Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and comparable transaction analysis. that Durtech is a likely takeover candidate and has asked Logan to estimate the company's Josh Logan is a buy-side

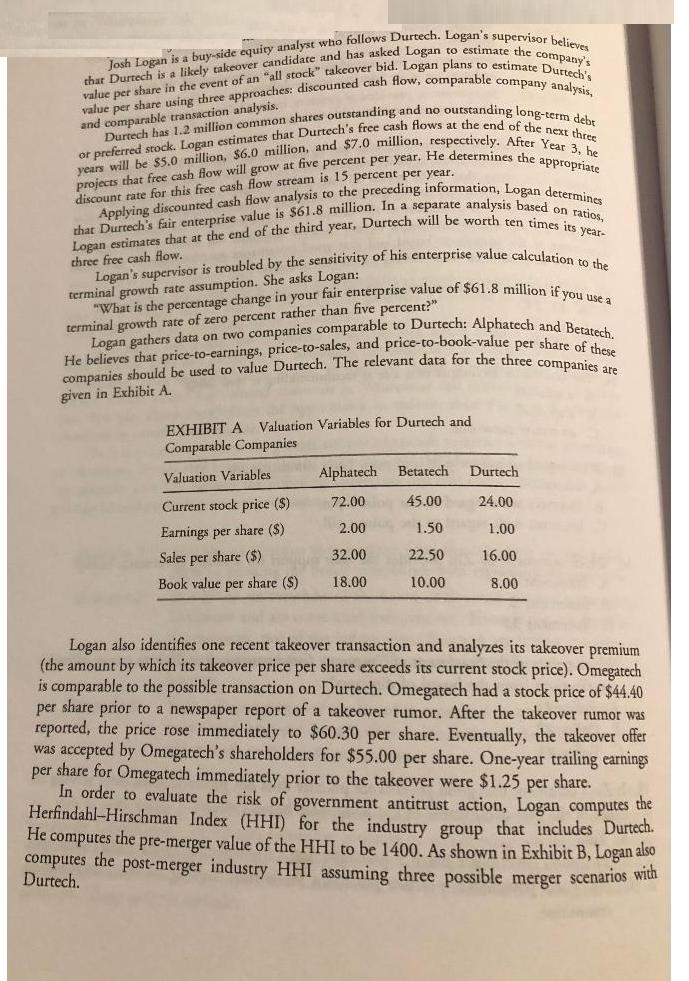

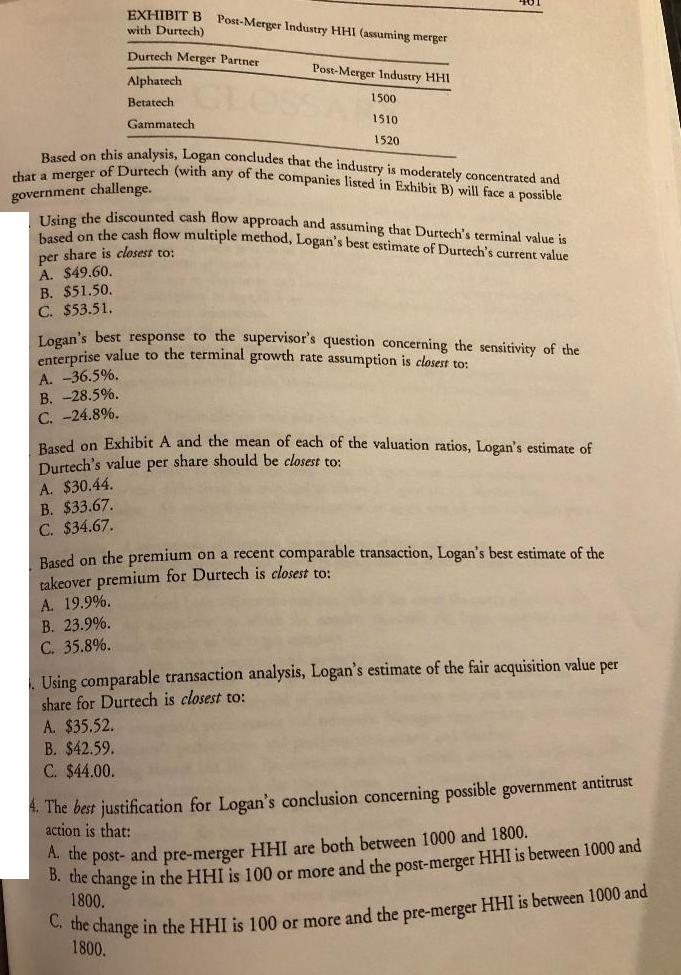

and comparable transaction analysis. that Durtech is a likely takeover candidate and has asked Logan to estimate the company's Josh Logan is a buy-side equity analyst who follows Durtech. Logan's supervisor believes value per share using three approaches: discounted cash flow, comparable company analysis, value per share in the event of an "all stock" takeover bid. Logan plans to estimate Durtech's Durtech has 1.2 million common shares outstanding and no outstanding long-term debr or preferred stock. Logan estimates that Durtech's free cash flows at the end of the next three years will be $5.0 million, $6.0 million, and $7.0 million, respectively. After Year 3, he projects that free cash flow will grow at five percent per year. He determines the appropriate that Durtech's fair enterprise value is $61.8 million. In a separate analysis based on ratios, Applying discounted cash flow analysis to the preceding information, Logan determines Logan estimates that at the end of the third year, Durtech will be worth ten times its year- discount rate for this free cash flow stream is 15 percent per year. three free cash flow. D Logan's supervisor is troubled by the sensitivity of his enterprise value calculation to the "What is the percentage change in your fair enterprise value of $61.8 million if you use a terminal growth rate assumption. She asks Logan: terminal growth rate of zero percent rather than five percent?" He believes that price-to-earnings, price-to-sales, and price-to-book-value per share of these Logan gathers data on two companies comparable to Durtech: Alphatech and Betatech. companies should be used to value Durtech. The relevant data for the three companies are given in Exhibit A. EXHIBIT A Valuation Variables for Durtech and Comparable Companies Valuation Variables Current stock price ($) Earnings per share ($) Sales per share ($) Book value per share ($) Alphatech Betatech Durtech 72.00 45.00 24.00 2.00 1.50 1.00 32.00 22.50 16.00 18.00 10.00 8.00 Logan also identifies one recent takeover transaction and analyzes its takeover premium (the amount by which its takeover price per share exceeds its current stock price). Omegatech is comparable to the possible transaction on Durtech. Omegatech had a stock price of $44.40 per share prior to a newspaper report of a takeover rumor. After the takeover rumor was reported, the price rose immediately to $60.30 per share. Eventually, the takeover offer was accepted by Omegatech's shareholders for $55.00 per share. One-year trailing earnings per share for Omegatech immediately prior to the takeover were $1.25 per share. In order to evaluate the risk of government antitrust action, Logan computes the Herfindahl-Hirschman Index (HHI) for the industry group that includes Durtech. He computes the pre-merger value of the HHI to be 1400. As shown in Exhibit B, Logan also computes the post-merger industry HHI assuming three possible merger scenarios with Durtech. EXHIBIT B Post-Merger Industry HHI (assuming merger with Durtech) Durtech Merger Partner Alphatech Betatech Gammatech A. $30.44. B. $33.67. C. $34.67. Post-Merger Industry HHI 1500 1510 Based on this analysis, Logan concludes that the industry is moderately concentrated and that a merger of Durtech (with any of the companies listed in Exhibit B) will face a possible government challenge. Using the discounted cash flow approach and assuming that Durtech's terminal value is based on the cash flow multiple method, Logan's best estimate of Durtech's current value per share is closest to: A. $49.60. B. $51.50. C. $53.51. 1520 Logan's best response to the supervisor's question concerning the sensitivity of the enterprise value to the terminal growth rate assumption is closest to: A. -36.5%. B.-28.5%. C.-24.8%. A. 19.9%. B. 23.9%. C. 35.8%. Based on Exhibit A and the mean of each of the valuation ratios, Logan's estimate of Durtech's value per share should be closest to: Based on the premium on a recent comparable transaction, Logan's best estimate of the takeover premium for Durtech is closest to: Using comparable transaction analysis, Logan's estimate of the fair acquisition value per share for Durtech is closest to: A. $35.52. B. $42.59. C. $44.00. 4. The best justification for Logan's conclusion concerning possible government antitrust action is that: A. the post- and pre-merger HHI are both between 1000 and 1800. the change in the HHI is 100 1800. C. the change in the HHI is 100 or more and the pre-merger HHI is between 1000 and 1800. more and the post-merger HHI is between 1000 and

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started