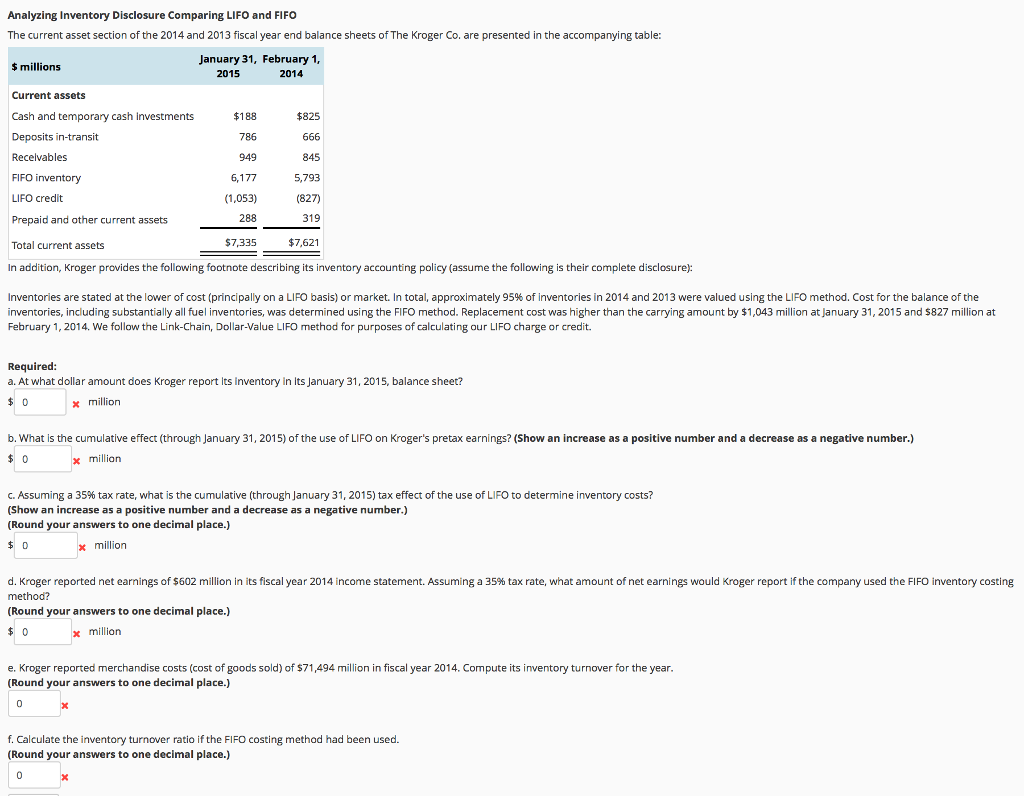

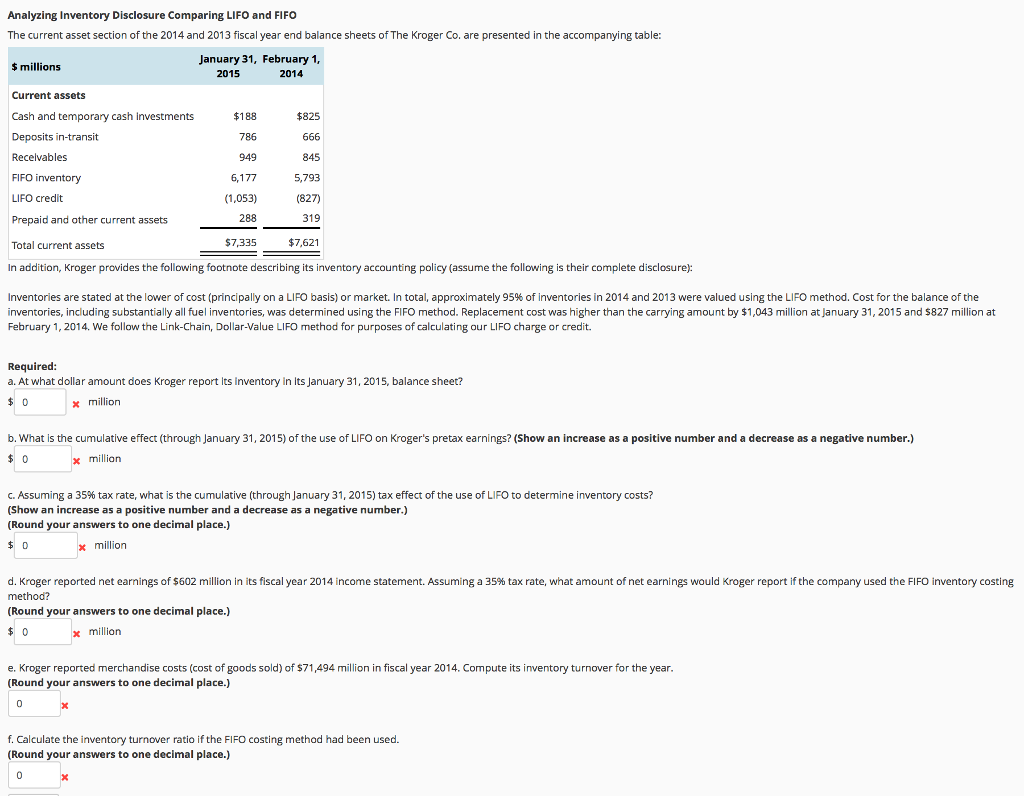

Analyzing Inventory Disclosure Comparing LIFO and FIFO The current asset section of the 2014 and 2013 fiscal year end balance sheets of The Kroger Co. are presented in the accompanying table: January 31, February 1 $millions Current assets Cash and temporary cash investments Deposits in-transit Recelvables FIFO inventory LIFO credit Prepaid and other current assets Total current assets In addition, Kroger provides the following footnote describing its inventory accounting policy (assume the following is their complete disclosure): 2015 2014 $188 786 949 6,177 (1,053) 288 7,335 $825 845 5,793 (827) 319 $7,621 Inventories are stated at the lower of cost (principally on a LIFO basis) or market. In total, approximately 95% of inventories in 2014 and 2013 were valued using the LIFO method. Cost for the balance of the inventories, including substantially all fuel inventories, was determined using the FIFO method. Replacement cost was higher than the carrying amount by $1,043 million at January 31, 2015 and $827 million at February 1, 2014. We follow the Link-Chain, Dollar-Value LIFO method for purposes of calculating our LIFO charge or credit. Required a. At what dollar amount does Kroger report its inventory in its January 31, 2015, balance sheet? $ 0 million b. What is the cumulative effect (through January 31, 2015) of the use of LIFO on Kroger's pretax earnings? (Show an increase as a positive number and a decrease as a negative number.) million C. Assuming a 35% tax rate, what is the cumulative (through January 31, 2015) tax effect of the use of LIFO to determine inventory costs? (Show an increase as a positive number and a decrease as a negative number.) (Round your answers to one decimal place.) million d. Kroger reported net earnings of $602 million in its fiscal year 2014 income statement. Assuming a 35% tax rate, what amount of net earnings would Kroger report if the company used the FIFO inventory costing method? (Round your answers to one decimal place.) million e. Kroger reported merchandise costs (cost of goods sold) of $71,494 million in fiscal year 2014. Compute its inventory turnover for the year (Round your answers to one decimal place.) f. Calculate the inventory turnover ratio if the FIFO costing method had been used. (Round your answers to one decimal place.)