & 86,540 & Balance at 31 December 2022 \\ \hline \end{tabular} Consolidated Statement of Cash Flows Consolidated Statement of Income Consolidated Statement of Financial Position