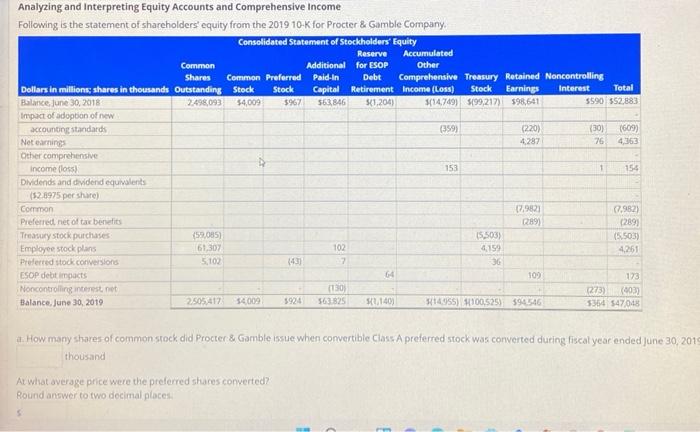

Analyzing and Interpreting Equity Accounts and Comprehensive Income Following is the statement of shareholders' equity from the 201910K for Procter 8 Gamble Company. a. How many shares of common srock did Procter 8 Gamble issue when comertible Class A preferred stock was converted during fiscal year ended june 30,20 . thousand At what average price were the preferred shaces converted? Round answer to two decimal ploces. b. How many shares did the company issue for employee stock plans during the year? thousand At what average price ware the common shares issued to employees? Round answer to two decimal places. c. The company reported basic EPS of $1.54 for the year. The company's stock price on june 28,2019 (the closest day before the fiscal year-end) was $120.62. Calculate the dividend payout ratio and dividend yield ratios. Round answers to one decimal place (example: 0.2345=23.5% ). Cvidend payout ratio D.vidend yield d. How many share of stock did PG repurchase during the year? thotrsand At what average price per share? Fround ansyer to two decimal places. e. Compute the company's market cap at june 28, 2019. Enter answer in millions, Round answer to thenearest million. What is the market to bookratio on that day? Round answer to two decimal places. Analyzing and Interpreting Equity Accounts and Comprehensive Income Following is the statement of shareholders' equity from the 201910K for Procter 8 Gamble Company. a. How many shares of common srock did Procter 8 Gamble issue when comertible Class A preferred stock was converted during fiscal year ended june 30,20 . thousand At what average price were the preferred shaces converted? Round answer to two decimal ploces. b. How many shares did the company issue for employee stock plans during the year? thousand At what average price ware the common shares issued to employees? Round answer to two decimal places. c. The company reported basic EPS of $1.54 for the year. The company's stock price on june 28,2019 (the closest day before the fiscal year-end) was $120.62. Calculate the dividend payout ratio and dividend yield ratios. Round answers to one decimal place (example: 0.2345=23.5% ). Cvidend payout ratio D.vidend yield d. How many share of stock did PG repurchase during the year? thotrsand At what average price per share? Fround ansyer to two decimal places. e. Compute the company's market cap at june 28, 2019. Enter answer in millions, Round answer to thenearest million. What is the market to bookratio on that day? Round answer to two decimal places