Answered step by step

Verified Expert Solution

Question

1 Approved Answer

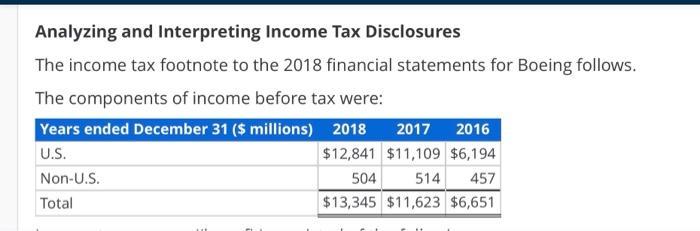

Analyzing and Interpreting Income Tax Disclosures The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax

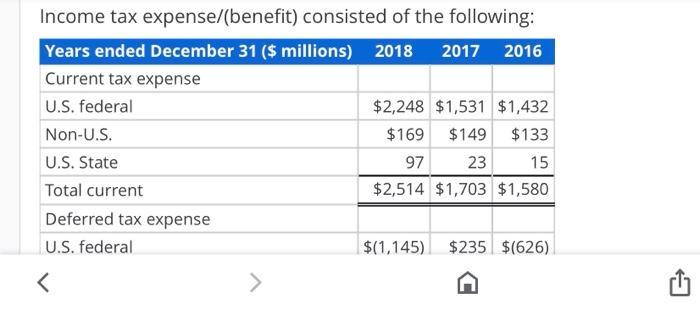

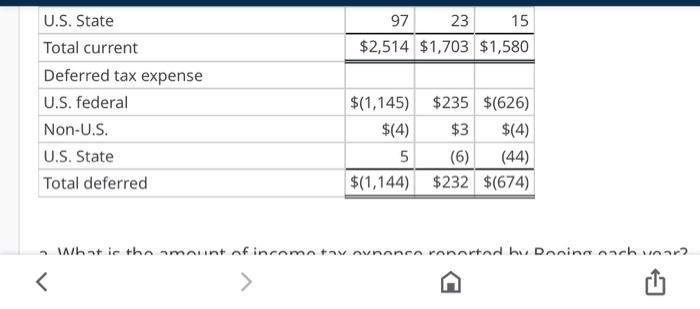

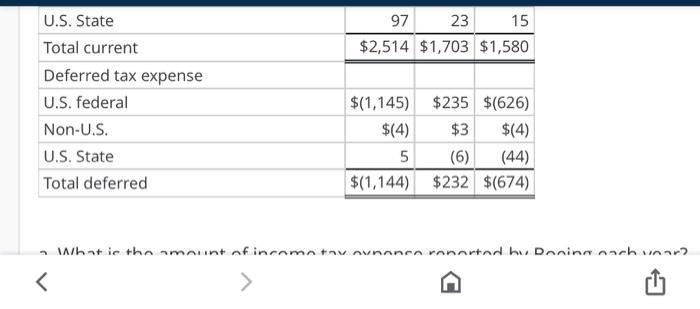

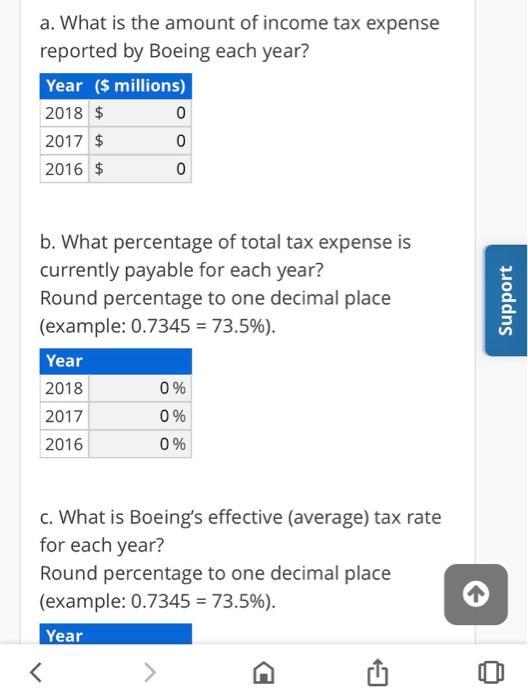

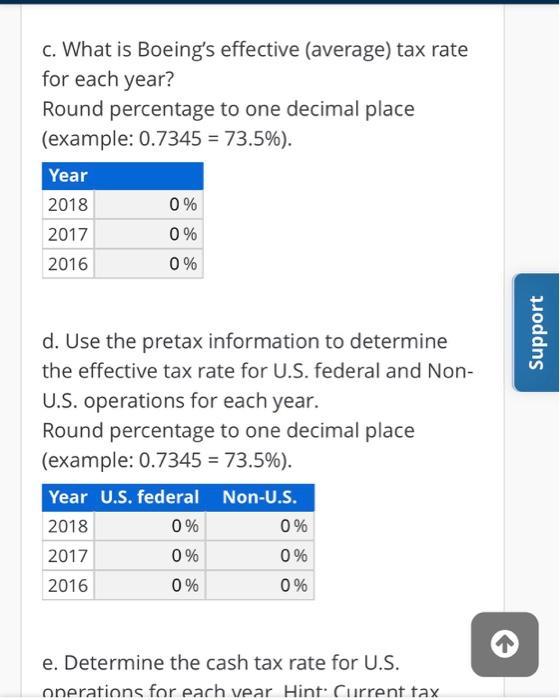

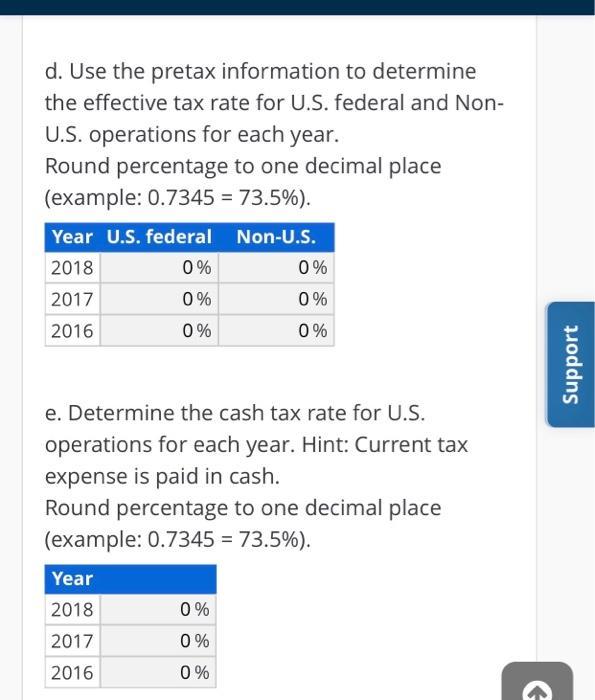

Analyzing and Interpreting Income Tax Disclosures The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax were: Years ended December 31 ($ millions) 2018 U.S. Non-U.S. Total 2017 2016 $12,841 $11,109 $6,194 504 514 457 $13,345 $11,623 $6,651 Income tax expense/(benefit) consisted of the following: Years ended December 31 ($ millions) 2018 2017 2016 Current tax expense U.S. federal Non-U.S. U.S. State Total current Deferred tax expense U.S. federal < $2,248 $1,531 $1,432 $169 $149 $133 97 23 15 $2,514 $1,703 $1,580 $(1,145) $235 $(626) U.S. State Total current Deferred tax expense U.S. federal Non-U.S. U.S. State Total deferred < 97 23 15 $2,514 $1,703 $1,580 $(1,145) $(4) 5 $(1,144) $235 $(626) $3 $(4) (6) (44) $232 $(674) What is the amount of income tax oynonce reported by Rooing each year? DE U.S. State Total current Deferred tax expense U.S. federal Non-U.S. U.S. State Total deferred < 97 23 15 $2,514 $1,703 $1,580 $(1,145) $(4) 5 $(1,144) $235 $(626) $3 $(4) (6) (44) $232 $(674) What is the amount of income tax oynonce reported by Rooing each year? DE a. What is the amount of income tax expense reported by Boeing each year? Year ($ millions) 2018 $ 2017 $ 2016 $ b. What percentage of total tax expense is currently payable for each year? Round percentage to one decimal place (example: 0.7345 = 73.5%). Year 2018 2017 2016 0 0 0 0% 0% 0% c. What is Boeing's effective (average) tax rate for each year? < Round percentage to one decimal place (example: 0.7345 = 73.5%). Year Support OD c. What is Boeing's effective (average) tax rate for each year? Round percentage to one decimal place (example: 0.7345 = 73.5%). Year 2018 2017 2016 0% 0% 0% d. Use the pretax information to determine the effective tax rate for U.S. federal and Non- U.S. operations for each year. Round percentage to one decimal place (example: 0.7345 = 73.5%). Year U.S. federal Non-U.S. 2018 2017 2016 0% 0% 0% 0% 0% 0% e. Determine the cash tax rate for U.S. operations for each year Hint: Current tax Support d. Use the pretax information to determine the effective tax rate for U.S. federal and Non- U.S. operations for each year. Round percentage to one decimal place (example: 0.7345 = 73.5%). Year U.S. federal Non-U.S. 2018 2017 2016 0% 0% 0% Year 2018 2017 2016 e. Determine the cash tax rate for U.S. operations for each year. Hint: Current tax expense is paid in cash. Round percentage to one decimal place (example: 0.7345 = 73.5%). 0% 0% 0% 0% 0% 0% Support

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started