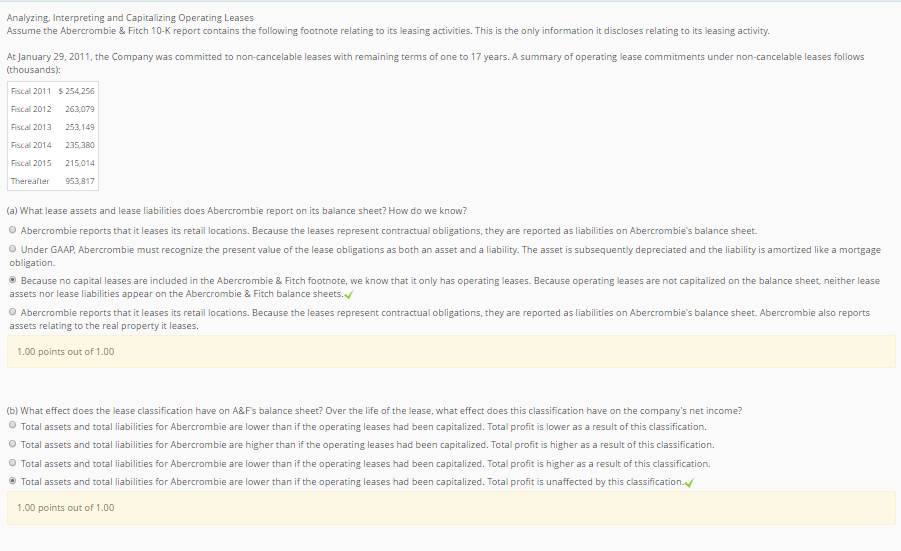

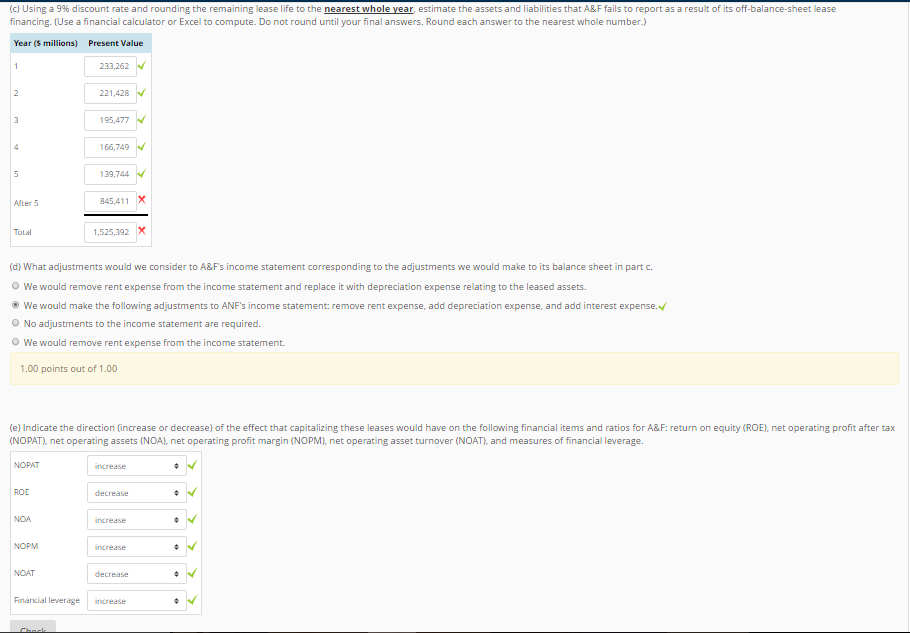

Analyzing, Interpreting and Capitalizing Operating Leases Assume the Abercrombie & Fitch 10-K report contains the following footnote relating to its leasing activities. This is the only information it discloses relating to its leasing activity. At January 29, 2011, the Company was committed to non-cancelable leases with remaining terms of one to 17 years. A summary of operating lease commitments under non-cancelable leases follows (thousands): Fiscal 2011 254,256 Fiscal 2012 263,079 Fiscal 2013 253,149 Fiscal 2015 215,014 Thereafter 953,817 (a) What lease assets and lease liabilities does Abercrombie report on its balance sheet? How do we know? O Abercrombie reports that it leases its retail locations. Because the leases represent contractual obligations, they are reported as liabilities on Abercrombie's balance sheet. O Under GAAP, Abercrombie must recognize the present value of the lease obligations as both an asset and a liability. The asset is subsequently depreciated and the liability is amortized like a mortgage obligation Because no capital leases are included in the Abercrombie&Fitch footnote, we know that it only has operating leases. Because operating leases are not capitalized on the balance sheet, neither lease assets nor lease liabilities appear on the Abercrombie & Fitch balance sheets. O Abercrombie reports that it leases its retail locations. Because the leases represent contractual obligations, they are reported as liabilities on Abercrombie's balance sheet. Abercrombie also reports assets relating to the real property it leases. 1.00 points out of 1.00 (b) What effect does the lease classification have on A&Fs balance sheet? Over the life of the lease, what effect does this classification have on the company's net income? Total assets and total liabilities for Abercrombie are lower than if the operating leases had been capitalized. Total profit is lower as a result of this classification. O Total assets and total liabilities for Abercrombie are higher than if the operating leases had been capitalized. Total profit is higher as a result of this classification. O Total assets and total liabilities for Abercrombie are lower than if the operating leases had been capitalized. Total profit is higher as a result of this classification. Total assets and total liabilities for Abercrombie are lower than if the operating leases had been capitalized. Total profit is unaffected by this classification 1.00 points out of 1.00