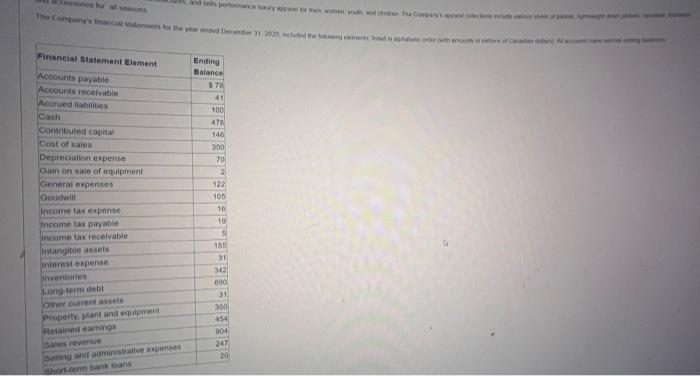

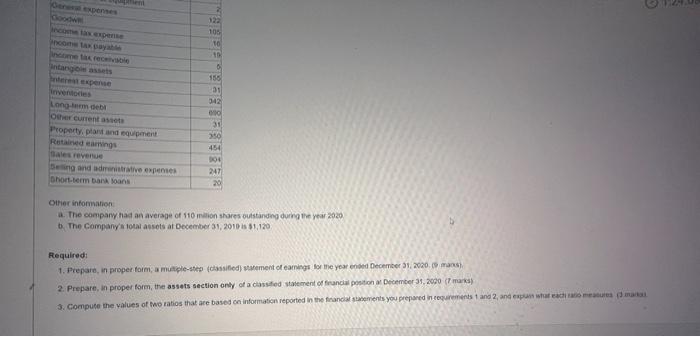

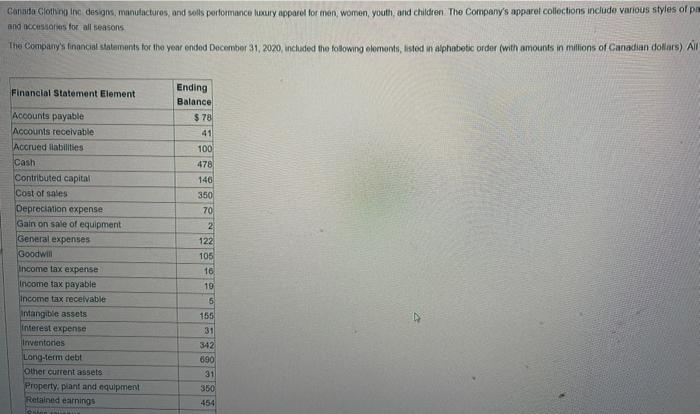

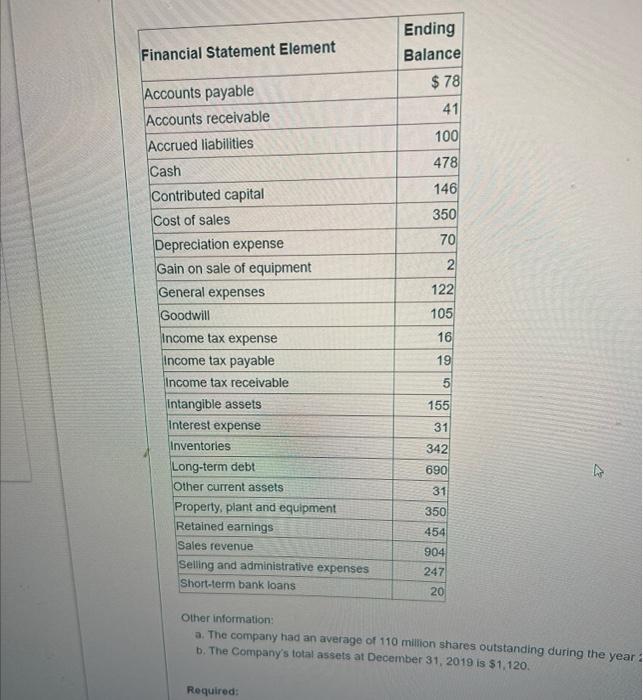

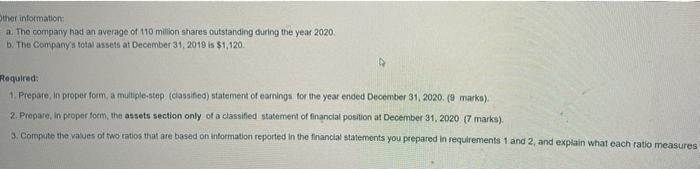

and cols permet The Centers for you and Dec.2001, clad w fotowe okna wewe Financial Statement Element Ending Balance 370 Accounts payable Accounts receivable Accrued abilities Contributed capital Cost of sales Depreciation expense Cain on sale of equipment General expenses Goodwill Income tax expense Income tax payable Income tax receivable Intangible assets toreste pense Inventories 40 100 470 146 350 70 2 122 105 10 10 5 165 31 342 000 31 350 454 004 Long-term debt Other current asset Property, plant and equipment Retained cuming Sales revenue Song and administrative expenses horsem bank loans 1 20 Dan ponses 322 105 10 10 156 31 042 nang stepen Inventore Longum deb Other current as Property, plant and equipment Rated earrings Sales reven Being and adve penses Dhort term bank loans 31 250 454 394 247 20 Other information a. The company had an average of 110 milion shares outstanding during the year 2020 b. The Company's 10tal assets at December 31, 2018 51,120 Required: 1. Prepare, in proper forma multiple-step (cassified) statement of earnings for the year and December 31, 2020. mans) 2. Prepare, in proper form, the assets section only of a classified statement of financial position at December 31, 2000 (marks) 3. Compute the values of two ratios that are based on information reported in the financiaments you prepared integrements 1 and 2, and expandera Conde Clothing in design, manufactures, and sells performance luxury apparel for men, women, youth and children. The Company's apparet collections include various styles of pe and accessories for all seasons The Company's financial statements for the year ended December 31, 2020, included the following olomonts, listed in alphabetic order with amounts in millions of Canadian dollars) Al Financial Statement Element Accounts payable Accounts receivable Accrued liabilities Cash Contributed capital Cost of sales Depreciation expense Gain on sale of equipment General expenses Goodwin Income tax expense Income tax payable Income tax receivable Intangible assets Interest expense Inventories Long-term debt Other current assets Property, plant and equipment Retained earnings Ending Balance $ 78 41 100 478 146 350 70 2 122 105 16 19 6 155 31 342 090 31 350 454 Financial Statement Element Ending Balance $78 41 100 478 146 Accounts payable Accounts receivable Accrued liabilities Cash Contributed capital Cost of sales Depreciation expense Gain on sale of equipment General expenses Goodwill 350 70 2 122 105 ou CD o 155 31 342 Income tax expense Income tax payable Income tax receivable Intangible assets Interest expense Inventories Long-term debt Other current assets Property, plant and equipment Retained earnings Sales revenue Selling and administrative expenses Short-term bank loans 690 4 31 350 454 904 247 20 Other information: a. The company had an average of 110 million shares outstanding during the year b. The Company's total assets at December 31, 2019 is $1,120. Required: Other information a. The company had an average of 110 million shares outstanding during the year 2020, b. The Company's total assets at December 31, 2019 is $1,120 Required: 1. Prepare in proper form, a multiple-stop (classified) statement of earnings for the year ended December 31, 2020. (marka) 2. Prepare, in proper form, the assets section only of a classified statement of financial position at December 31, 2020 (7 marks) 3. Compute the values of two ratios that are based on information reported in the financial statements you prepared in requirements 1 and 2, and explain what each ratio measures