Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Analyzing the quality of earnings and sustainability of capital expenditures) Look up the statement of cash flows for both Home Depot and Lowes using

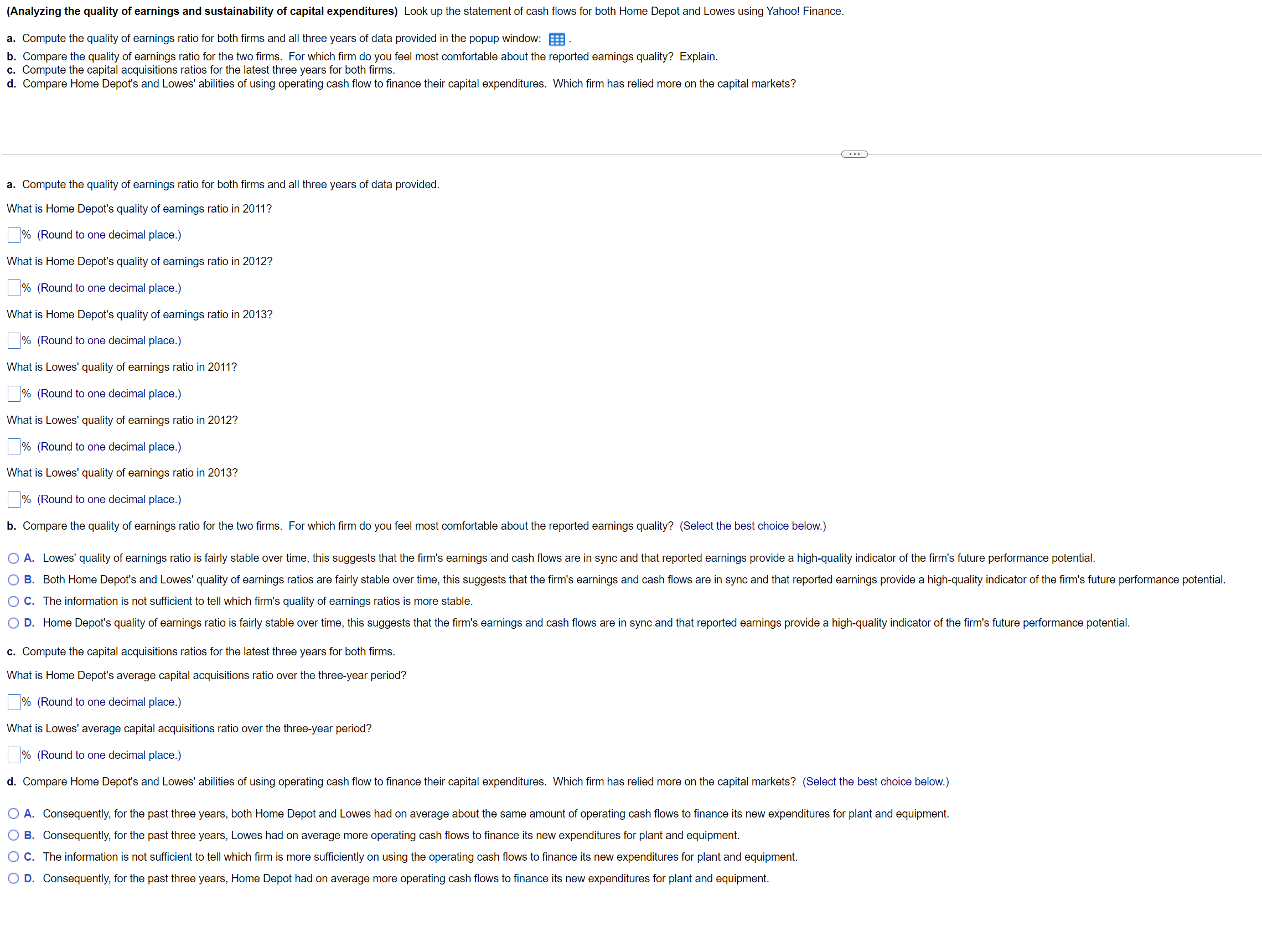

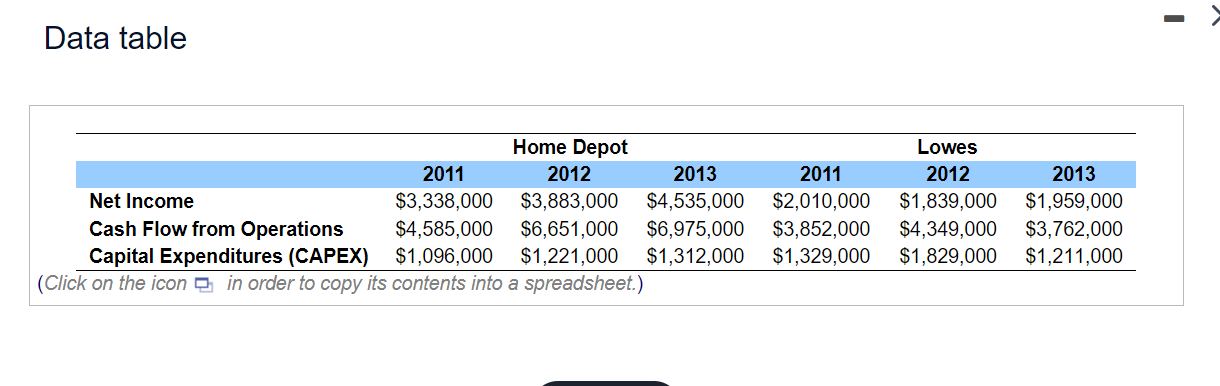

(Analyzing the quality of earnings and sustainability of capital expenditures) Look up the statement of cash flows for both Home Depot and Lowes using Yahoo! Finance. a. Compute the quality of earnings ratio for both firms and all three years of data provided in the popup window: b. Compare the quality of earnings ratio for the two firms. For which firm do you feel most comfortable about the reported earnings quality? Explain. c. Compute the capital acquisitions ratios for the latest three years for both firms. d. Compare Home Depot's and Lowes' abilities of using operating cash flow to finance their capital expenditures. Which firm has relied more on the capital markets? . a. Compute the quality of earnings ratio for both firms and all three years of data provided. What is Home Depot's quality of earnings ratio in 2011? % (Round to one decimal place.) What is Home Depot's quality of earnings ratio in 2012? % (Round to one decimal place.) What is Home Depot's quality of earnings ratio in 2013? % (Round to one decimal place.) What is Lowes' quality of earnings ratio in 2011? % (Round to one decimal place.) What is Lowes' quality of earnings ratio in 2012? % (Round to one decimal place.) What is Lowes' quality of earnings ratio in 2013? % (Round to one decimal place.) b. Compare the quality of earnings ratio for the two firms. For which firm do you feel most comfortable about the reported earnings quality? (Select the best choice below.) A. Lowes' quality of earnings ratio is fairly stable over time, this suggests that the firm's earnings and cash flows are in sync and that reported earnings provide a high-quality indicator of the firm's future performance potential. B. Both Home Depot's and Lowes' quality of earnings ratios are fairly stable over time, this suggests that the firm's earnings and cash flows are in sync and that reported earnings provide a high-quality indicator of the firm's future performance potential. C. The information is not sufficient to tell which firm's quality of earnings ratios is more stable. D. Home Depot's quality of earnings ratio is fairly stable over time, this suggests that the firm's earnings and cash flows are in sync and that reported earnings provide a high-quality indicator of the firm's future performance potential. c. Compute the capital acquisitions ratios for the latest three years for both firms. What is Home Depot's average capital acquisitions ratio over the three-year period? % (Round to one decimal place.) What is Lowes' average capital acquisitions ratio over the three-year period? % (Round to one decimal place.) d. Compare Home Depot's and Lowes' abilities of using operating cash flow to finance their capital expenditures. Which firm has relied more on the capital markets? (Select the best choice below.) A. Consequently, for the past three years, both Home Depot and Lowes had on average about the same amount of operating cash flows to finance its new expenditures for plant and equipment. B. Consequently, for the past three years, Lowes had on average more operating cash flows to finance its new expenditures for plant and equipment. C. The information is not sufficient to tell which firm is more sufficiently on using the operating cash flows to finance its new expenditures for plant and equipment. O D. Consequently, for the past three years, Home Depot had on average more operating cash flows to finance its new expenditures for plant and equipment. Data table Home Depot Lowes 2011 Net Income Cash Flow from Operations Capital Expenditures (CAPEX) (Click on the icon in order to copy its contents into a spreadsheet.) $3,338,000 2012 2013 2011 $3,883,000 $4,535,000 $2,010,000 $1,839,000 $1,959,000 $4,585,000 $6,651,000 $6,975,000 $3,852,000 $4,349,000 $3,762,000 $1,096,000 $1,221,000 $1,312,000 2012 2013 $1,329,000 $1,829,000 $1,211,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Quality of earnings ratio The quality of earnings ratio is calculated by dividing cash flows from operating activities by net income It measures the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started