Question

Analyze this case and: Examine the case below and do the following: 1.Indicates the income items that are part of the gross income. 2.Indicates the

Analyze this case and:

Examine the case below and do the following:

1.Indicates the income items that are part of the gross income.

2.Indicates the salary exclusions.

3.Identify the deductions to which the taxpayer is entitled to calculate the adjusted gross income.

4.Calculate adjusted gross income.

5.Indicates the status that the taxpayer must file.

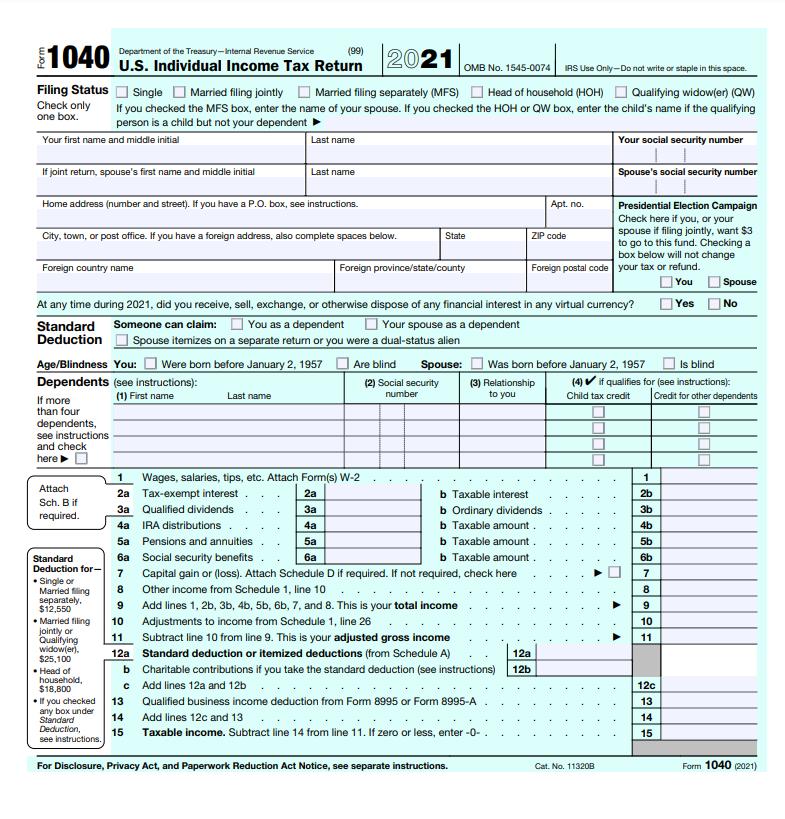

6.Fill out Form 1040.

Case 1

José Pérez is an administrator of a private company, where his salary for this taxable year was $70,000. He received $15,000 in dividends from a corporation in which he invested and a $50,000 inheritance. In addition, he received $10,000 in interest from a cooperative of which he is a member. José is married to Rafaela Morales, who is disabled and receives $20,000 in social security.

The taxpayer, credits and deductions

Introduction

We must analyze the responsibility of the taxpayer to report all the income generated, without distinction of origin. Discuss the most common elements, which include the credits and deductions allowed in the Federal Internal Revenue Code of the EE.UU.. Determine the individual income subject to the payment of taxes and, through this process, we will be able to calculate the adjusted gross income after discounting the deductions and exclusions allowed, as well as calculate the net income subject to taxes.

Analyze this case and:

Examine the case below and do the following:

1.Indicates the income items that are part of the gross income.

2.Indicates the salary exclusions.

3.Identify the deductions to which the taxpayer is entitled to calculate the adjusted gross income.

4.Calculate adjusted gross income.

5.Indicates the status that the taxpayer must file.

6.Fill out Form 1040.

Case 1

José Pérez is an administrator of a private company, where his salary for this taxable year was $70,000. He received $15,000 in dividends from a corporation in which he invested and a $50,000 inheritance. In addition, he received $10,000 in interest from a cooperative of which he is a member. José is married to Rafaela Morales, who is disabled and receives $20,000 in social security.

1040 Filing Status Single Married filing jointly Check only one box. Your first name and middle initial If joint return, spouse's first name and middle initial Home address (number and street). If you have a P.O. box, see instructions. Department of the Treasury-Internal Revenue Service (99) 2021 U.S. Individual Income Tax Return City, town, or post office. If you have a foreign address, also complete spaces below. Foreign country name If more than four dependents, OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Married filing separately (MFS) Head of household (HOH) Qualifying widow(er) (QW) If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is a child but not your dependent Last name Your social security number see instructions and check here Age/Blindness You: Were born before January 2, 1957 Dependents (see instructions): (1) First name Attach Sch. Bif required. Standard Deduction for- Single or Married filing separately. $12,550 Married filing jointly or Qualifying widow(er). $25,100 Head of household, $18,800 If you checked any box under Standard Deduction, see instructions. At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Standard Someone can claim: You as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Last name Last name 12a b c 13 14 15 1 Wages, salaries, tips, etc. Attach Form(s) W-2 2a Tax-exempt interest 3a Qualified dividends State Foreign province/state/county 2a 3a 4a 5a 6a Your spouse as a dependent Are blind Spouse: (2) Social security number 4a 5a 6a 7 8 9 10 11 Subtract line 10 from line 9. This is your adjusted gross income Standard deduction or itemized deductions (from Schedule A) Charitable contributions if you take the standard deduction (see instructions) Add lines 12a and 12b Qualified business income deduction from Form 8995 or Form 8995-A Add lines 12c and 13 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- b Taxable interest b Ordinary dividends IRA distributions. b Taxable amount. Pensions and annuities b Taxable amount. Social security benefits b Taxable amount. Capital gain or (loss). Attach Schedule D if required. If not required, check here Other income from Schedule 1, line 10 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income Adjustments to income from Schedule 1, line 26 Presidential Election Campaign Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign postal code your tax or refund. You Yes For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Apt. no. ZIP code Was born before January 2, 1957 (3) Relationship to you Spouse's social security number 12a 12b Cat. No. 11320B Is blind (4) if qualifies for (see instructions): Credit for other dependents Child tax credit U A A 1 2b 3b 4b 5b 6b 7 8 9 10 11 Spouse No 12c 13 14 15 Form 1040 (2021)

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Introduction Effective communication and managing workplace drama are crucial aspects of maintaining a healthy work environment In Anastasia Penrights TED talk 5 Steps to Removing Yourself from Drama ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started