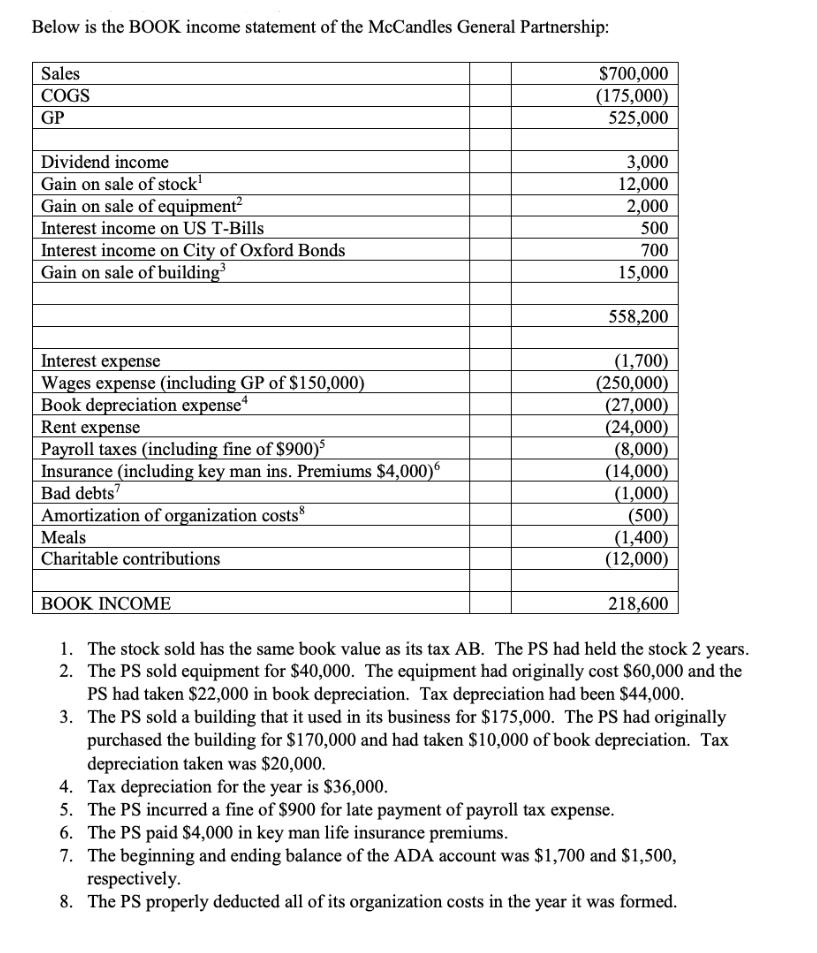

Below is the BOOK income statement of the McCandles General Partnership: Sales COGS GP Dividend income Gain on sale of stock Gain on sale

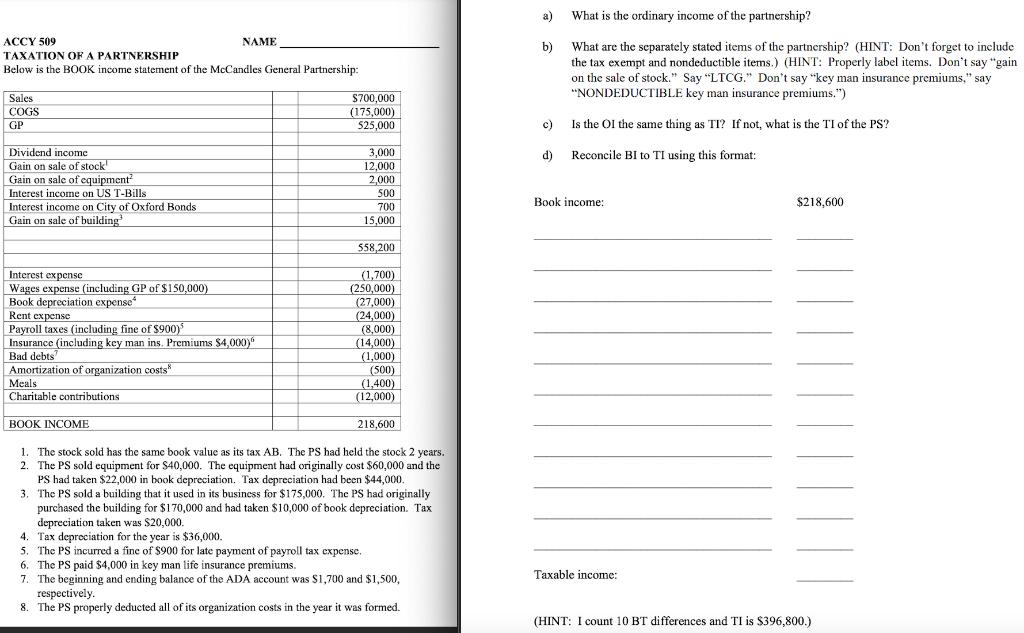

Below is the BOOK income statement of the McCandles General Partnership: Sales COGS GP Dividend income Gain on sale of stock Gain on sale of equipment Interest income on US T-Bills Interest income on City of Oxford Bonds Gain on sale of building3 Interest expense Wages expense (including GP of $150,000) Book depreciation expense4 Rent expense Payroll taxes (including fine of $900)5 Insurance (including key man ins. Premiums $4,000) Bad debts Amortization of organization costs Meals Charitable contributions $700,000 (175,000) 525,000 BOOK INCOME 3,000 12,000 2,000 (8,000) (14,000) (1,000) (500) (1,400) (12,000) 218,600 1. The stock sold has the same book value as its tax AB. The PS had held the stock 2 years. 2. The PS sold equipment for $40,000. The equipment had originally cost $60,000 and the PS had taken $22,000 in book depreciation. Tax depreciation had been $44,000. 3. The PS sold a building that it used in its business for $175,000. The PS had originally purchased the building for $170,000 and had taken $10,000 of book depreciation. Tax depreciation taken was $20,000. 500 700 15,000 558,200 (1,700) (250,000) (27,000) (24,000) 4. Tax depreciation for the year is $36,000. 5. The PS incurred a fine of $900 for late payment of payroll tax expense. 6. The PS paid $4,000 in key man life insurance premiums. 7. The beginning and ending balance of the ADA account was $1,700 and $1,500, respectively. 8. The PS properly deducted all of its organization costs in the year it was formed. ACCY 509 TAXATION OF A PARTNERSHIP Below is the BOOK income statement of the McCandles General Partnership: Sales COGS GP Dividend income Gain on sale of stock Gain on sale of equipment Interest income on US T-Bills Interest income on City of Oxford Bonds Gain on sale of building Interest expense Wages expense (including GP of $150,000) Book depreciation expense Rent expense Payroll taxes (including fine of $900) Insurance (including key man ins. Premiums $4,000) Bad debts Amortization of organization costs Meals Charitable contributions NAME BOOK INCOME $700,000 (175,000) 525,000 3,000 12,000 2,000 500 700 15,000 558,200 (1,700) (250,000) (27,000) (24,000) (8,000) (14,000) (1,000) (500) (1,400) (12,000) 218,600 1. The stock sold has the same book value as its tax AB. The PS had held the stock 2 years. 2. The PS sold equipment for $40,000. The equipment had originally cost $60,000 and the PS had taken $22,000 in book depreciation. Tax depreciation had been $44,000. 3. The PS sold a building that it used in its business for $175,000. The PS had originally purchased the building for $170,000 and had taken $10,000 of book depreciation. Tax depreciation taken was $20,000. 4. Tax depreciation for the year is $36,000. 5. The PS incurred a fine of $900 for late payment of payroll tax expense. 6. The PS paid $4,000 in key man life insurance premiums. 7. The beginning and ending balance of the ADA account was $1,700 and $1,500, respectively. 8. The PS properly deducted all of its organization costs in the year it was formed. What is the ordinary income of the partnership? What are the separately stated items of the partnership? (HINT: Don't forget to include the tax exempt and nondeductible items.) (HINT: Properly label items. Don't say "gain on the sale of stock." Say "LTCG." Don't say "key man insurance premiums," say "NONDEDUCTIBLE key man insurance premiums.") c) Is the OI the same thing as TI? If not, what is the TI of the PS? Reconcile BI to TI using this format: a) b) d) Book income: Taxable income: $218,600 (HINT: I count 10 BT differences and TI is $396,800.)

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a What is the ordinary income of the partnership The ordinary income of the McCandles General Partnership is 218600 This figure is calculated by subtr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started