Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Analyze your convictions about the use of credit and debt. Describe the biblical principles relevant to personal financial decision making. Examine past automobile purchase decisions

Analyze your convictions about the use of credit and debt.

Describe the biblical principles relevant to personal financial decision making.

Examine past automobile purchase decisions in relation to the alternatives available and your long-term financial goals.

Describe the importance of health insurance, and then evaluate cost-savings techniques you can apply to your personal finances.

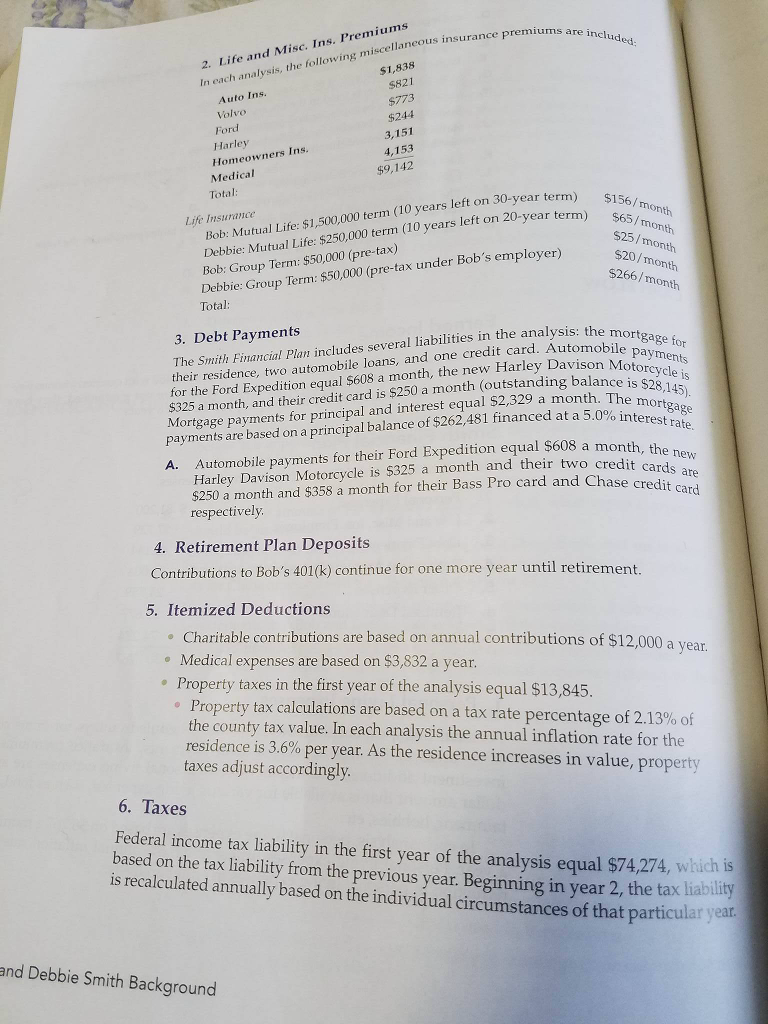

Develop a debt-payment plan for a real-life scenario

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started