Answered step by step

Verified Expert Solution

Question

1 Approved Answer

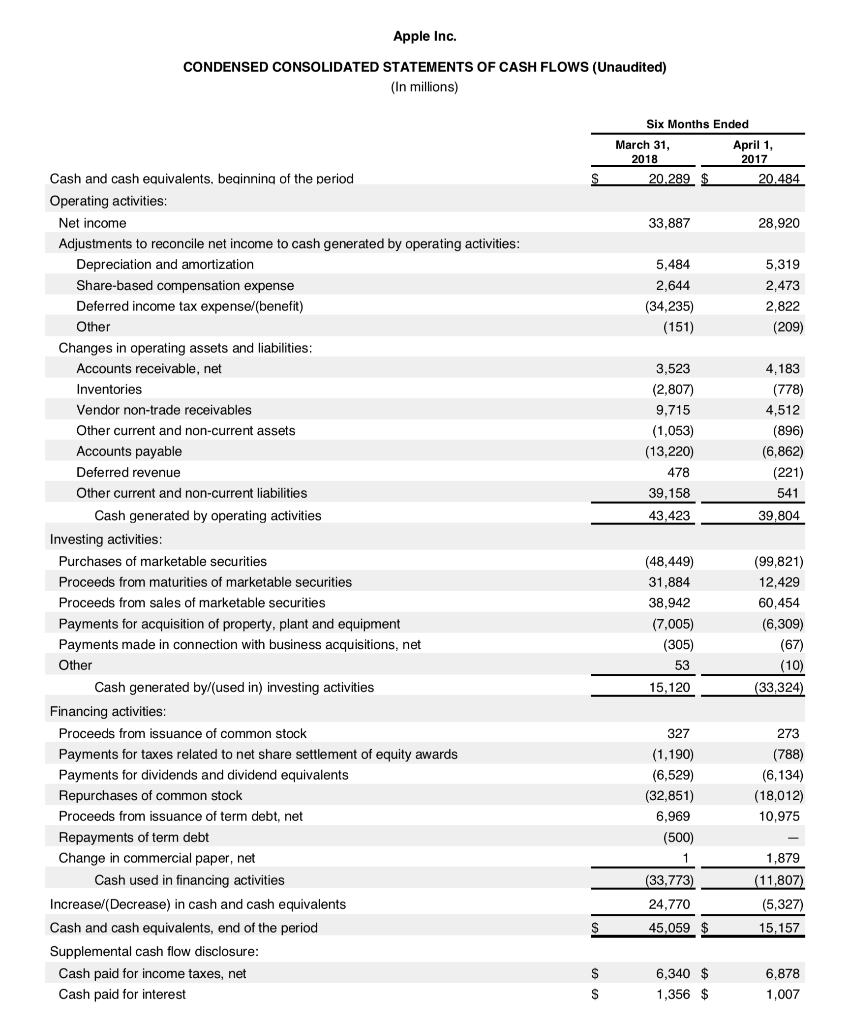

Analyze the Statement of Cash Flows for Apple inc. 1.Discuss the change in cash flows for the three (3) different categories of cash flows and

Analyze the Statement of Cash Flows for Apple inc. 1.Discuss the change in cash flows for the three (3) different categories of cash flows and identify the totals for each category and at least one (1) significant item in each. Be sure to interpret this information in terms of the long-term health of the company. Provide support for your response.

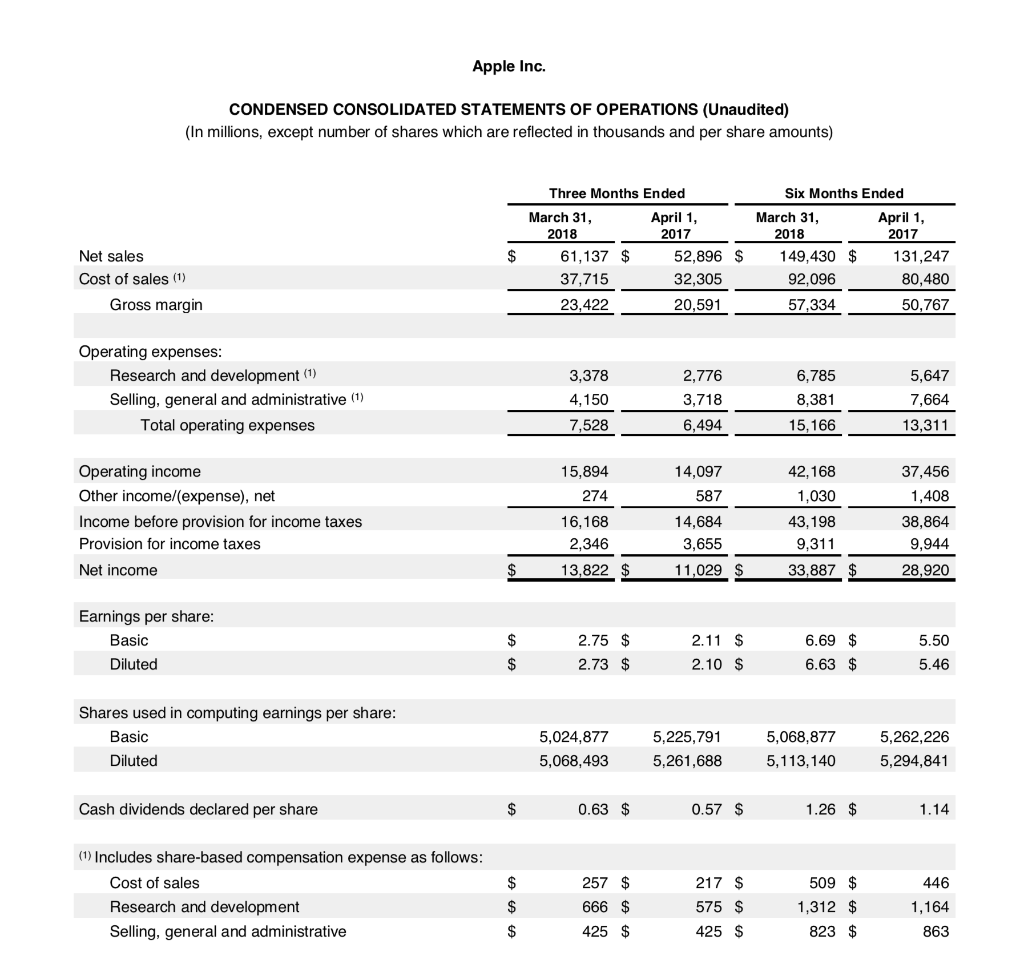

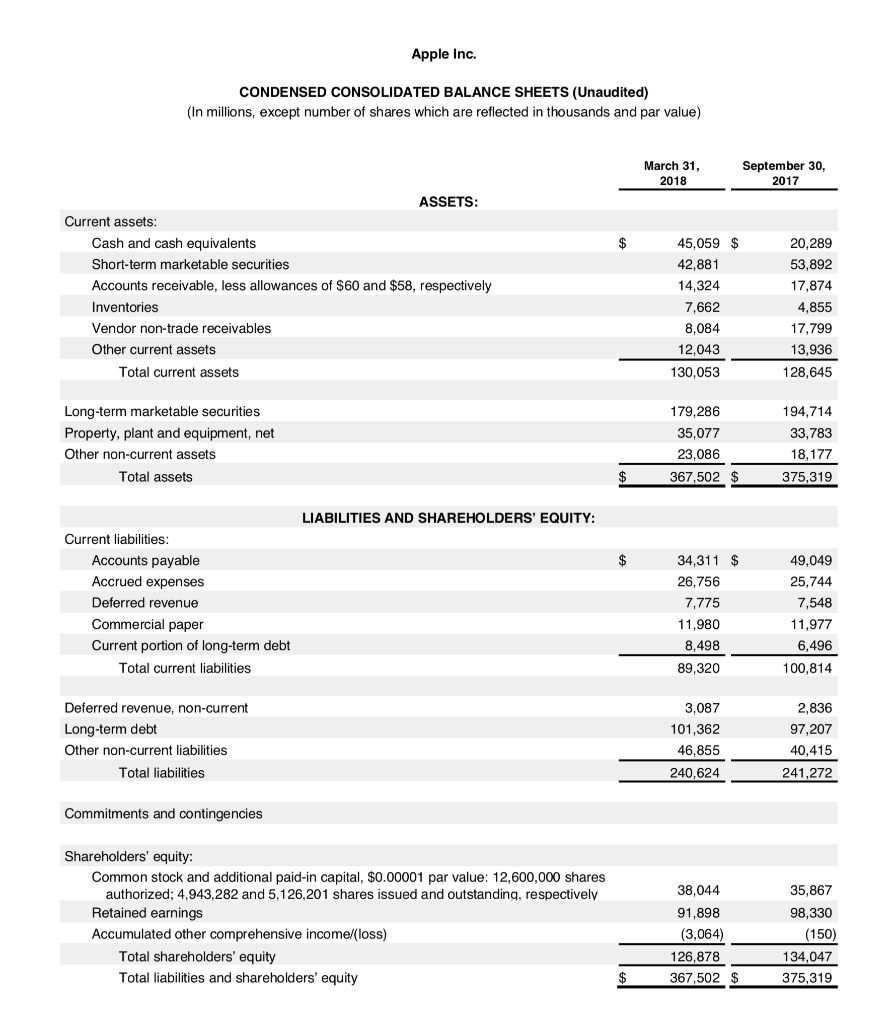

Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (In millions, except number of shares which are reflected in thousands and per share amounts) Three Months Ended Six Months Ended March 31, April 1, 2017 March 31 2018 2018 2017 Net sales Cost of sales (1) 61,137 $ 37,715 23,422 52,896 32,305 20,591 149,430 $ 131,247 80,480 50,767 92,096 Gross margin 57,334 Operating expenses Research and development (1) Selling, general and administrative) 3,378 4,150 7,528 2,776 3,718 6,494 6,785 8,381 15,166 5,647 7,664 13,311 Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income 15,894 274 16,168 2,346 13,822 $ 14,097 587 14,684 3,655 11,029 $ 42,168 1,030 43,198 9,311 37,456 1,408 38,864 9,944 28,920 33,887$ Earnings per share Basic Diluted 2.75 $ 6.69 $ 5.50 5.46 Shares used in computing earnings per share Basic Diluted 5,024,877 5,068,493 5,225,791 5,261,688 5,068,877 5,113,140 5,262,226 5,294,841 Cash dividends declared per share 0.57 S (1) Includes share-based compensation expense as follows Cost of sales Research and development Selling, general and administrative 257 $ 666 $ 425 $ 575 $ 425 $ 509 $ 1,312 $ 446 1,164 863 Apple Ind. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In millions, except number of shares which are reflected in thousands and par value) March 31 2018 September 30, 2017 ASSETS Current assets Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $60 and $58, respectively Inventories Vendor non-trade receivables Other current assets 45,059 $ 42,881 14,324 7,662 8,084 12,043 130,053 20,289 53,892 17,874 4,855 17,799 13,936 128,645 Total current assets Long-term marketable securities Property, plant and equipment, net Other non-current assets 179,286 35,077 23,086 367,502 $ 194,714 33,783 18,177 375,319 Total assets LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities Accounts payable Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt 49,049 25,744 7,548 11,977 6,496 100,814 34,311 $ 26,756 7,775 11,980 8,498 89,320 Total current liabilities Deferred revenue, non-current Long-term debt Other non-current liabilities 3,087 101,362 46,855 240,624 2,836 97,207 40,415 241,272 Total liabilities Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares 38,044 91,898 (3,064) 126,878 35,867 98,330 (150) 134,047 375,319 authorized; 4,943,282 and 5,126,201 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income (loss) Total shareholders' equity Total liabilities and shareholders' equity 367,502 $ Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (In millions) Six Months Ended March 31 April 1, 2017 2018 Cash and cash equivalents, beginning of the period Operating activities Net income 33,887 28,920 Adjustments to reconcile net income to cash generated by operating activities Depreciation and amortization Share-based compensation expense Deferred income tax expense/(benefit) Other 5,484 2,644 (34,235) 5,319 2,473 2,822 (209) Changes in operating assets and liabilities Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities 3,523 (2,807) 9,715 4,183 (778) 4,512 (896) (13,220) 478 39,158 43.423 (221) 541 39,804 Cash generated by operating activities Investing activities Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Other (48,449) 31,884 38,942 005 (99,821) 12,429 60,454 (6,309) (67) (10) 33,324 53 Cash generated by/(used in) investing activities 15,120 Financing activities Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Change in commercial paper, net 327 (6,529) (32,851) 6,969 (500) 273 (788) (6,134) (18,012) 10,975 1,879 11,807 Cash used in financing activities Increase/(Decrease) in cash and cash equivalents Cash and cash equivalents, end of the period Supplemental cash flow disclosure 24,770 45,059 15,157 Cash paid for income taxes, net Cash paid for interest 6,340 $ 1,356 $ 6,878 1,007Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started