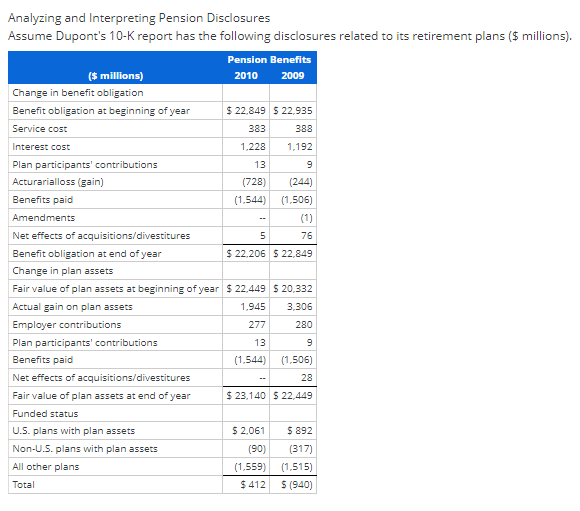

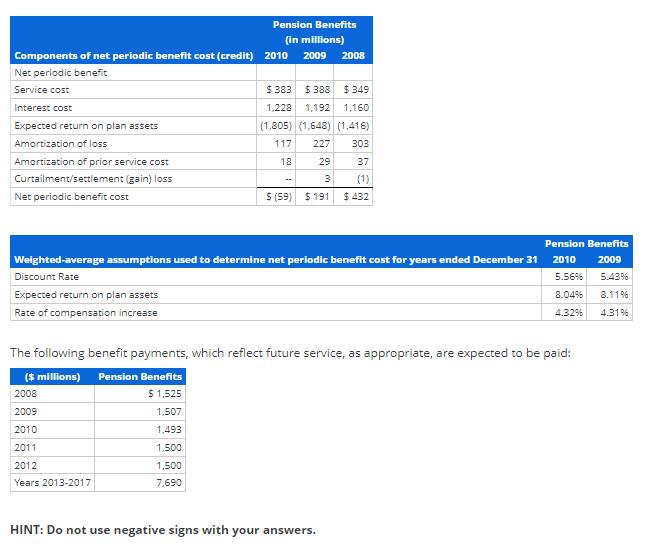

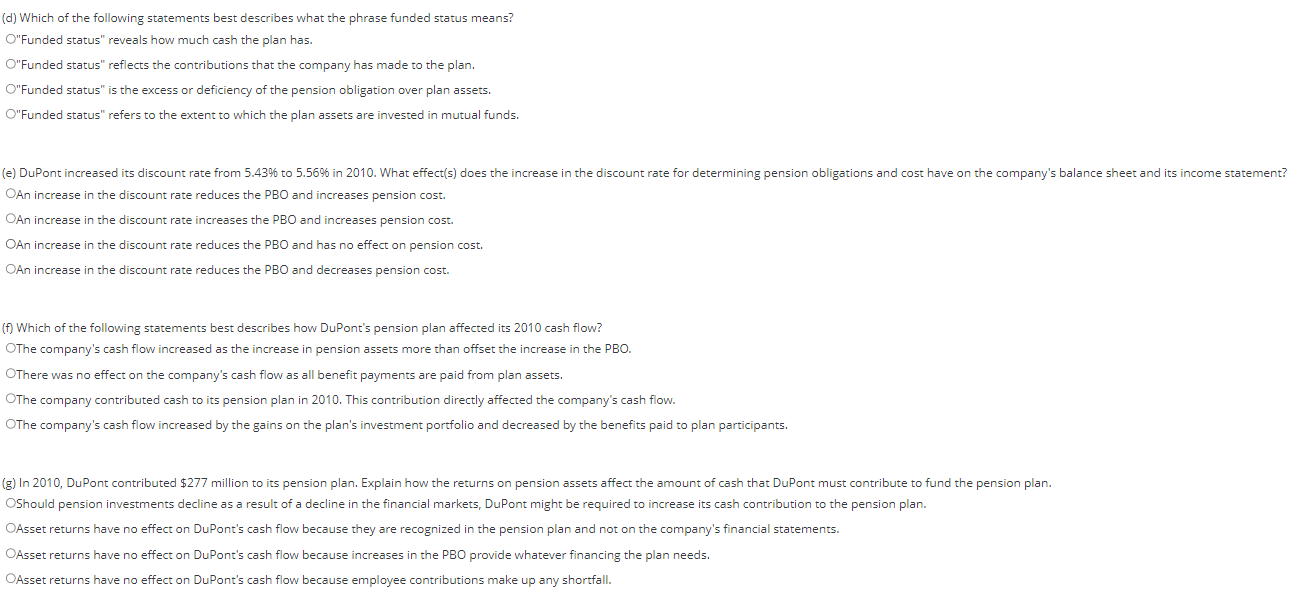

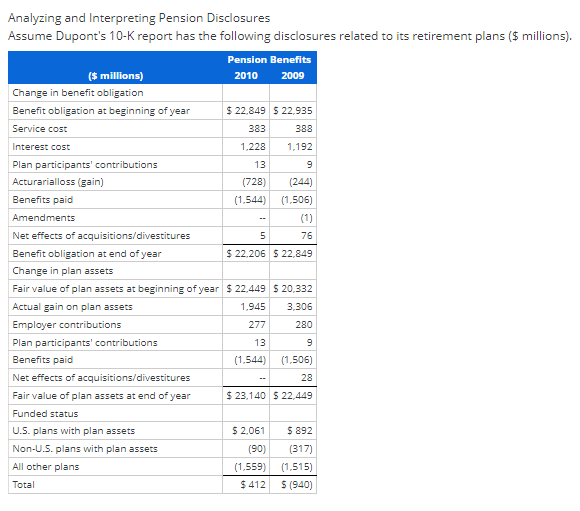

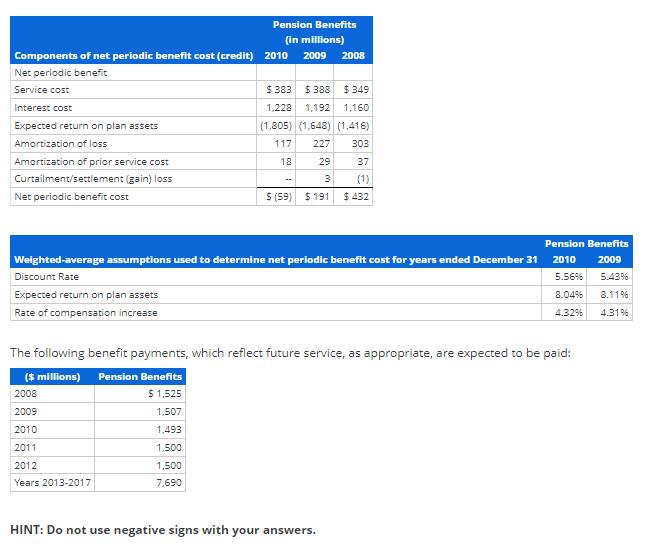

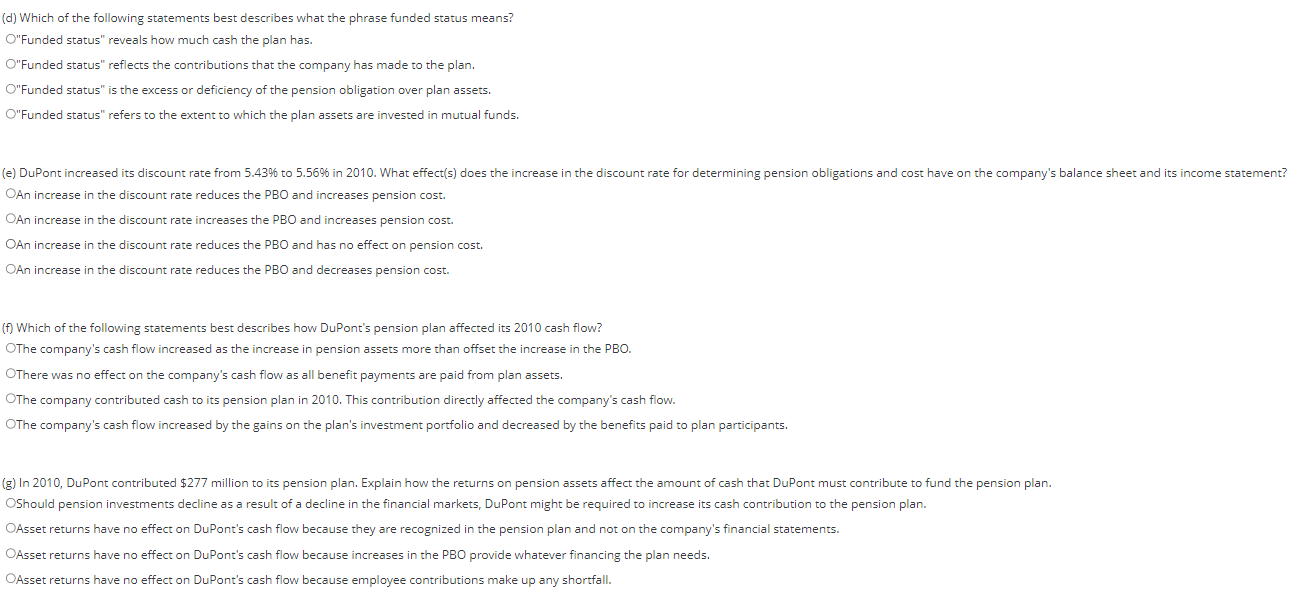

Analyzing and Interpreting Pension Disclosures Assume Dupont's 10K report has the following disclosures related to its retirement plans (\$ millions). The following benefit payments, which reflect future service, as appropriate, are expected to be paid: HINT: Do not use negative signs with your answers. (d) Which of the following statements best describes what the phrase funded status means? "Funded status" reveals how much cash the plan has. "Funded status" reflects the contributions that the company has made to the plan. 'Funded status" is the excess or deficiency of the pension obligation over plan assets. D"Funded status" refers to the extent to which the plan assets are invested in mutual funds. OAn increase in the discount rate reduces the PBO and increases pension cost. OAn increase in the discount rate increases the PBO and increases pension cost. OAn increase in the discount rate reduces the PBO and has no effect on pension cost. OAn increase in the discount rate reduces the PBO and decreases pension cost. (f) Which of the following statements best describes how DuPont's pension plan affected its 2010 cash flow? OThe company's cash flow increased as the increase in pension assets more than offset the increase in the PBO. OThere was no effect on the company's cash flow as all benefit payments are paid from plan assets. OThe company contributed cash to its pension plan in 2010 . This contribution directly affected the company's cash flow. OThe company's cash flow increased by the gains on the plan's investment portfolio and decreased by the benefits paid to plan participants. (g) In 2010, DuPont contributed $277 million to its pension plan. Explain how the returns on pension assets affect the amount of cash that DuPont must contribute to fund the pension plan. OShould pension investments decline as a result of a decline in the financial markets, DuPont might be required to increase its cash contribution to the pension plan. OAsset returns have no effect on DuPont's cash flow because they are recognized in the pension plan and not on the company's financial statements. OAsset returns have no effect on DuPont's cash flow because increases in the PBO provide whatever financing the plan needs. OAsset returns have no effect on DuPont's cash flow because employee contributions make up any shortfall