Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the impact of the increase in sales over the next year. eCar expects that automobile sales will increase significantly over the next year. During

- Analyze the impact of the increase in sales over the next year. eCar expects that automobile sales will increase significantly over the next year. During the year covered by the data in Exhibit eCar produced and delivered about cars. eCar expects that sales will increase to about cars next year.

- Consider the following questions related to the impact of this increase in sales

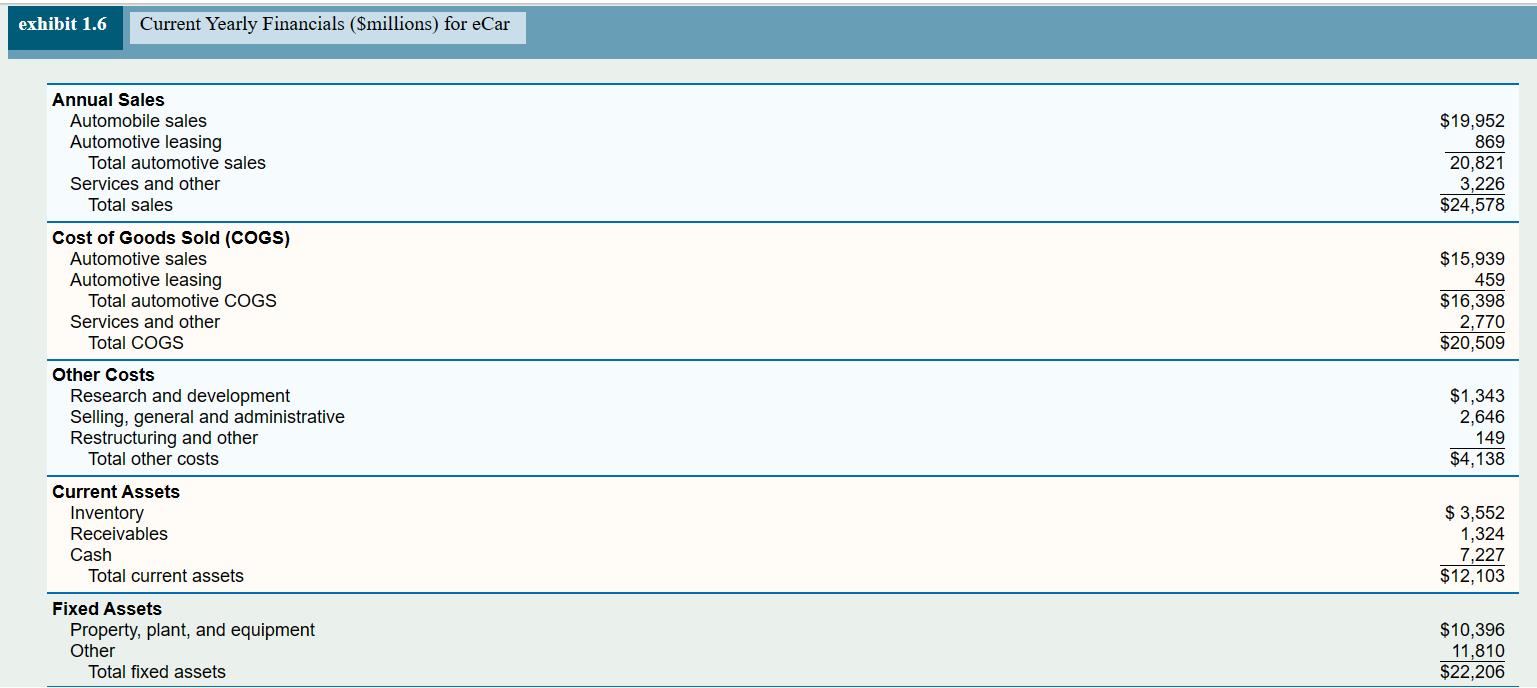

- .aUsing your spreadsheet, calculate the average revenue sales price and cost of each car produced last year. Base the cost estimate on the automotive sales COGS this reflects the variable cost for each carbAssume that the relationships between average revenue and cost stay the same next year revenuecar and variable costcar stay the same and that nothing else changes in the financials. If sales do improve to cars, what would be the expected profit margin, asset turnover, and return on assets if it were possible for the company to do this?cWhat questions might you explore with management to evaluate the assumptions that were made in your calculations?Current Yearly Financials $millions for eCar

exhibit 1.6 Current Yearly Financials (Smillions) for eCar Annual Sales Automobile sales Automotive leasing Total automotive sales Services and other Total sales Cost of Goods Sold (COGS) Automotive sales Automotive leasing Total automotive COGS Services and other Total COGS Other Costs Research and development Selling, general and administrative Restructuring and other Total other costs Current Assets Inventory Receivables Cash Total current assets Fixed Assets Property, plant, and equipment Other Total fixed assets $19,952 869 20,821 3,226 $24,578 $15,939 459 $16,398 2,770 $20,509 $1,343 2,646 149 $4,138 $ 3,552 1,324 7,227 $12,103 $10,396 11,810 $22,206

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets calculate the expected profit margin asset turnover and return on assets if eCars sales in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started