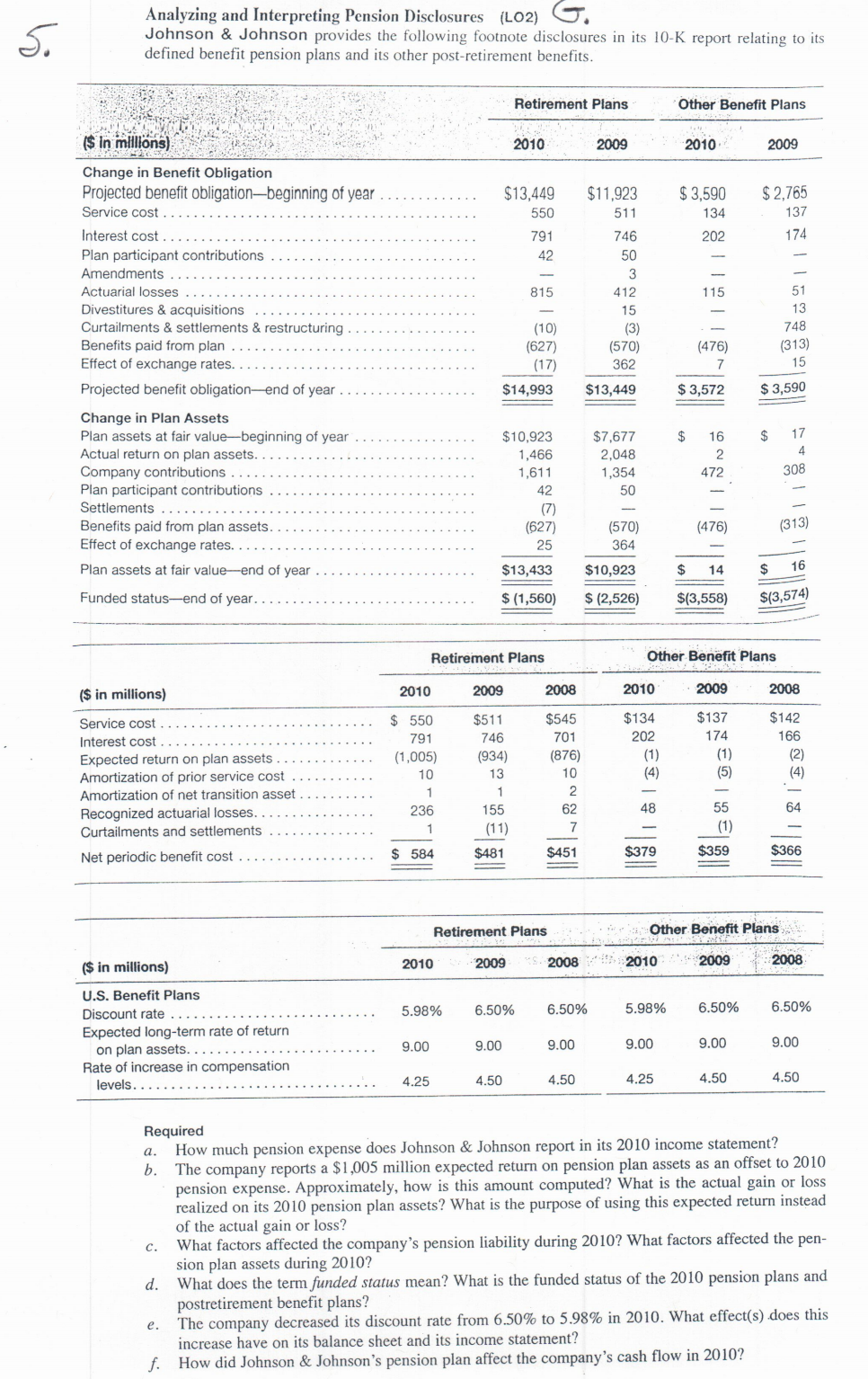

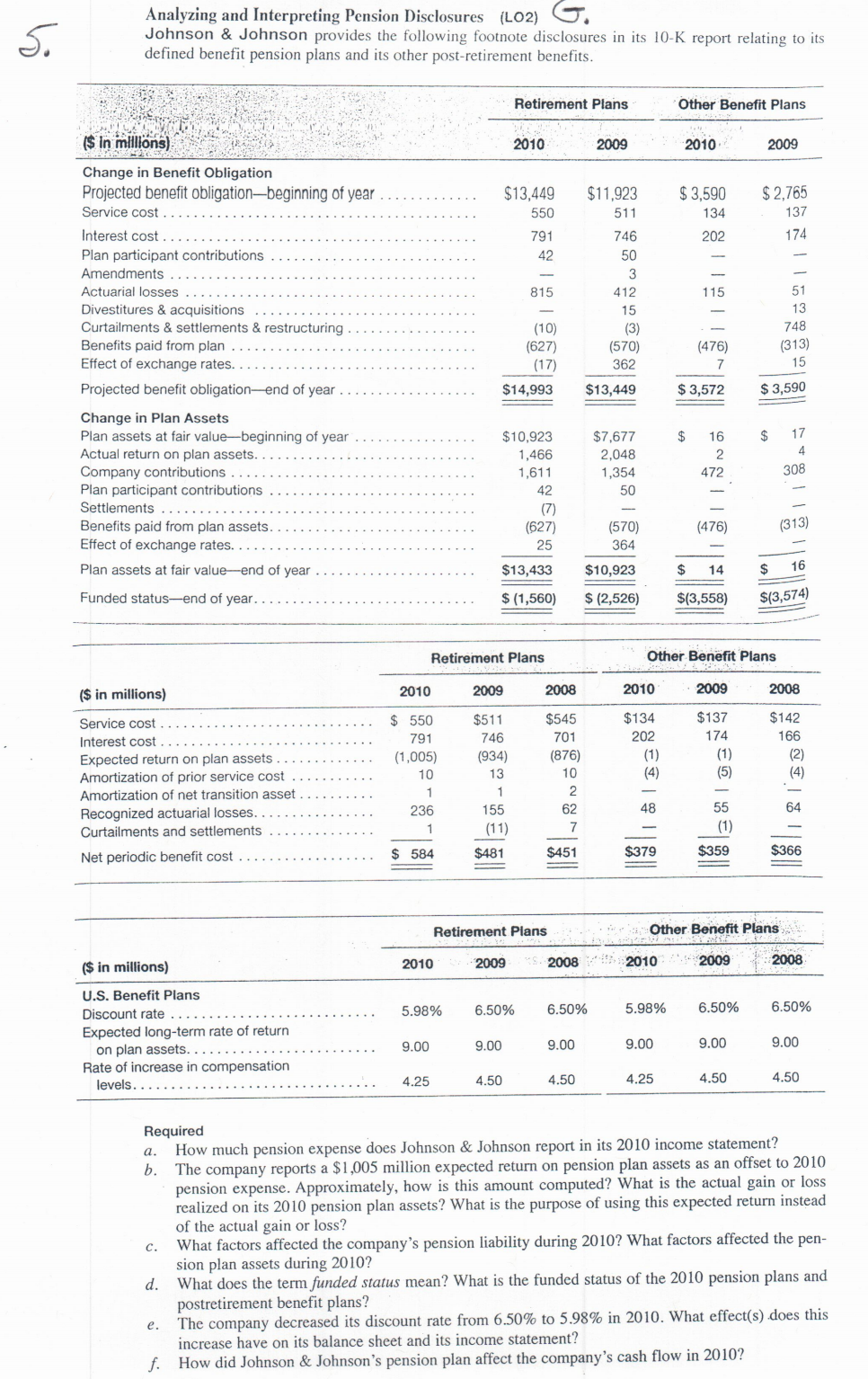

Analyzing and Interpreting Pension Disclosures (LO2) G. Johnson & Johnson provides the following footnote disclosures in its 10-K report relating to its defined benefit pension plans and its other post-retirement benefits. Retirement Plans Other Benefit Plans ($ in millions) 2010 2009 2010 2009 $13,449 550 $ 2,765 $11,923 511 746 $ 3,590 134 202 791 174 50 815 412 115 (10) (3) 748 (476) (313) Change in Benefit Obligation Projected benefit obligation-beginning of year.. Service cost Interest cost ....... Plan participant contributions Amendments Actuarial losses ............... Divestitures & acquisitions ... Curtailments & settlements & restructuring. Benefits paid from plan. Effect of exchange rates........ Projected benefit obligation--end of year .... Change in Plan Assets Plan assets at fair value-beginning of year Actual return on plan assets... Company contributions ........... Plan participant contributions .... Settlements .......... Benefits paid from plan assets.... Effect of exchange rates.. Plan assets at fair value-end of year .. Funded status-end of year. ........ (627) (17) $14,993 (570) 362 $13,449 15 $ 3,572 $ 3,590 $ 16 $ 17 $10,923 1,466 1,611 $7,677 2,048 1,354 50 308 - 42 (627) (476) (313) 25 (570) 364 $10,923 $13,433 $ 14 $ 16 $ (1,560) $ (2,526) $(3,558) $(3,574) Retirement Plans Other Benefit Plans ($ in millions) 2010 2009 2008 2010 2009 2008 $545 $134 $142 $ 550 791 (1,005) $511 746 (934) $137 174 202 166 701 (876) (2) 10 10 (4) Service cost ....... Interest cost ... Expected return on plan assets ...... Amortization of prior service cost .... Amortization of net transition asset.. Recognized actuarial losses. Curtailments and settlements Net periodic benefit cost ........ 2 62 $ 584 S481 19 $359 $366 Retirement Plans Other Benefit Plans 2010 2009 2008 ($ in millions) 2010 2009 2008 5.98% 6.50% 6.50% 5.98% 6.50% 6.50% U.S. Benefit Plans Discount rate ........ Expected long-term rate of return on plan assets........ Rate of increase in compensation levels........ 9.00 9.00 9.00 9.00 9.00 9.00 4.25 4.50 4.50 4.25 4.50 4.50 Required a. How much pension expense does Johnson & Johnson report in its 2010 income statement? b. The company reports a $1,005 million expected return on pension plan assets as an offset to 2010 pension expense. Approximately, how is this amount computed? What is the actual gain or loss realized on its 2010 pension plan assets? What is the purpose of using this expected return instead of the actual gain or loss? What factors affected the company's pension liability during 2010? What factors affected the pen- sion plan assets during 2010? d. What does the term funded status mean? What is the funded status of the 2010 pension plans and postretirement benefit plans? e. The company decreased its discount rate from 6.50% to 5.98% in 2010. What effect(s) does this increase have on its balance sheet and its income statement? f. How did Johnson & Johnson's pension plan affect the company's cash flow in 2010? Analyzing and Interpreting Pension Disclosures (LO2) G. Johnson & Johnson provides the following footnote disclosures in its 10-K report relating to its defined benefit pension plans and its other post-retirement benefits. Retirement Plans Other Benefit Plans ($ in millions) 2010 2009 2010 2009 $13,449 550 $ 2,765 $11,923 511 746 $ 3,590 134 202 791 174 50 815 412 115 (10) (3) 748 (476) (313) Change in Benefit Obligation Projected benefit obligation-beginning of year.. Service cost Interest cost ....... Plan participant contributions Amendments Actuarial losses ............... Divestitures & acquisitions ... Curtailments & settlements & restructuring. Benefits paid from plan. Effect of exchange rates........ Projected benefit obligation--end of year .... Change in Plan Assets Plan assets at fair value-beginning of year Actual return on plan assets... Company contributions ........... Plan participant contributions .... Settlements .......... Benefits paid from plan assets.... Effect of exchange rates.. Plan assets at fair value-end of year .. Funded status-end of year. ........ (627) (17) $14,993 (570) 362 $13,449 15 $ 3,572 $ 3,590 $ 16 $ 17 $10,923 1,466 1,611 $7,677 2,048 1,354 50 308 - 42 (627) (476) (313) 25 (570) 364 $10,923 $13,433 $ 14 $ 16 $ (1,560) $ (2,526) $(3,558) $(3,574) Retirement Plans Other Benefit Plans ($ in millions) 2010 2009 2008 2010 2009 2008 $545 $134 $142 $ 550 791 (1,005) $511 746 (934) $137 174 202 166 701 (876) (2) 10 10 (4) Service cost ....... Interest cost ... Expected return on plan assets ...... Amortization of prior service cost .... Amortization of net transition asset.. Recognized actuarial losses. Curtailments and settlements Net periodic benefit cost ........ 2 62 $ 584 S481 19 $359 $366 Retirement Plans Other Benefit Plans 2010 2009 2008 ($ in millions) 2010 2009 2008 5.98% 6.50% 6.50% 5.98% 6.50% 6.50% U.S. Benefit Plans Discount rate ........ Expected long-term rate of return on plan assets........ Rate of increase in compensation levels........ 9.00 9.00 9.00 9.00 9.00 9.00 4.25 4.50 4.50 4.25 4.50 4.50 Required a. How much pension expense does Johnson & Johnson report in its 2010 income statement? b. The company reports a $1,005 million expected return on pension plan assets as an offset to 2010 pension expense. Approximately, how is this amount computed? What is the actual gain or loss realized on its 2010 pension plan assets? What is the purpose of using this expected return instead of the actual gain or loss? What factors affected the company's pension liability during 2010? What factors affected the pen- sion plan assets during 2010? d. What does the term funded status mean? What is the funded status of the 2010 pension plans and postretirement benefit plans? e. The company decreased its discount rate from 6.50% to 5.98% in 2010. What effect(s) does this increase have on its balance sheet and its income statement? f. How did Johnson & Johnson's pension plan affect the company's cash flow in 2010