Question

analyzing the below portfolio's beta and providing an actual calculation (showing the math) of your portfolio's beta. For the second explain and interpret the portfolio's

analyzing the below portfolio's beta and providing an actual calculation (showing the math) of your portfolio's beta. For the second explain and interpret the portfolio's beta using the following scenarios.

- The Standard & Poor's Corporation (S&P) experiences a 10% decline from today's value;

- The S&P experiences a 20% increase from today's value.

Here is my portfolio:

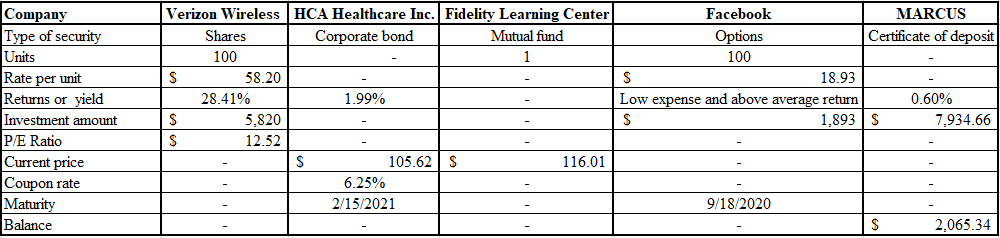

Company : Verizon Wireless, 100 shares. rate per unit $58.20, returns on yield 28.41%. investment amount $5,820 P/E ratio $12.52

Company: HCA Healthcare Inc. Corporate bond. Returns or yield 1.99% current price $105.62 coupon rate 6.25% maturity 2/15/2021

Company: Fidelity Learning Center. Mutual Fund P/E $116.01.

Company: Facebook. 100 options. Rate of unit $18.93. investment amount $1,893 maturity date 9/18/2020

Company: MARCUS. Certificate of deposit. Returns or yield 0.60%. investment amount $7,934.66

Thank you for your help!

Units Shares 100 Company Type of security Verizon Wireless HCA Healthcare Inc. Fidelity Learning Center Corporate bond Mutual fund 1 Facebook Options 100 MARCUS Certificate of deposit Rate per unit S 58.20 S 18.93 Returns or yield 28.41% 1.99% Investment amount S 5.820 Low expense and above average return S 0.60% 1,893 $ 7,934.66 P/E Ratio S 12.52 Current price S 105.62 $ 116.01 Coupon rate 6.25% Maturity 2/15/2021 Balance 9/18/2020 S 2,065.34

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started