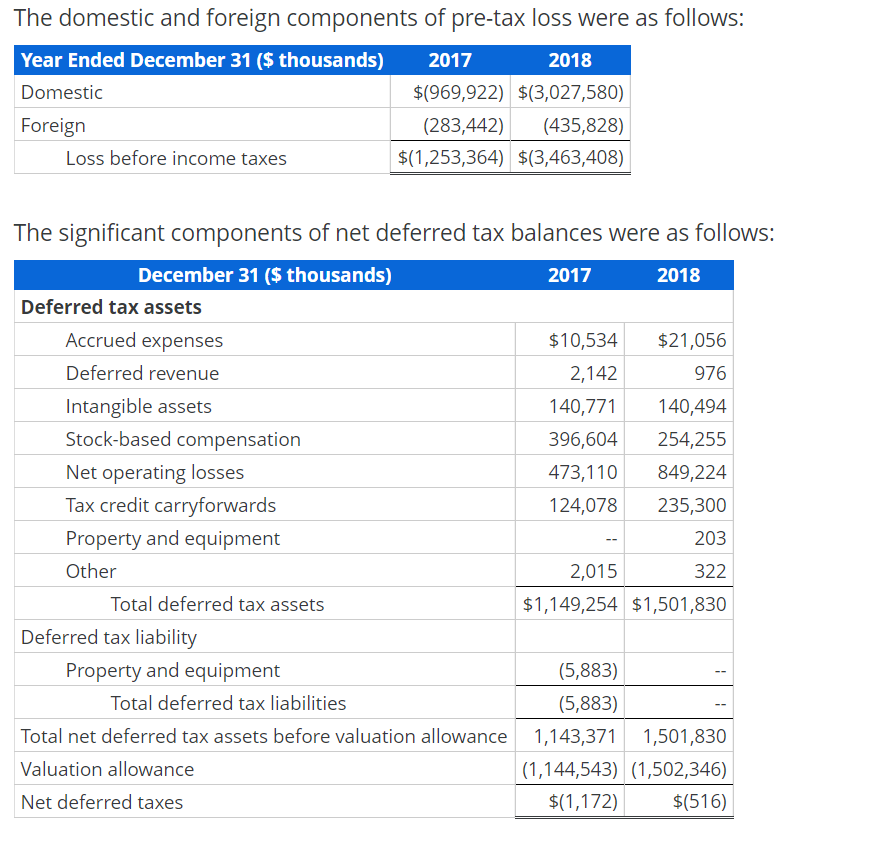

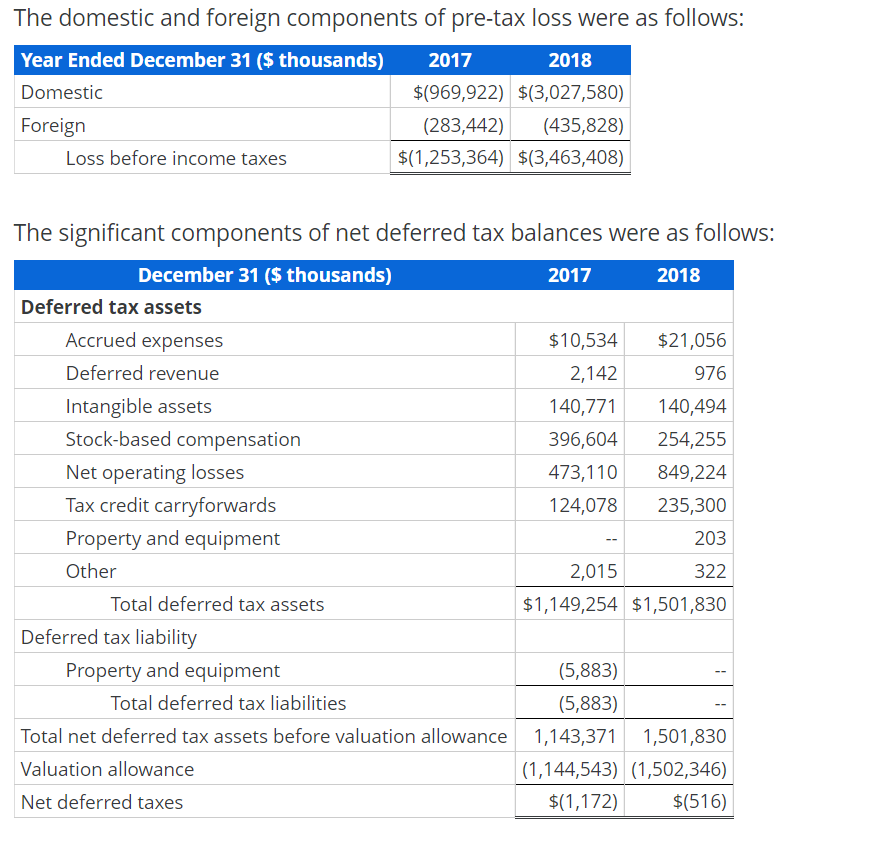

Analyzing and Interpreting Tax Footnote (Financial Statement Effects Template) Snapchat Inc. reports total tax expense of $2,547 thousands on its income statement for year ended December 31, 2018, and paid cash of $3,958 thousand for taxes and decreased taxes payable by $755 thousand. The tax footnote in the company's 10-K filing reports the following deferred tax assets and liabilities information.

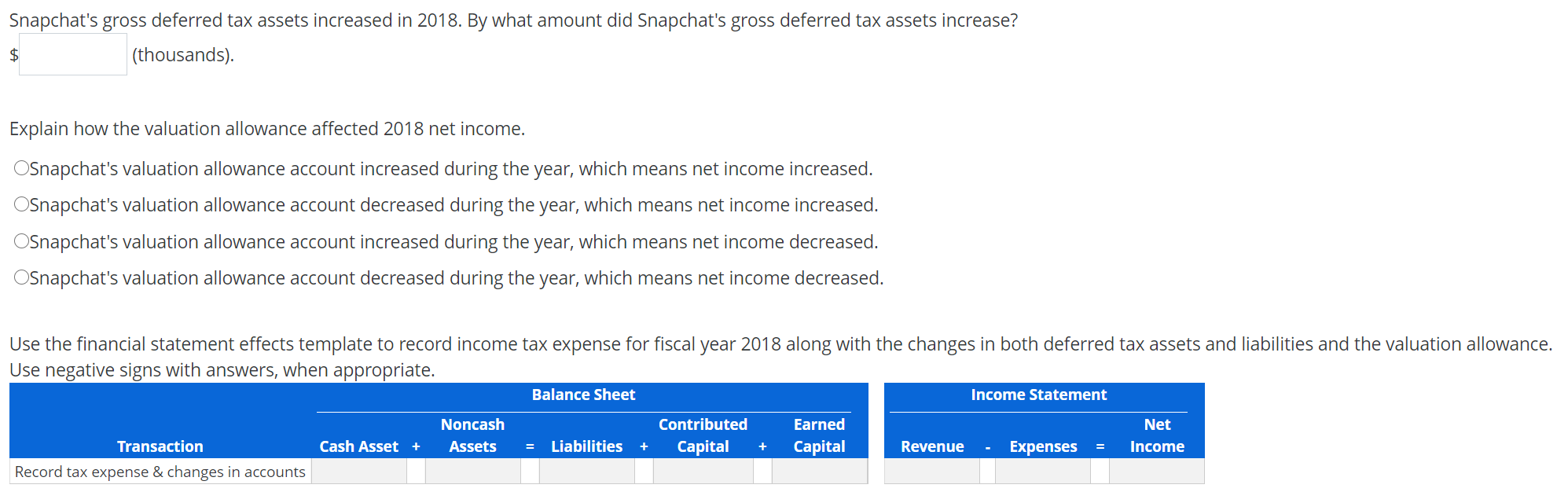

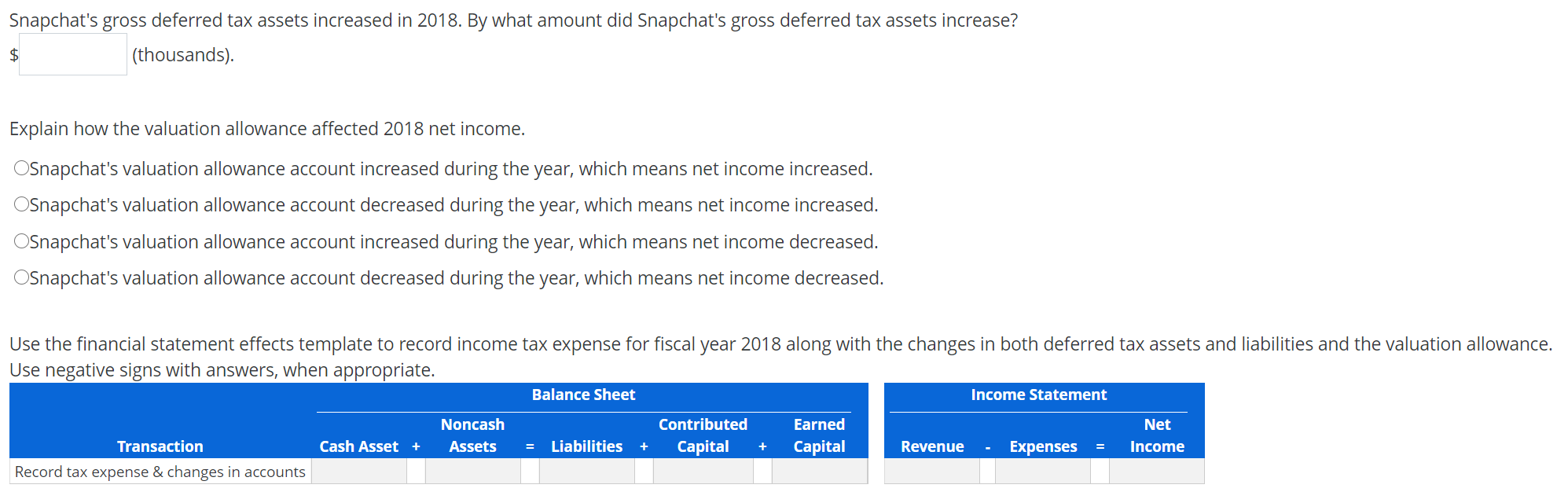

The domestic and foreign components of pre-tax loss were as follows: Year Ended December 31 ($ thousands) 2017 2018 Domestic $(969,922) $(3,027,580) Foreign (283,442) (435,828) Loss before income taxes $(1,253,364) $(3,463,408) The significant components of net deferred tax balances were as follows: December 31 ($ thousands) 2017 2018 Deferred tax assets Accrued expenses $10,534 $21,056 Deferred revenue 2,142 976 Intangible assets 140,771 140,494 Stock-based compensation 396,604 254,255 Net operating losses 473,110 849,224 Tax credit carryforwards 124,078 235,300 Property and equipment 203 Other 2,015 322 Total deferred tax assets $1,149,254 $1,501,830 Deferred tax liability Property and equipment (5,883) Total deferred tax liabilities (5,883) Total net deferred tax assets before valuation allowance 1,143,371 1,501,830 Valuation allowance (1,144,543) (1,502,346) Net deferred taxes $(1,172) $(516) Snapchat's gross deferred tax assets increased in 2018. By what amount did Snapchat's gross deferred tax assets increase? $ (thousands). Explain how the valuation allowance affected 2018 net income. OSnapchat's valuation allowance account increased during the year, which means net income increased. OSnapchat's valuation allowance account decreased during the year, which means net income increased. OSnapchat's valuation allowance account increased during the year, which means net income decreased. OSnapchat's valuation allowance account decreased during the year, which means net income decreased. Use the financial statement effects template to record income tax expense for fiscal year 2018 along with the changes in both deferred tax assets and liabilities and the valuation allowance. Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Assets Contributed Capital Earned Capital Net Income Cash Asset + Liabilities + + Revenue Expenses Transaction Record tax expense & changes in accounts The domestic and foreign components of pre-tax loss were as follows: Year Ended December 31 ($ thousands) 2017 2018 Domestic $(969,922) $(3,027,580) Foreign (283,442) (435,828) Loss before income taxes $(1,253,364) $(3,463,408) The significant components of net deferred tax balances were as follows: December 31 ($ thousands) 2017 2018 Deferred tax assets Accrued expenses $10,534 $21,056 Deferred revenue 2,142 976 Intangible assets 140,771 140,494 Stock-based compensation 396,604 254,255 Net operating losses 473,110 849,224 Tax credit carryforwards 124,078 235,300 Property and equipment 203 Other 2,015 322 Total deferred tax assets $1,149,254 $1,501,830 Deferred tax liability Property and equipment (5,883) Total deferred tax liabilities (5,883) Total net deferred tax assets before valuation allowance 1,143,371 1,501,830 Valuation allowance (1,144,543) (1,502,346) Net deferred taxes $(1,172) $(516) Snapchat's gross deferred tax assets increased in 2018. By what amount did Snapchat's gross deferred tax assets increase? $ (thousands). Explain how the valuation allowance affected 2018 net income. OSnapchat's valuation allowance account increased during the year, which means net income increased. OSnapchat's valuation allowance account decreased during the year, which means net income increased. OSnapchat's valuation allowance account increased during the year, which means net income decreased. OSnapchat's valuation allowance account decreased during the year, which means net income decreased. Use the financial statement effects template to record income tax expense for fiscal year 2018 along with the changes in both deferred tax assets and liabilities and the valuation allowance. Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Assets Contributed Capital Earned Capital Net Income Cash Asset + Liabilities + + Revenue Expenses Transaction Record tax expense & changes in accounts