Analyze three items on the balance sheet (or balance sheet-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the companys performance related to these items appears to be improving, deteriorating, or remaining stable. Justify your answer.

Analyze three items on the balance sheet (or balance sheet-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the companys performance related to these items appears to be improving, deteriorating, or remaining stable. Justify your answer.

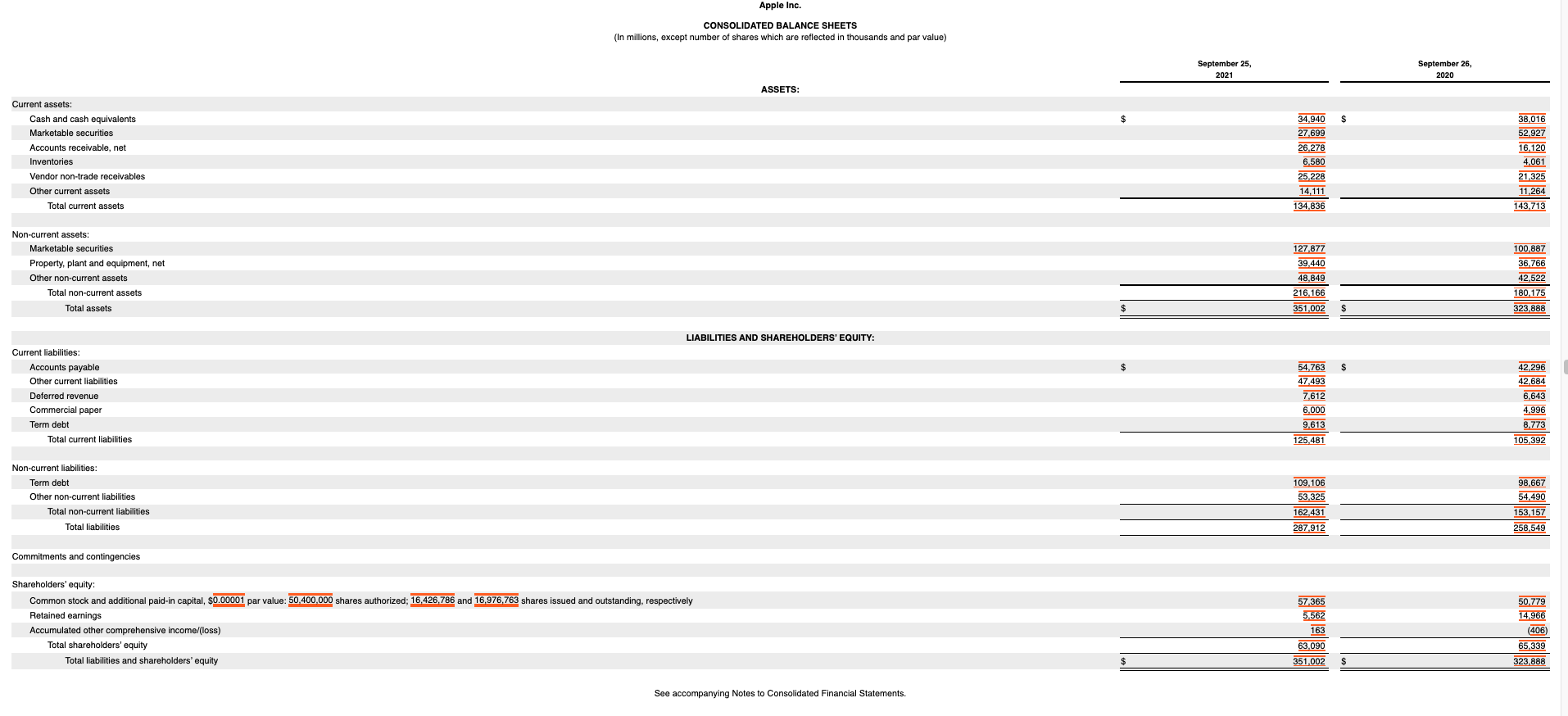

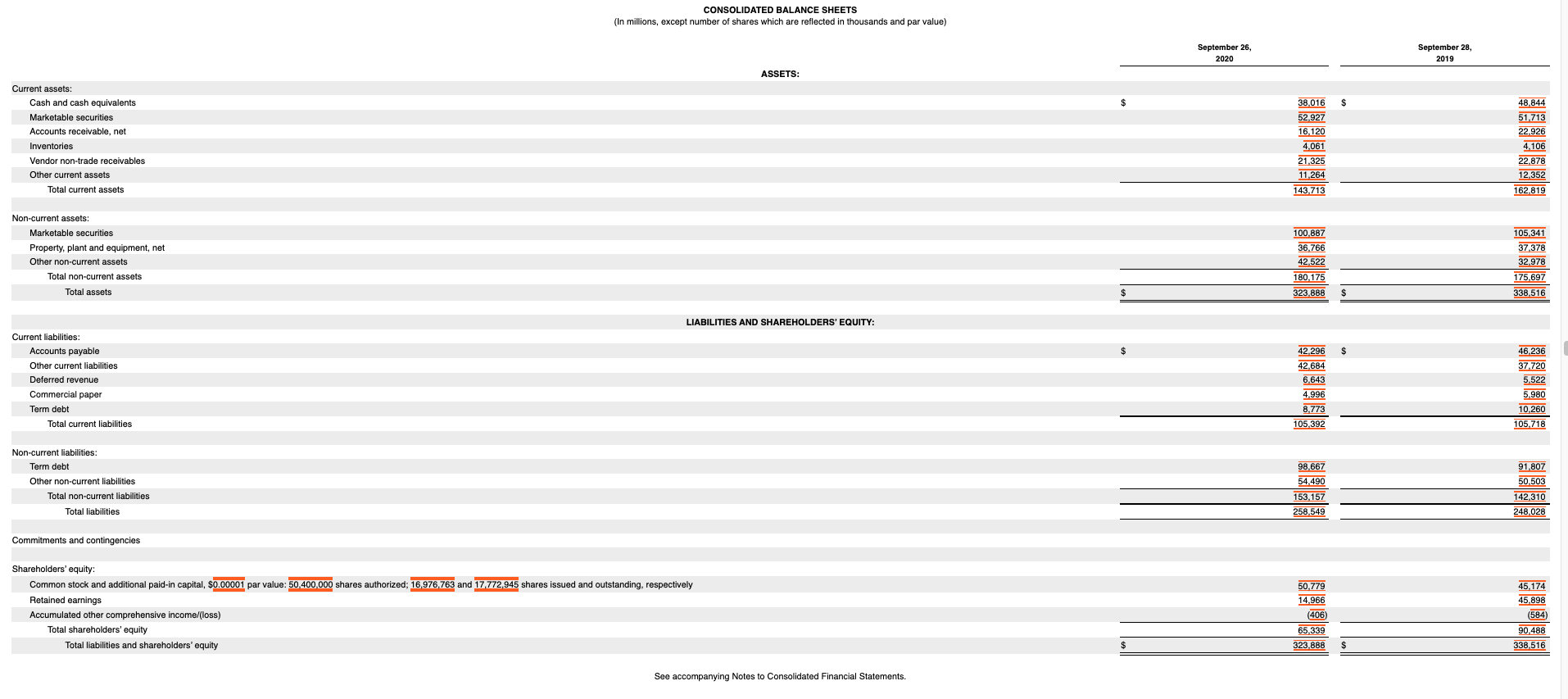

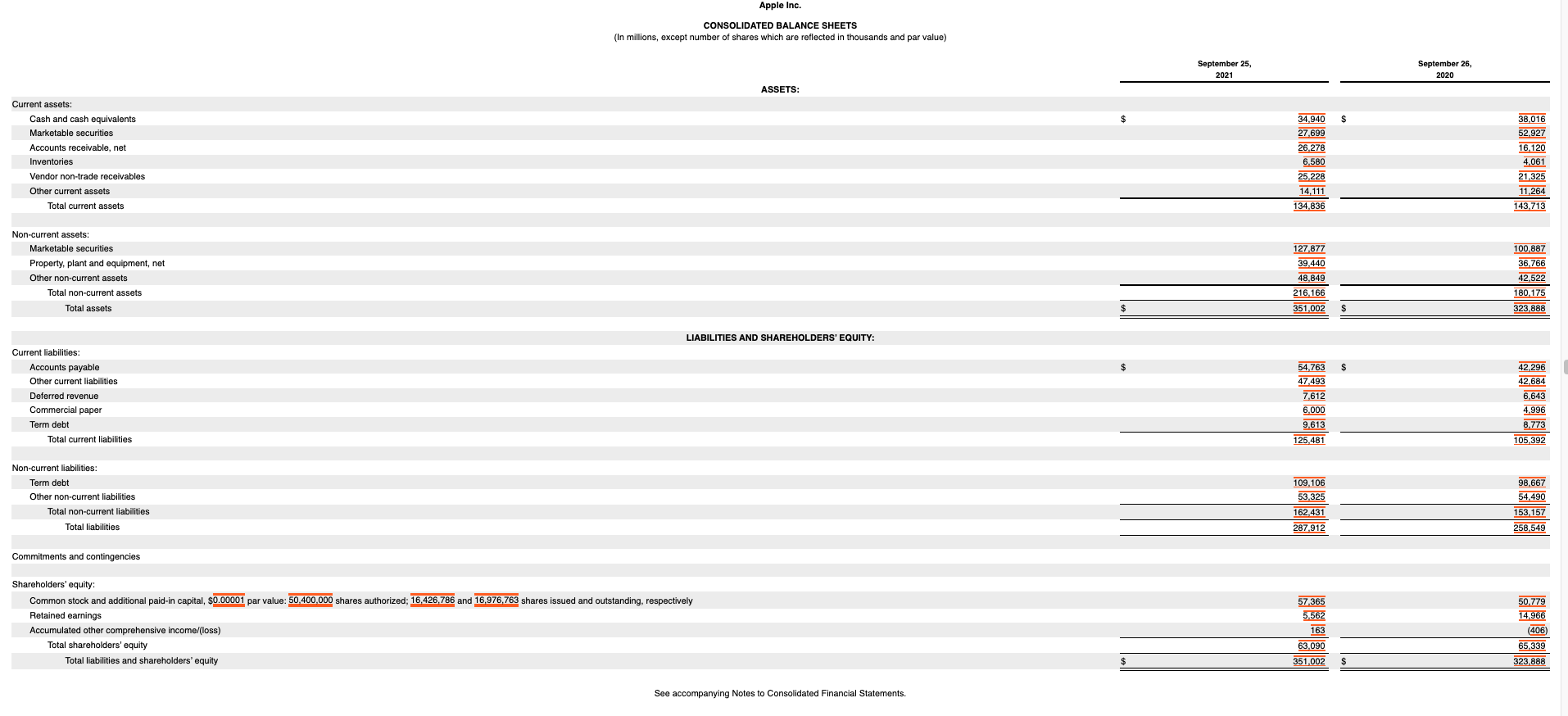

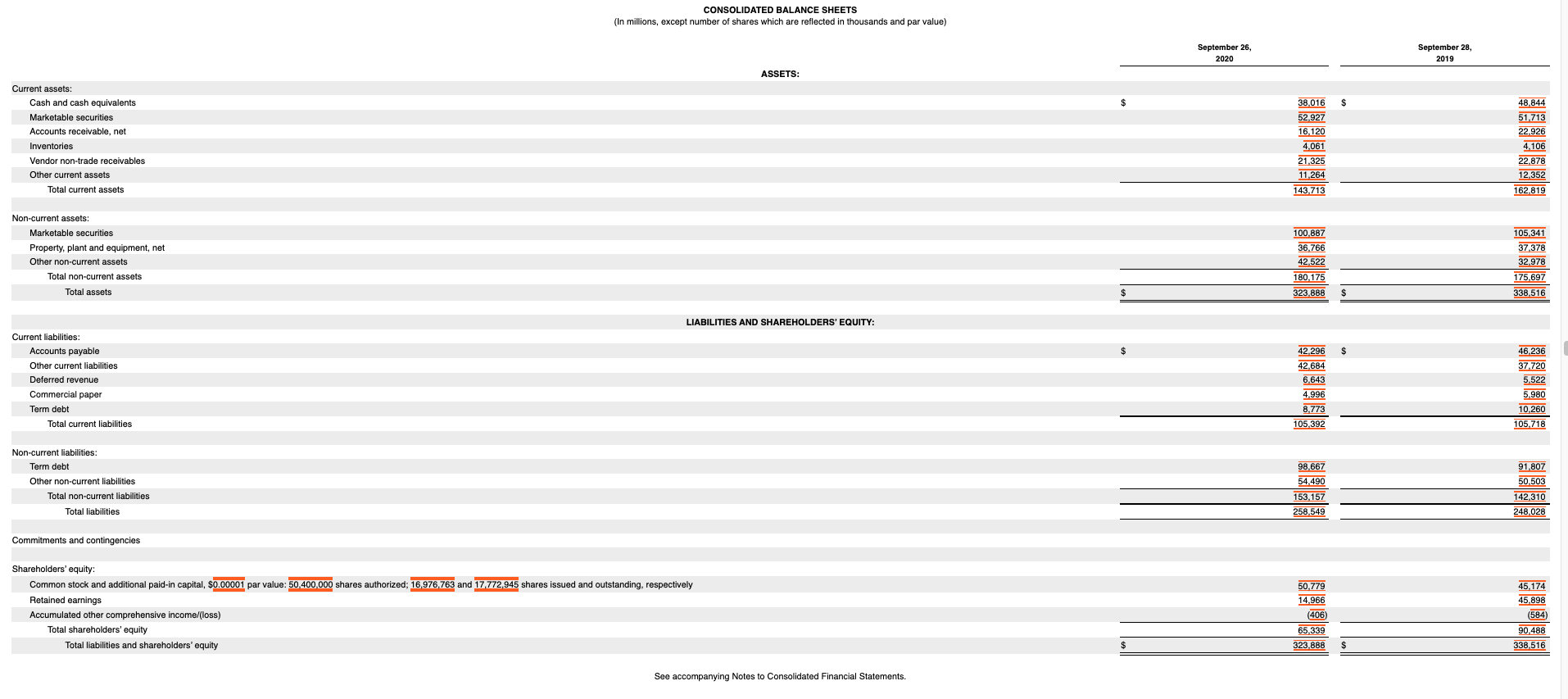

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 25, 2021 September 26, 2020 ASSETS: $ Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 34.940 27,699 26.278 6.580 25 228 14,111 134.836 38,016 52.927 16,120 4,061 21,325 11,264 143.713 127 877 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 39.440 48,849 216.16 351,002 100,887 36.766 42,522 180.17 323,888 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 54.763 47.493 7,612 6,000 9.613 125,481 42.296 42.684 6,643 4.996 8.773 105,392 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 109,106 53,325 162,431 287,912 98.667 54.490 153,157 258,549 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 50.400.000 shares authorized; 16.426,786 and 16,976,763 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 57.365 5,562 163 63,090 351,002 50.779 14.966 (406) 65,339 323.888 See accompanying Notes Consolidated Financial Statements. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 26, 2020 September 28, 2019 ASSETS: $ $ Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 38,016 52.927 16.120 4.061 21.325 11,264 48,844 51.71 22,926 4.106 22,878 12.352 162,819 143.713 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 100,887 36.766 42.522 180.17 323,888 105,341 37.378 32,978 175,697 338,516 LIABILITIES AND SHAREHOLDERS' EQUITY: $ Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 42.296 42,684 6.643 4.996 8.773 105,392 46.236 37.720 5.522 5,980 10,260 105.71 Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 98,667 54.490 153,157 258,549 91,807 50.503 142.310 248.028 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, S0.00001 par value: 50.400.000 shares authorized; 16,976,763 and 17.772,945 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/loss) Total shareholders' equity Total liabilities and shareholders' equity 50.779 14.966 (406) 65,339 323,888 45,174 45,898 (584) 90.488 338,510 See accompanying Notes to Consolidated Financial Statements

Analyze three items on the balance sheet (or balance sheet-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the companys performance related to these items appears to be improving, deteriorating, or remaining stable. Justify your answer.

Analyze three items on the balance sheet (or balance sheet-based financial ratios; see the list on p. 3) for your base company for the last three years and discuss whether the companys performance related to these items appears to be improving, deteriorating, or remaining stable. Justify your answer.