Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze the problem situation(s) described below. Organize and record your work for each of the following tasks. Using precise mathematical language, justify and explain

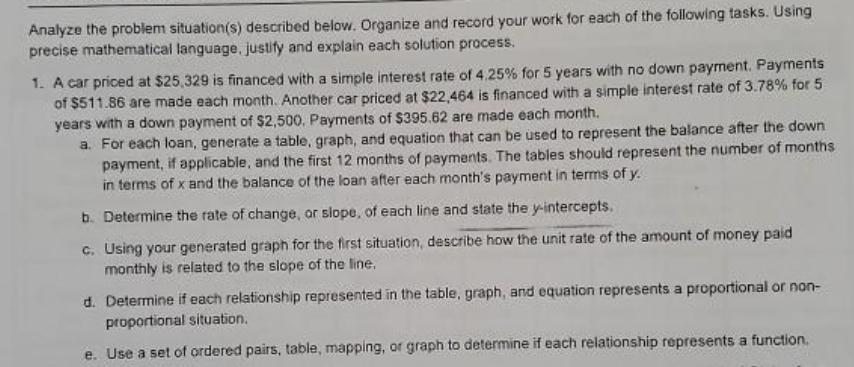

Analyze the problem situation(s) described below. Organize and record your work for each of the following tasks. Using precise mathematical language, justify and explain each solution process. 1. A car priced at $25,329 is financed with a simple interest rate of 4.25% for 5 years with no down payment. Payments of $511.86 are made each month. Another car priced at $22,464 is financed with a simple interest rate of 3.78% for 5 years with a down payment of $2,500. Payments of $395.62 are made each month. a. For each loan, generate a table, graph, and equation that can be used to represent the balance after the down payment, if applicable, and the first 12 months of payments. The tables should represent the number of months in terms of x and the balance of the loan after each month's payment in terms of y. b. Determine the rate of change, or slope, of each line and state the y-intercepts. c. Using your generated graph for the first situation, describe how the unit rate of the amount of money paid monthly is related to the slope of the line. d. Determine if each relationship represented in the table, graph, and equation represents a proportional or non- proportional situation. e. Use a set of ordered pairs, table, mapping, or graph to determine if each relationship represents a function.

Step by Step Solution

★★★★★

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

a Lets generate the tables graphs and equations for each loan Loan 1 The car is priced at 25329 financed at a simple interest rate of 425 for 5 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started