Answered step by step

Verified Expert Solution

Question

1 Approved Answer

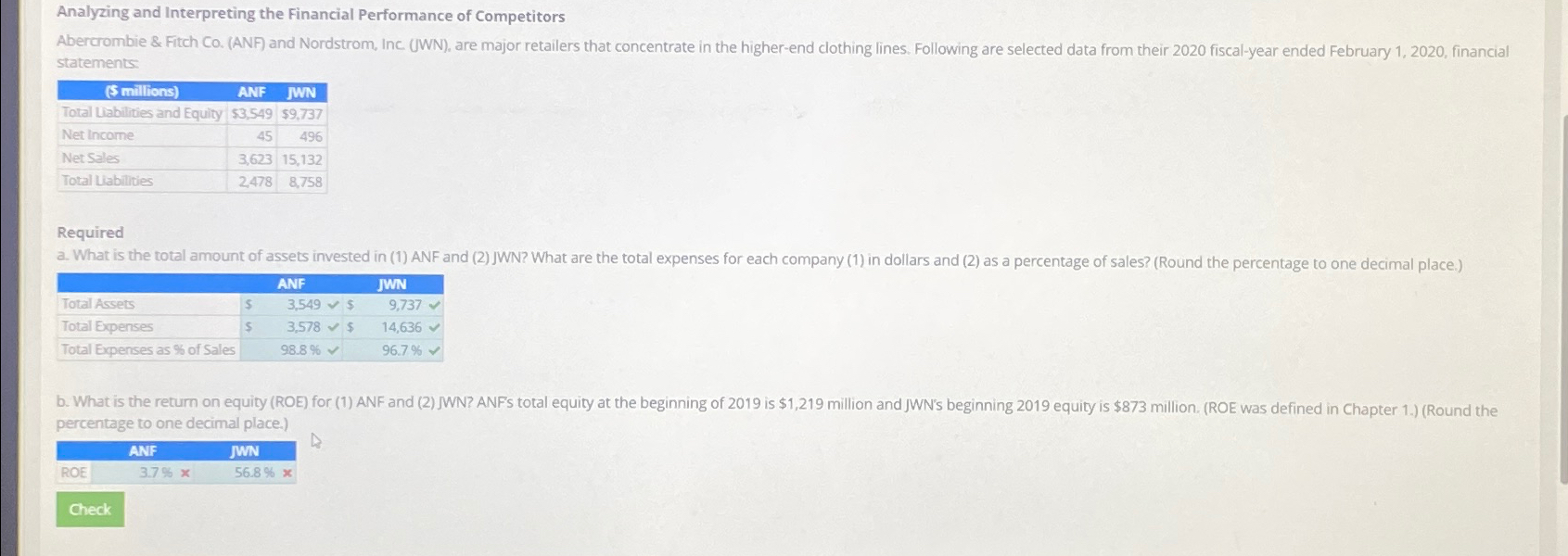

Analyzing and Interpreting the Financial Performance of Competitors Abercrombie & Fitch Co. (ANF) and Nordstrom, Inc. (JWN), are major retailers that concentrate in the

Analyzing and Interpreting the Financial Performance of Competitors Abercrombie & Fitch Co. (ANF) and Nordstrom, Inc. (JWN), are major retailers that concentrate in the higher-end clothing lines. Following are selected data from their 2020 fiscal-year ended February 1, 2020, financial statements: ($ millions) ANF JWN Total Liabilities and Equity $3,549 $9,737 Net Income Net Sales Total Liabilities 45 496 3,623 15,132 2,478 8,758 Required a. What is the total amount of assets invested in (1) ANF and (2) JWN? What are the total expenses for each company (1) in dollars and (2) as a percentage of sales? (Round the percentage to one decimal place.) Total Assets Total Expenses ANF $ 3,549 $ $ 3,578 $ 98.8 % - JWN 9,737 14,636 96.7% Total Expenses as % of Sales b. What is the return on equity (ROE) for (1) ANF and (2) JWN? ANF's total equity at the beginning of 2019 is $1,219 million and JWN's beginning 2019 equity is $873 million. (ROE was defined in Chapter 1.) (Round the percentage to one decimal place.) D ANF ROE 3.7% x JWN 56.8% x Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started