Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the firms current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firms liquidity, activity ,

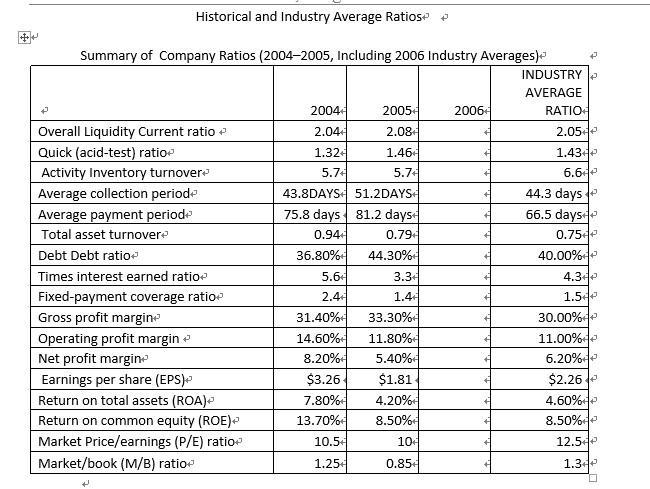

Analyze the firm’s current financial position from both a cross-sectional and a time-series viewpoint. Break your analysis into evaluations of the firm’s liquidity, activity, debt, profitability, and market.

Summarize the firm’s overall financial position on the basis of your findings in part b.

Historical and Industry Average Ratios Summary of Company Ratios (2004-2005, Including 2006 Industry Averages) < Overall Liquidity Current ratio + Quick (acid-test) ration Activity Inventory turnover Average collection periode Average payment periode Total asset turnover Debt Debt ratio Times interest earned ratio Fixed-payment coverage ratio Gross profit margine Operating profit margin Net profit margine Earnings per share (EPS) Return on total assets (ROA) Return on common equity (ROE)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the firms current financial position lets break it down into different categories from both a crosssectional and timeseries viewpoint 1 Liq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started