Question

Analyze the most recent annual reports of two Canadian retailing firms, Roots Corporation (hereafter referred to as Roots) and Reitmans (Canada) Limited. (hereafter referred to

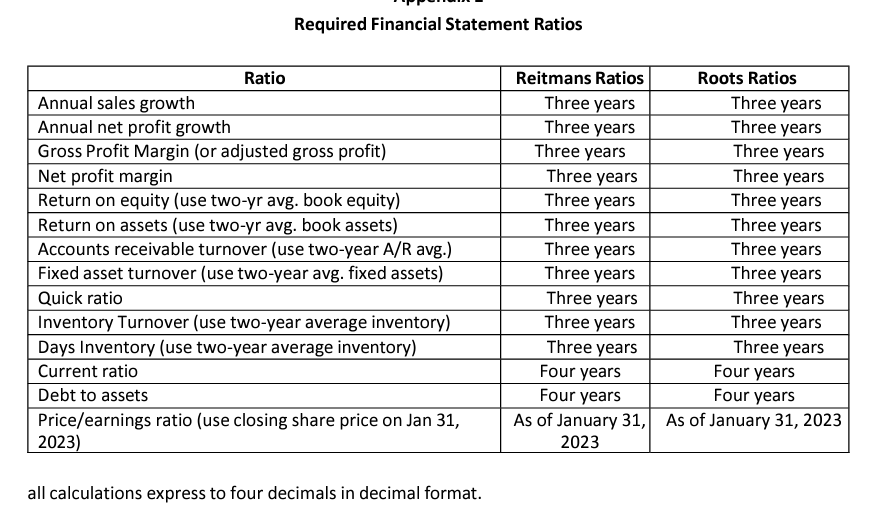

Analyze the most recent annual reports of two Canadian retailing firms, Roots Corporation (hereafter referred to as Roots) and Reitmans (Canada) Limited. (hereafter referred to as Reitmans). Calculate the financial statement ratios listed below using the Excel file with four years of restated and standardized financial statements for Roots and Reitmans. Aim to calculate ratios for at least three years. For each ratio, comment on the trend and possible explanations (including information provided in the annual reports). All calculations should be supported by calculations in Excel.

Aim for a paragraph of explanation for each ratio. Ratio calculations should be in the table above (with all calculations supported in the excel document).

Required Financial Statement Ratios all calculations express to four decimals in decimal format. Required Financial Statement Ratios all calculations express to four decimals in decimal formatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started