Answered step by step

Verified Expert Solution

Question

1 Approved Answer

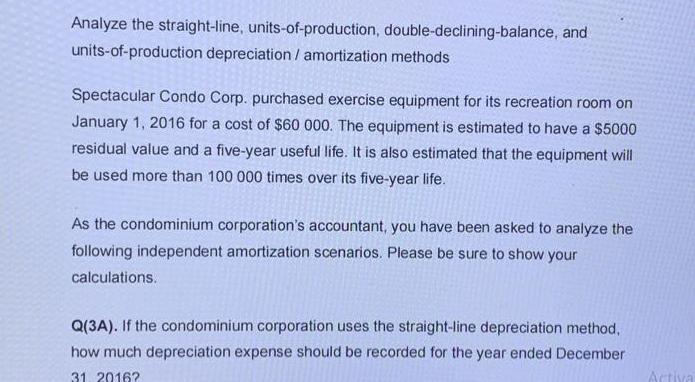

Analyze the straight-line, units-of-production, double-declining-balance, and units-of-production depreciation / amortization methods Spectacular Condo Corp. purchased exercise equipment for its recreation room on January 1,

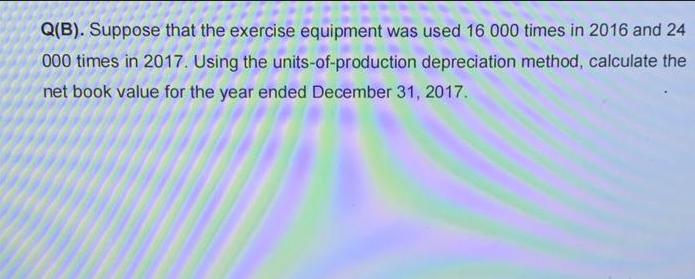

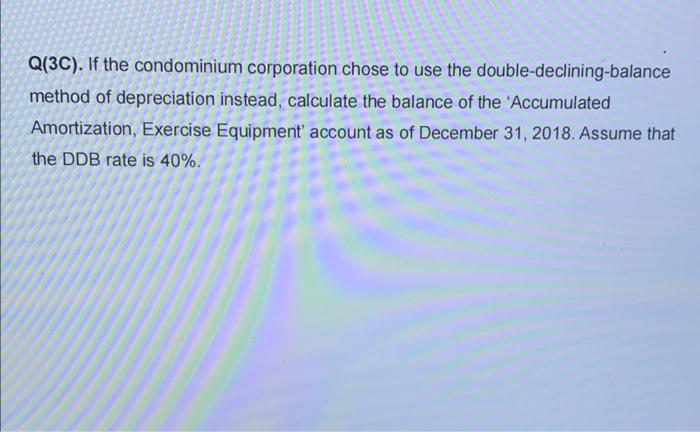

Analyze the straight-line, units-of-production, double-declining-balance, and units-of-production depreciation / amortization methods Spectacular Condo Corp. purchased exercise equipment for its recreation room on January 1, 2016 for a cost of $60 000. The equipment is estimated to have a $5000 residual value and a five-year useful life. It is also estimated that the equipment will be used more than 100 000 times over its five-year life. As the condominium corporation's accountant, you have been asked to analyze the following independent amortization scenarios. Please be sure to show your calculations. Q(3A). If the condominium corporation uses the straight-line depreciation method, how much depreciation expense should be recorded for the year ended December 31, 2016? Activa Q(B). Suppose that the exercise equipment was used 16 000 times in 2016 and 24 000 times in 2017. Using the units-of-production depreciation method, calculate the net book value for the year ended December 31, 2017. Q(3C). If the condominium corporation chose to use the double-declining-balance method of depreciation instead, calculate the balance of the 'Accumulated Amortization, Exercise Equipment' account as of December 31, 2018. Assume that the DDB rate is 40%. Q(3D). Assuming that the condominium corporation is calculating amortization for internal purposes, which method would you recommend? Explain why. Q(3E). Explain how your chosen method would be similar or different from the method required for taxation purposes here in Canada. In Canada you are unable to use the previous method when claiming a depreciation expense on your taxes. If you acquired a depreciable asset (tangible asset), such as a building, furniture, or equipment, to use in your business or professional activities you are required to use the Capital Cost Allowance method (CCA). You can claim a portion of the assets cost each year as a deduction is called a capital cost allowance (CCA).

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

It seems that you are asking for help with a series of questions related to the depreciation calculations of exercise equipment owned by Spectacular Condo Corp using different methods of depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started