Question

Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet Following are the income statement and balance sheet of Seagate Technology for fiscal 2019. Note:

Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet

Following are the income statement and balance sheet of Seagate Technology for fiscal 2019.

Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places.

| SEGATE TECHNOLOGY PLC | |

|---|---|

| Consolidated Statement of Income | |

| For Year Ended June 28, 2019, $ millions | |

| Revenue | $10,390 |

| Cost of revenue | 7,458 |

| Product development | 991 |

| Marketing and administrative | 453 |

| Amortization of intangibles | 23 |

| Restructuring and other, net | (22) |

| Total operating expenses | 8,903 |

| Income from operations | 1,487 |

| Interest income | 84 |

| Interest expense | (224) |

| Other, net | 25 |

| Other expense, net | (115) |

| Income before income taxes | 1,372 |

| (Benefit) provision for income taxes | (640) |

| Net income | $2,012 |

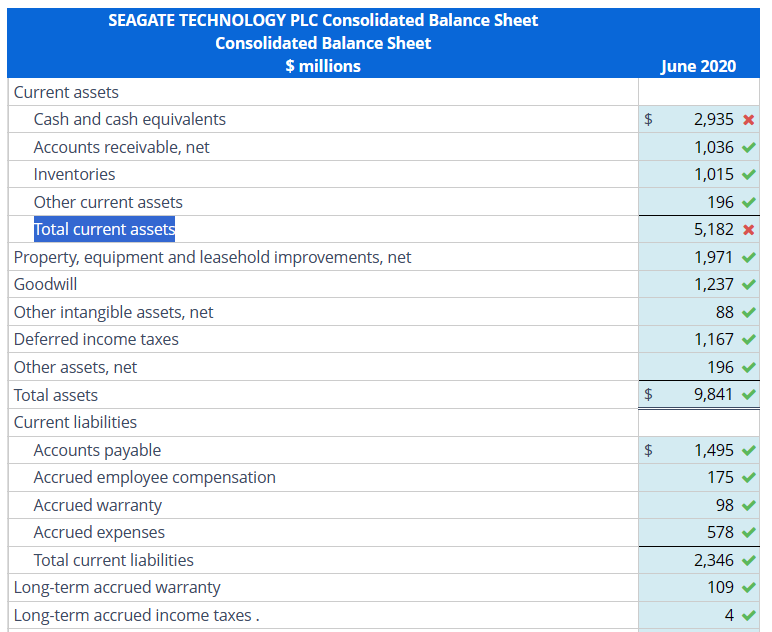

| SEAGATE TECHNOLOGY PLC Consolidated Balance Sheet | |

|---|---|

| Consolidated Balance Sheet | |

| $ millions | June 28, 2019 |

| Current assets | |

| Cash and cash equivalents | $2,220 |

| Accounts receivable, net | 989 |

| Inventories | 970 |

| Other current assets | 184 |

| Total current assets | 4,363 |

| Property, equipment and leasehold improvements, net | 1,869 |

| Goodwill | 1,237 |

| Other intangible assets, net | 111 |

| Deferred income taxes | 1,114 |

| Other assets, net | 191 |

| Total assets | $8,885 |

| Current liabilities | |

| Accounts payable | $1,420 |

| Accrued employee compensation | 169 |

| Accrued warranty | 91 |

| Accrued expenses | 552 |

| Total current liabilities | 2,232 |

| Long-term accrued warranty | 104 |

| Long-term accrued income taxes . | 4 |

| Other noncurrent liabilities | 130 |

| Long-term debt, less current portion | 4,253 |

| Total liabilities | 6,723 |

| Shareholders' equity | |

| Ordinary shares? par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and | |

| 1,354,218,154 shares issued and outstanding, respectively | 0 |

| Additional paid-in capital | 6,545 |

| Accumulated other comprehensive loss | (34) |

| Accumulated deficit | (4,349) |

| Total shareholders' equity | 2,162 |

| Total liabilities and shareholders' equity | $8,885 |

Forecast Seagate Technology's 2020 income statement using the following forecast assumptions, which are expressed as a percentage of revenue unless otherwise indicated. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_. Note: Use negative signs with answers, when appropriate.

| Assumptions | ||

|---|---|---|

| Revenue growth | 5% | growth |

| Cost of revenue | 71.8% | of revenue |

| Product development | 9.5% | of revenue |

| Marketing and administrative | 4.4% | of revenue |

| Amortization of intangibles | No change | |

| Restructuring and other, net | $0 | million |

| Interest income | No change | |

| Interest expense | No change | |

| Other, net | No change | |

| Income tax rate | 21% |

| SEGATE TECHNOLOGY PLC | ||

|---|---|---|

| Consolidated Statement of Income | ||

| $ millions | June 2020 | |

| Revenue | Answer 1

| |

| Cost of revenue | Answer 2

| |

| Product development | Answer 3

| |

| Marketing and administrative | Answer 4

| |

| Amortization of intangibles | Answer 5

| |

| Restructuring and other, net | Answer 6

| |

| Total operating expenses | Answer 7

| |

| Income from operations | Answer 8

| |

| Interest income | Answer 9

| |

| Interest expense | Answer 10

| |

| Other, net | Answer 11

| |

| Other expense, net | Answer 12

| |

| Income before income taxes | Answer 13

| |

| (Benefit) provision for income taxes | Answer 14

| |

| Net income | Answer 15

|

Forecast Seagate Technology's 2020 balance sheet using the following forecast assumptions, which are expressed as a percentage of revenue unless otherwise indicated. Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal places. Use Increase Decimal or Decrease Decimal to adjust decimal places. Do not round answers. Then enter the answers into the provided spaces below with _two decimal places_. Note: Use negative signs with answers, when appropriate.

| Assumptions | ||

|---|---|---|

| Accounts receivable, net | 9.5% | of revenue |

| Inventories | 9.3% | of revenue |

| Other current assets | 1.8% | of revenue |

| Deferred income taxes | 10.7% | of revenue |

| Other assets, net | 1.8% | of revenue |

| Accounts payable | 13.7% | of revenue |

| Accrued employee compensation | 1.6% | of revenue |

| Accrued warranty | 0.9% | of revenue |

| Accrued expenses | 5.3% | of revenue |

| Long-term accrued warranty | 1.0% | of revenue |

| Other noncurrent liabilities | 1.3% | of revenue |

| Goodwill | No change | |

| Long-term accrued income taxes | No change | |

| Long-term debt, less current portion | No change | |

| Ordinary Shares | No change | |

| Accumulated other comprehensive loss | No change | |

| CAPEX | 5.8% | of revenue |

| Depreciation expense | 5.4% | of beginning Property, equipment and leasehold improvements, gross |

| Beginning Property, equipment and leasehold improvements, gross | $9,835 | million |

| Stock-based compensation | $99 | million, increases Capital in excess of par value by the same amount. Assume that the company routinely includes this form of compensation in operating expenses each year. |

| Dividend payout ratio | 35.4% |

| SEAGATE TECHNOLOGY PLC Consolidated Balance Sheet | ||

|---|---|---|

| Consolidated Balance Sheet | ||

| $ millions | June 2020 | |

| Current assets | ||

| Cash and cash equivalents | Answer 16

| |

| Accounts receivable, net | Answer 17

| |

| Inventories | Answer 18

| |

| Other current assets | Answer 19

| |

| Total current assets | Answer 20

| |

| Property, equipment and leasehold improvements, net | Answer 21

| |

| Goodwill | Answer 22

| |

| Other intangible assets, net | Answer 23

| |

| Deferred income taxes | Answer 24

| |

| Other assets, net | Answer 25

| |

| Total assets | Answer 26

| |

| Current liabilities | ||

| Accounts payable | Answer 27

| |

| Accrued employee compensation | Answer 28

| |

| Accrued warranty | Answer 29

| |

| Accrued expenses | Answer 30

| |

| Total current liabilities | Answer 31

| |

| Long-term accrued warranty | Answer 32

| |

| Long-term accrued income taxes . | Answer 33

| |

| Other noncurrent liabilities | Answer 34

| |

| Long-term debt, less current portion | Answer 35

| |

| Total liabilities | Answer 36

| |

| Shareholders' equity | ||

| Ordinary shares? par value $0.0001, 2.6 billion shares authorized, 1,340,697,595 and | ||

| 1,354,218,154 shares issued and outstanding, respectively | Answer 37

| |

| Additional paid-in capital | Answer 38

| |

| Accumulated other comprehensive loss | Answer 39

| |

| Accumulated deficit | Answer 40

| |

| Total shareholders' equity | Answer 41

| |

| Total liabilities and shareholders' equity | Answer 42

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started