Question

Analyzing and Interpreting Receivables and Related Ratios Following is the current asset section from Intuit Inc.s balance sheet. Total revenues were $4,171 million ($1,515 million

Analyzing and Interpreting Receivables and Related Ratios

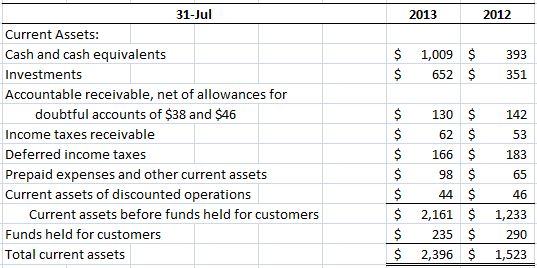

Following is the current asset section from Intuit Inc.s balance sheet.

Total revenues were $4,171 million ($1,515 million in product sales and $2,656 million in service revenues and other) in 2013.

Required

a. What are Intuits gross accounts receivable at the end of 2012 and 2013?

b. For both 2013 and 2012, compute the ratio of the allowance for uncollectible accounts to gross receivables. What trend do you observe?

c. Compute the receivables turnover ratio and the average collection period for 2013 based on gross receivables computed in part a. Does the collection period (days sales in receivables) appear reasonable given Intuits lines of business (Intuits products include QuickBooks, TurboTax and Quicken, which it sells to consumers and small businesses)? Explain.

d. Is the percentage of Intuits allowance for uncollectable accounts to gross accounts receivable consistent with what you expect for Intuits line of business? Explain.

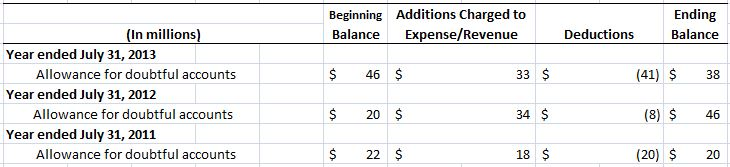

e. Intuit discloses the following table related to its allowance for uncollectable accounts from its 10-K. Comment on the charge in the allowance during 2011 through 2013.

Please answer all parts of the question (a-e), written and math. Thanks!

Please answer all parts of the question (a-e), written and math. Thanks!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started