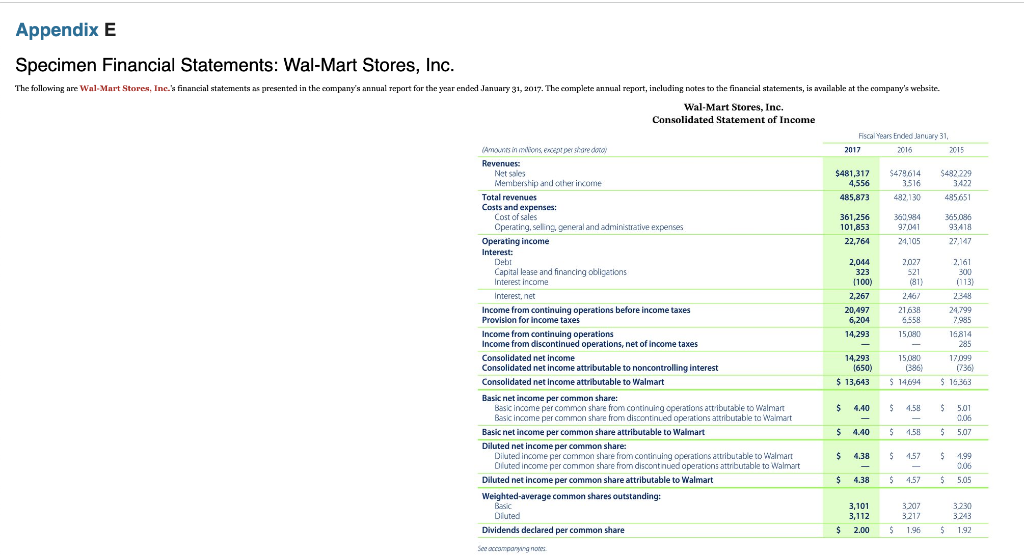

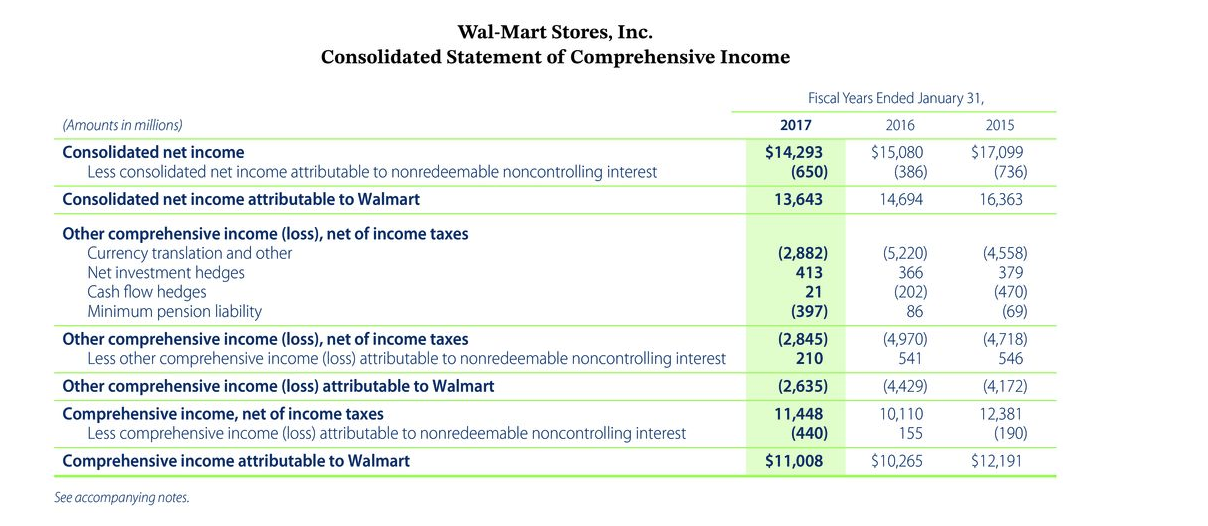

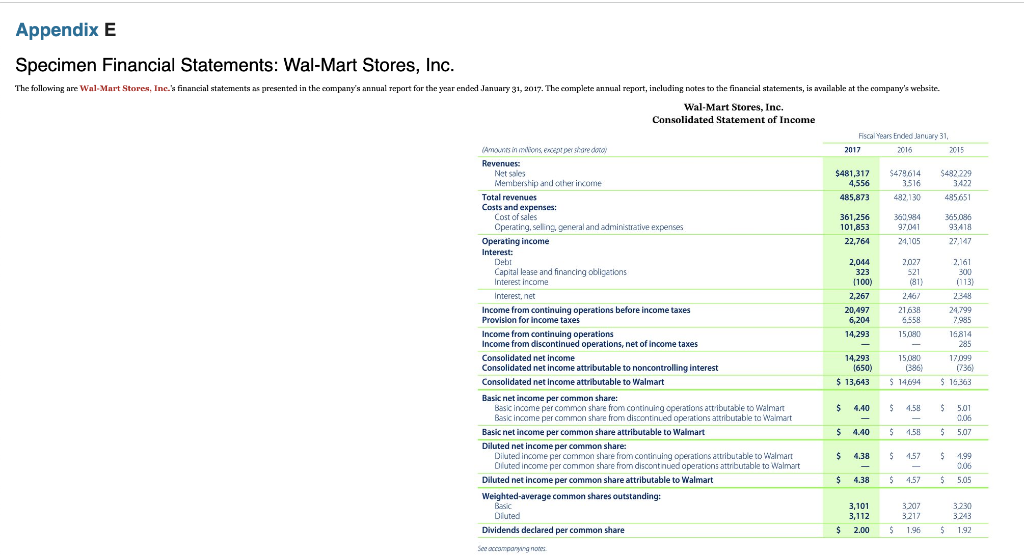

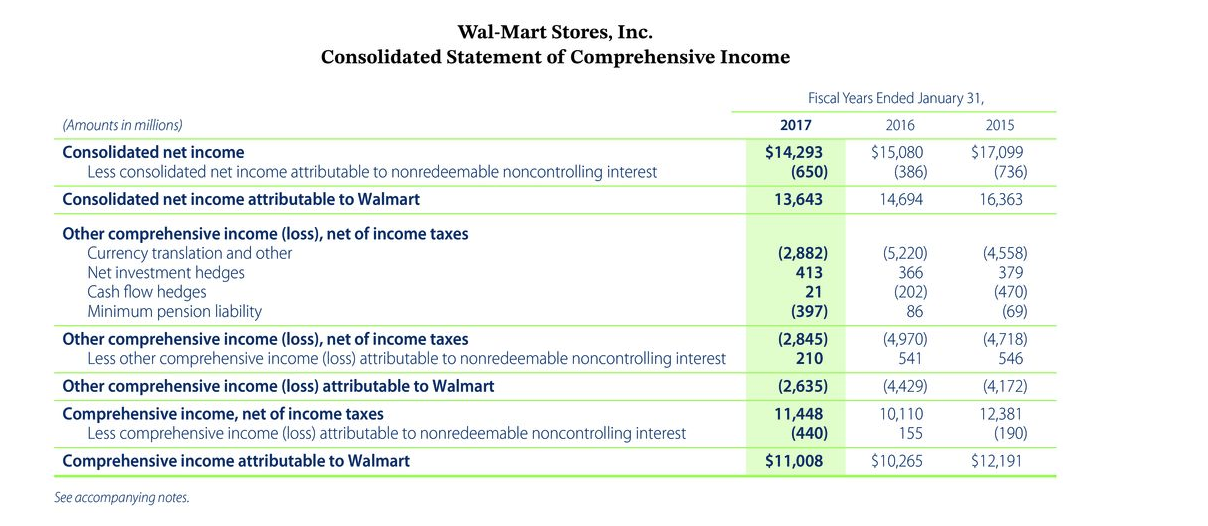

And here is Appendix E for Wal-mart:

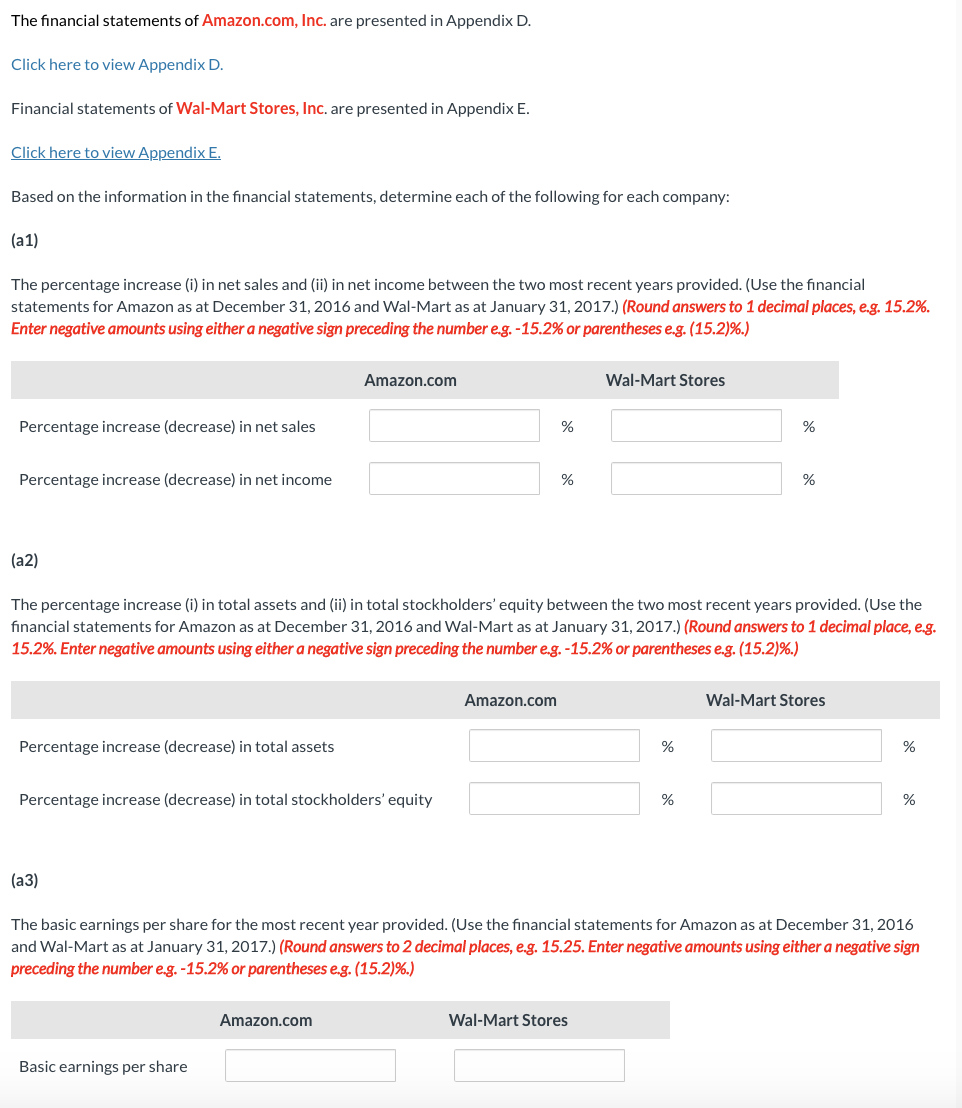

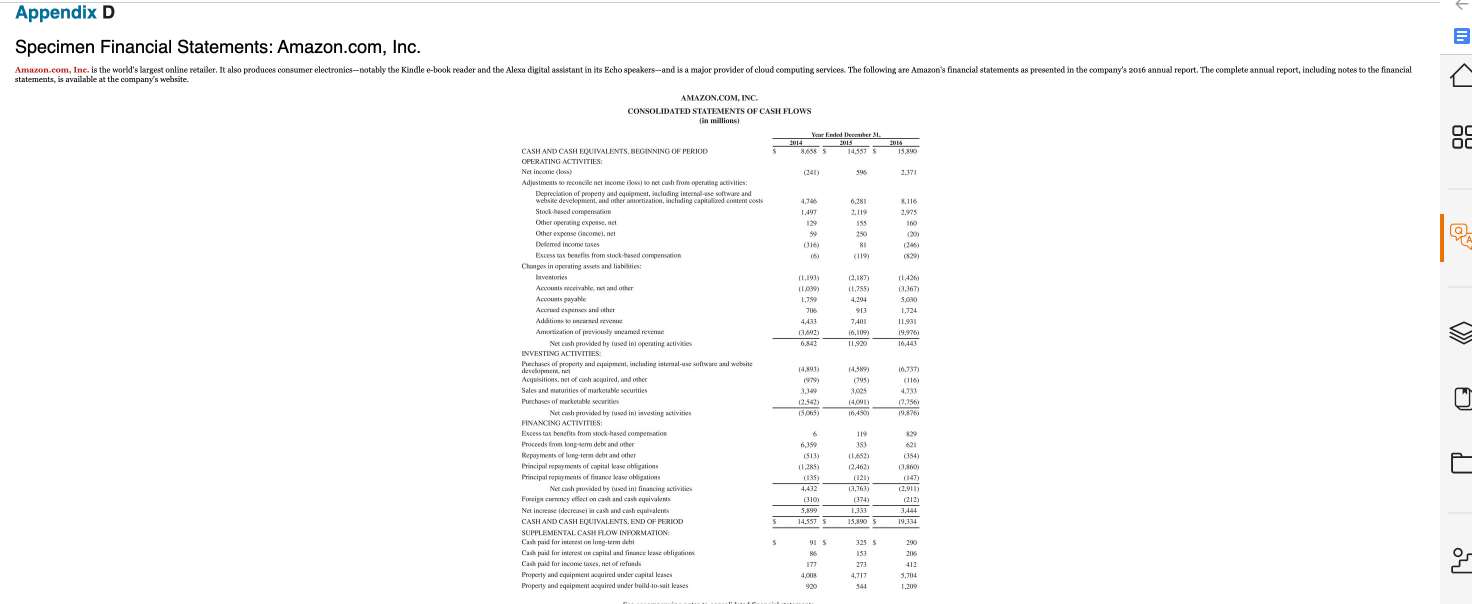

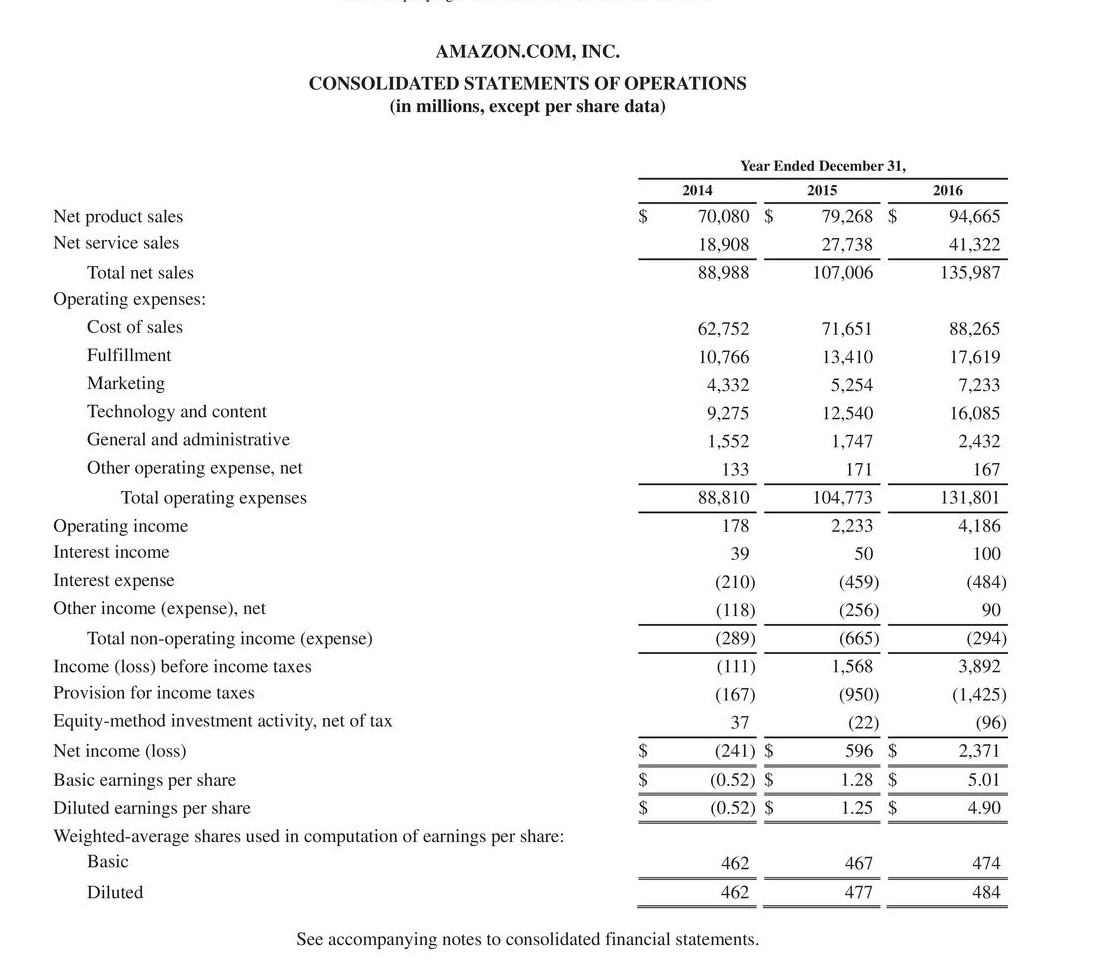

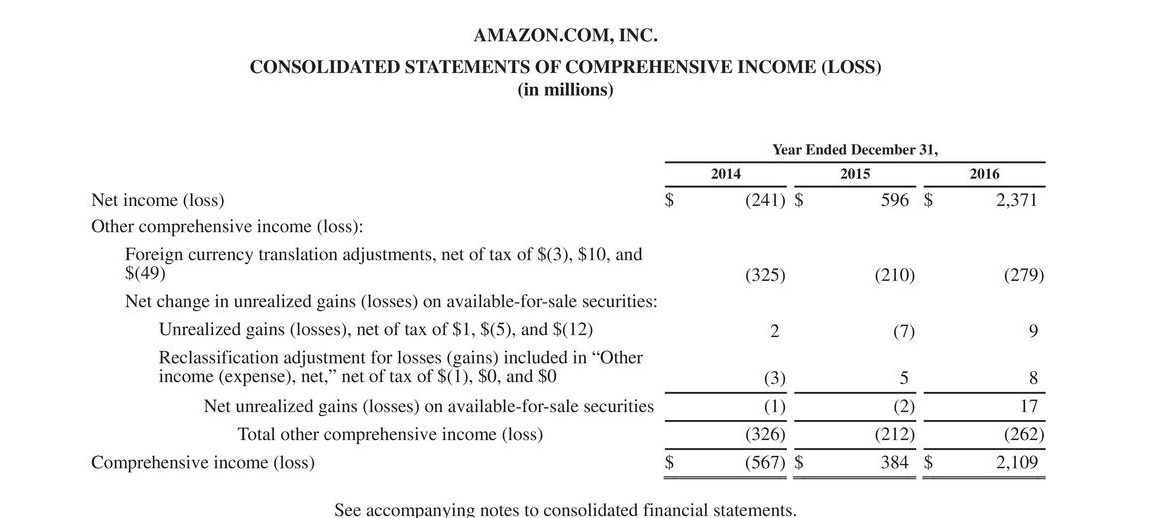

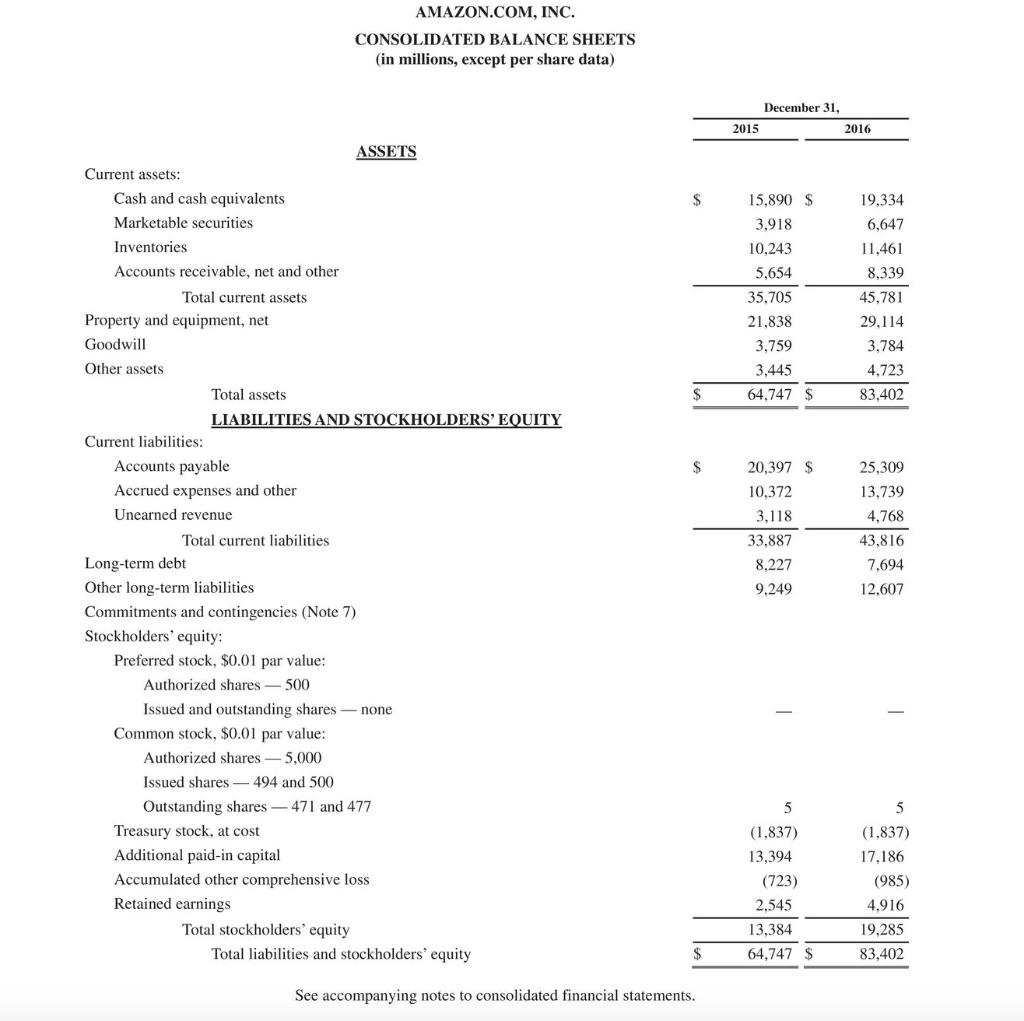

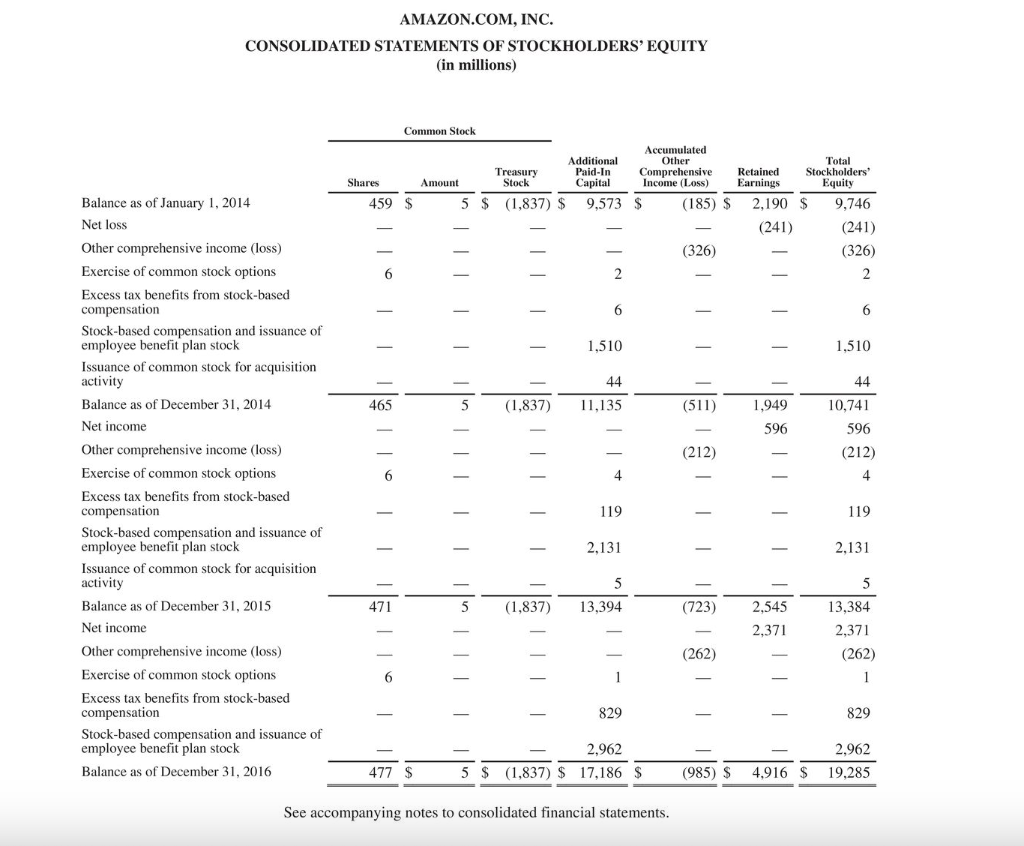

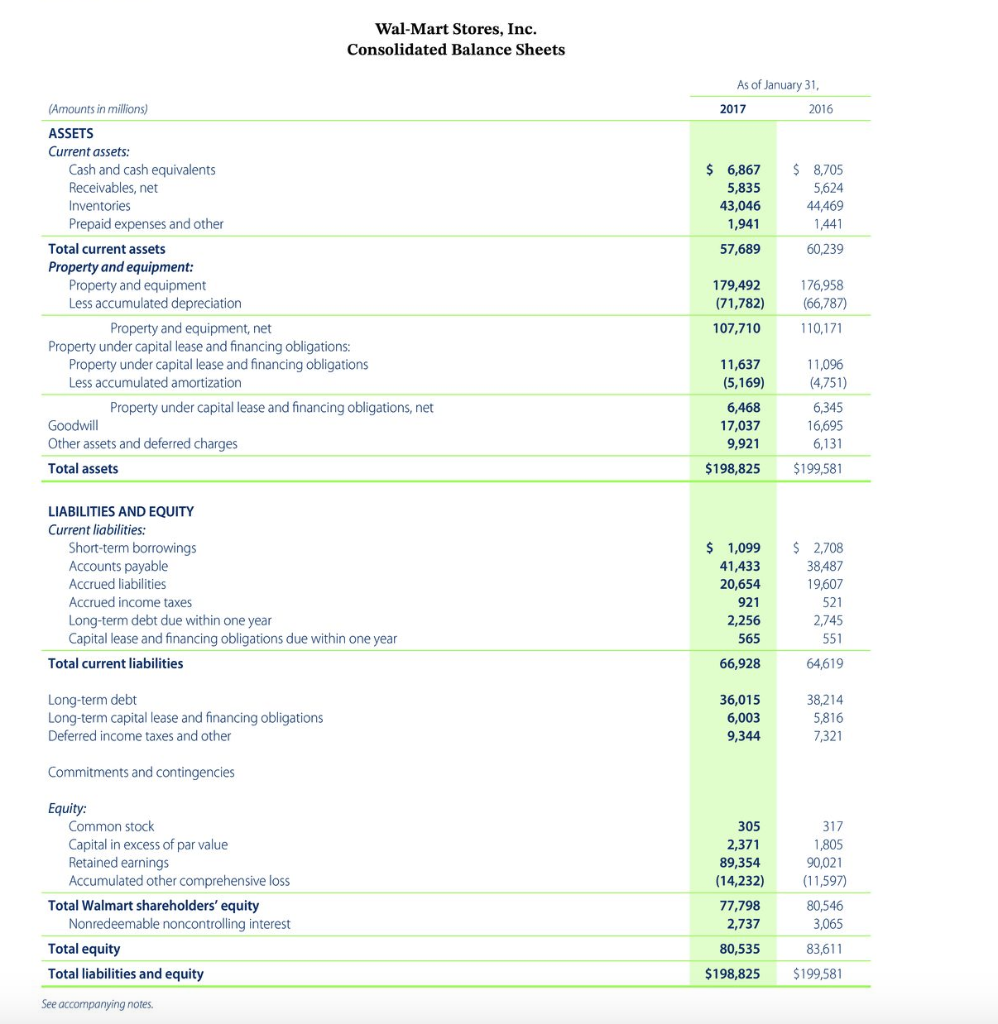

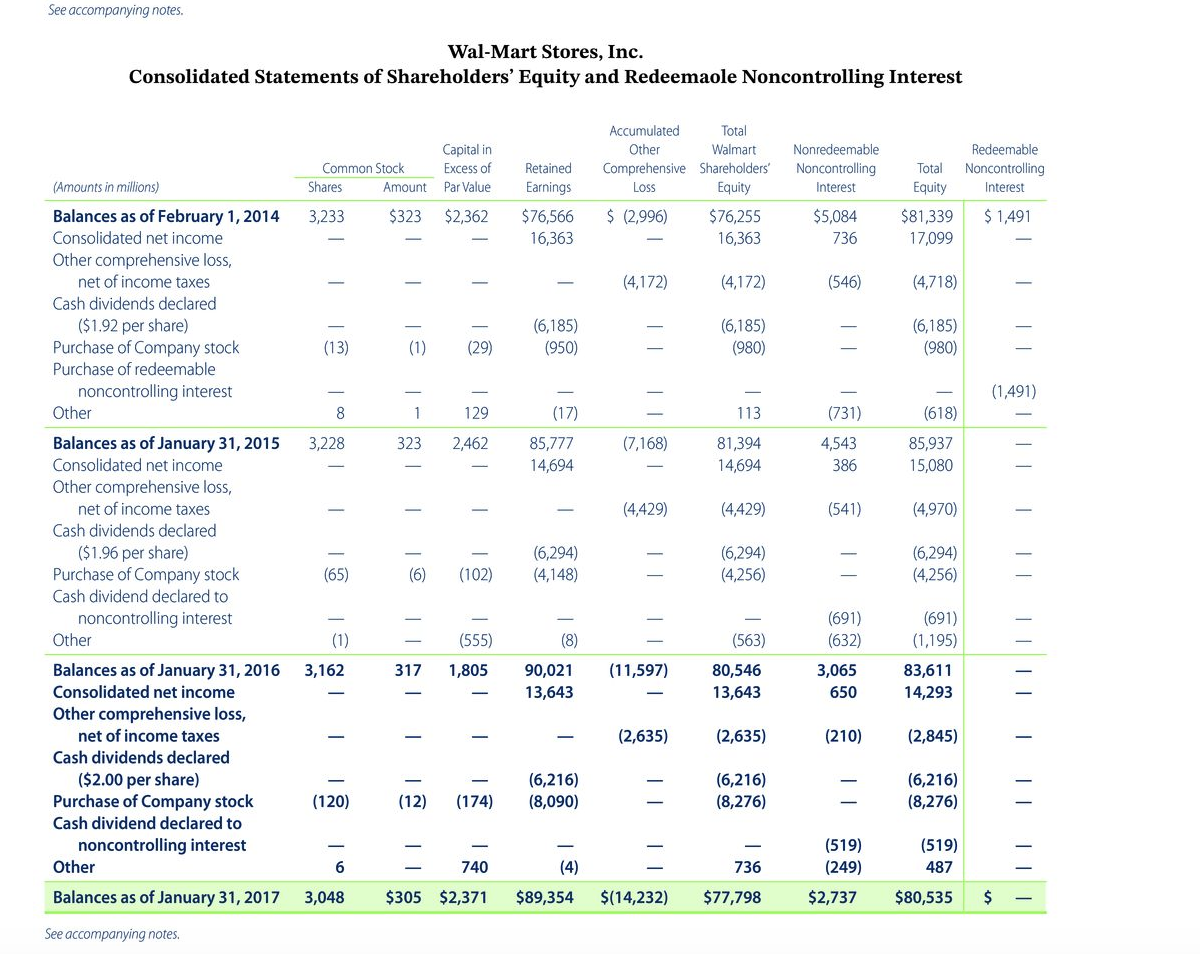

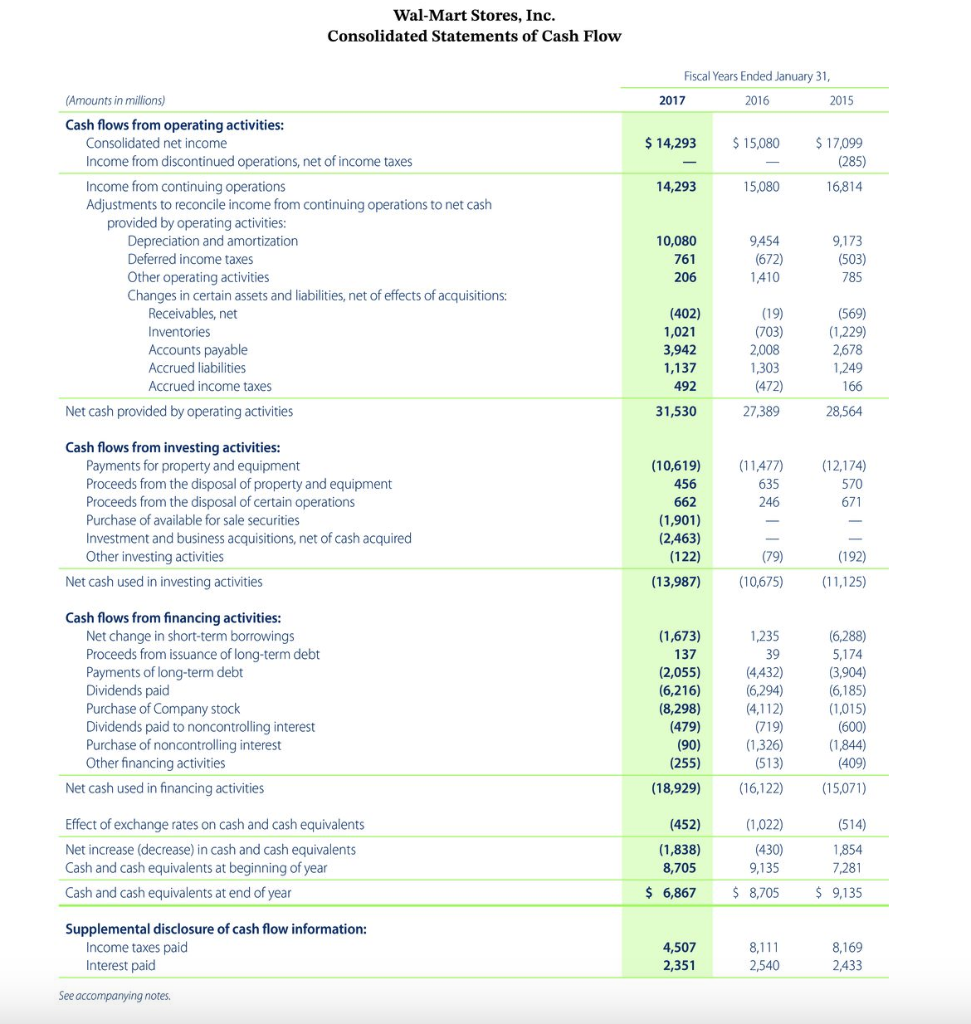

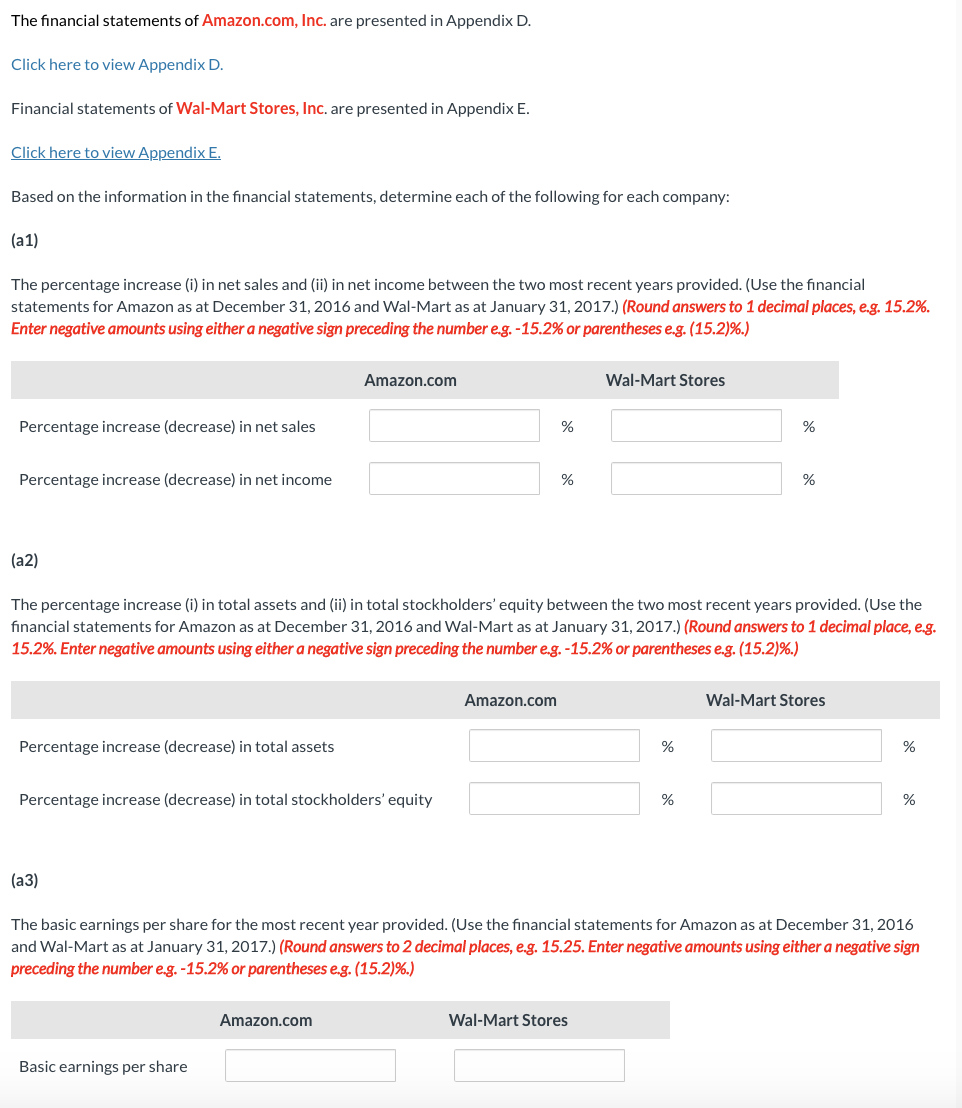

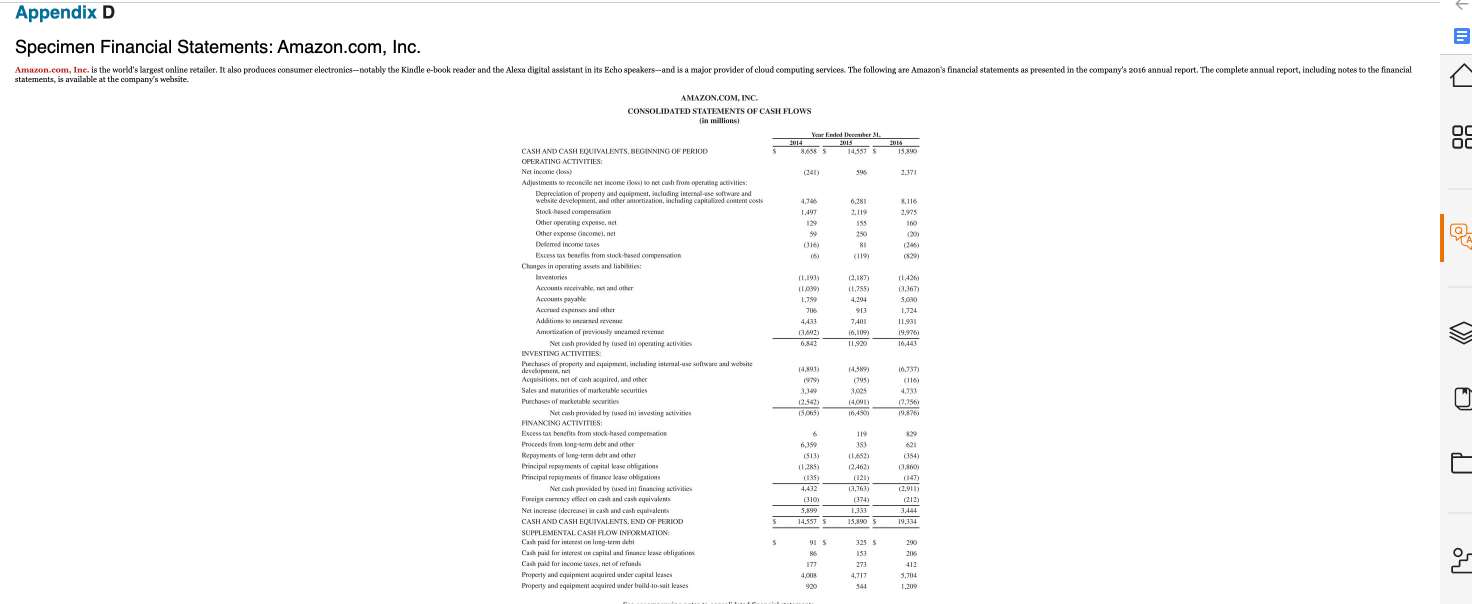

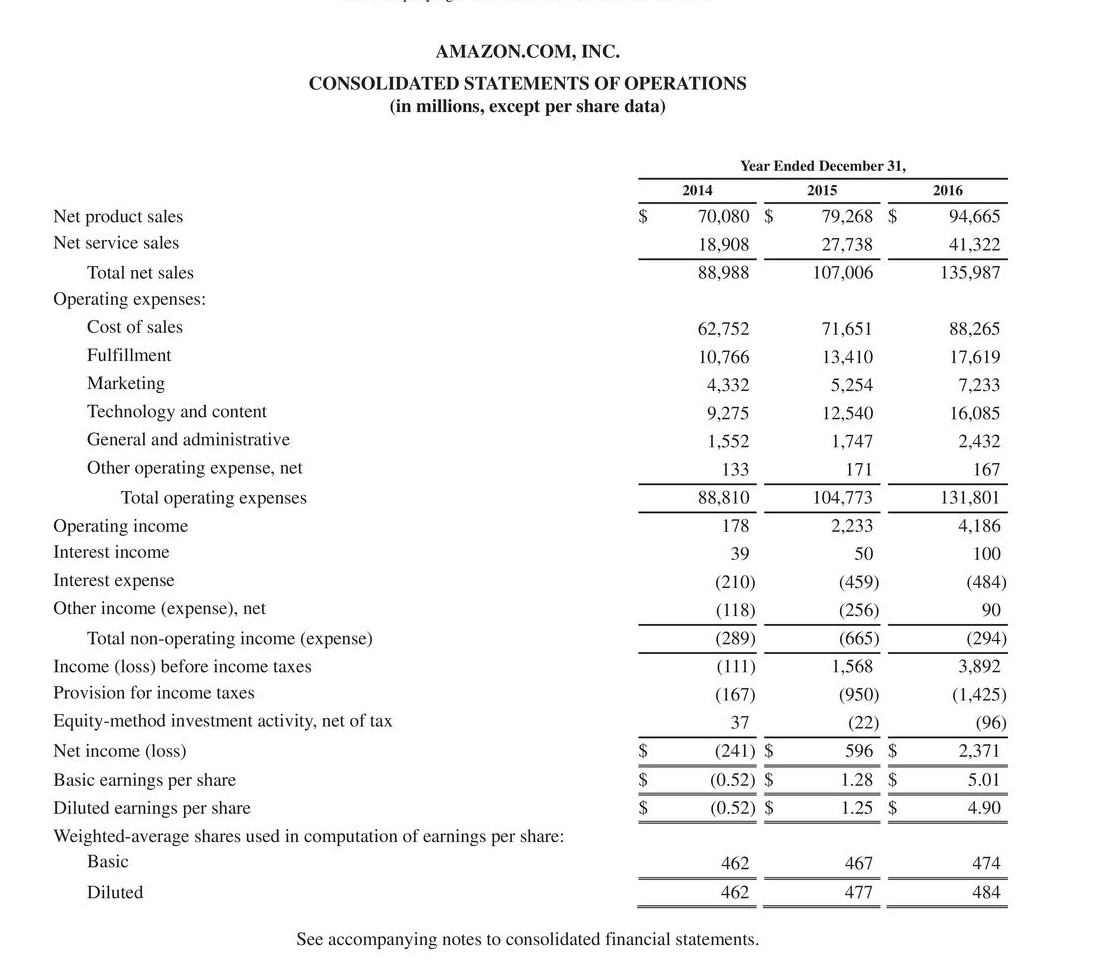

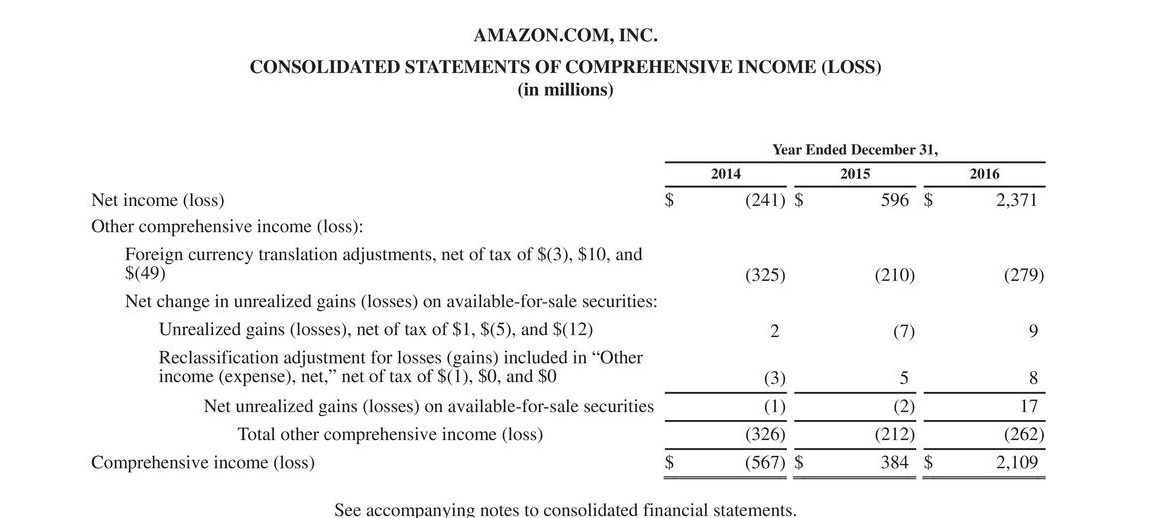

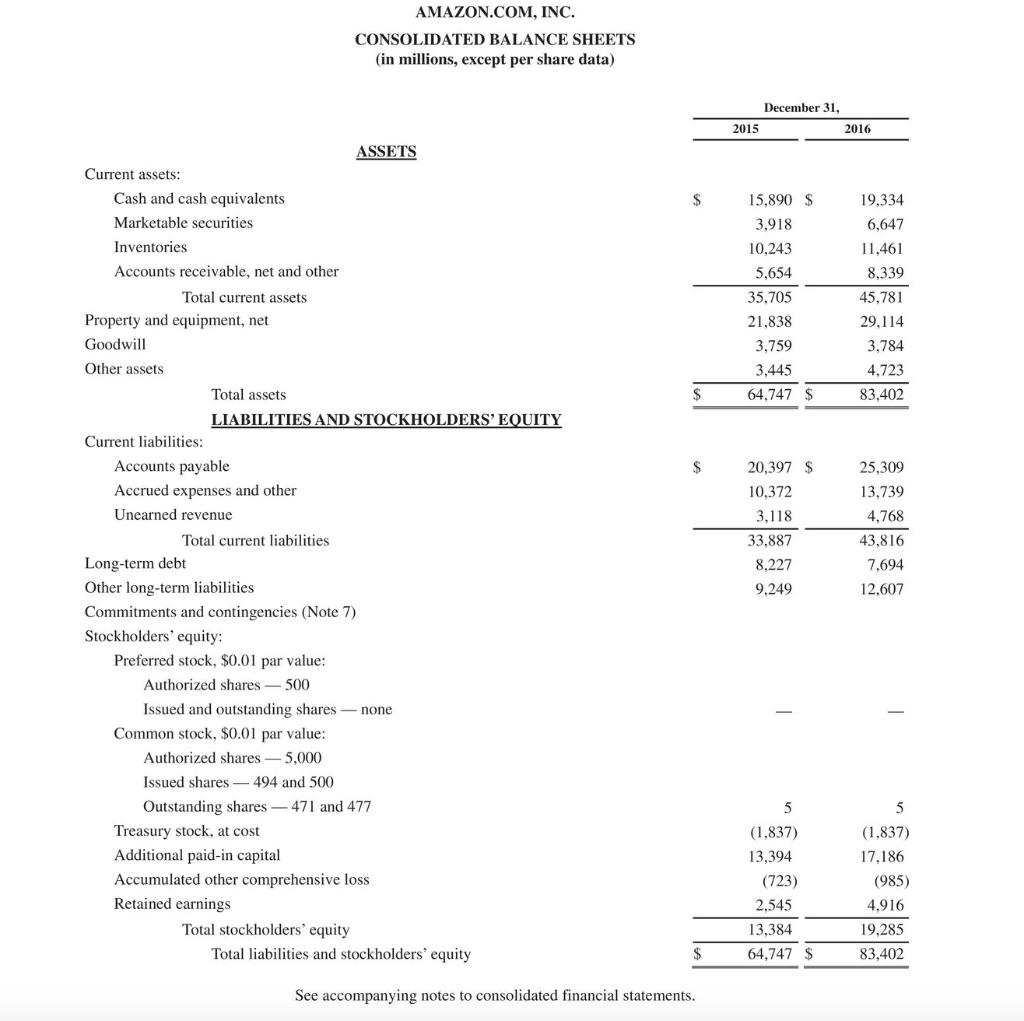

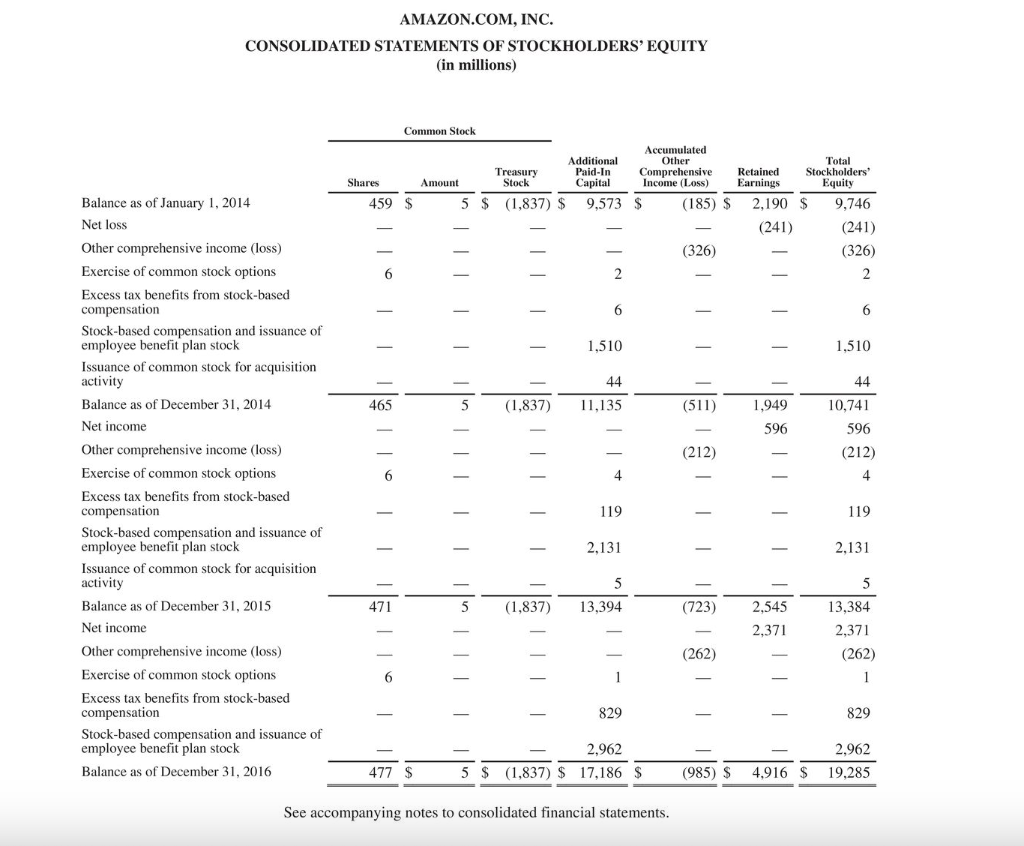

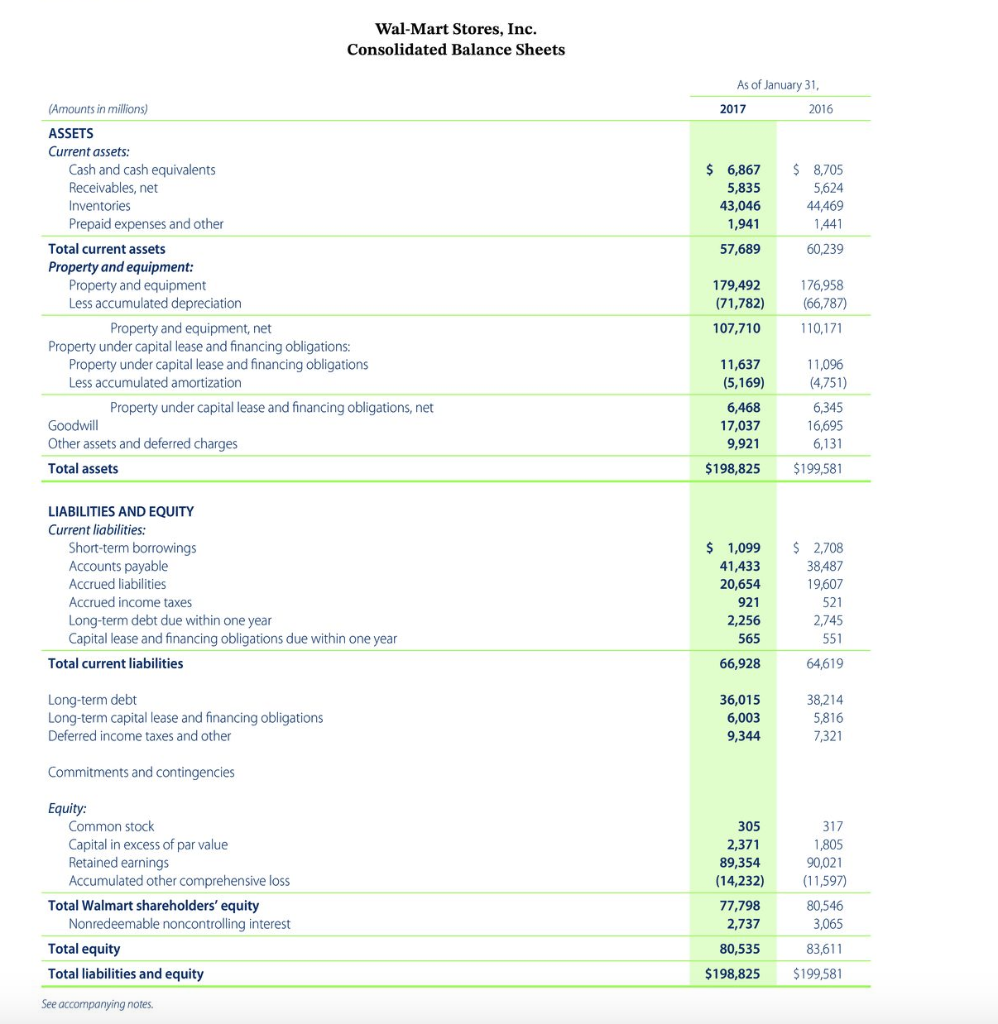

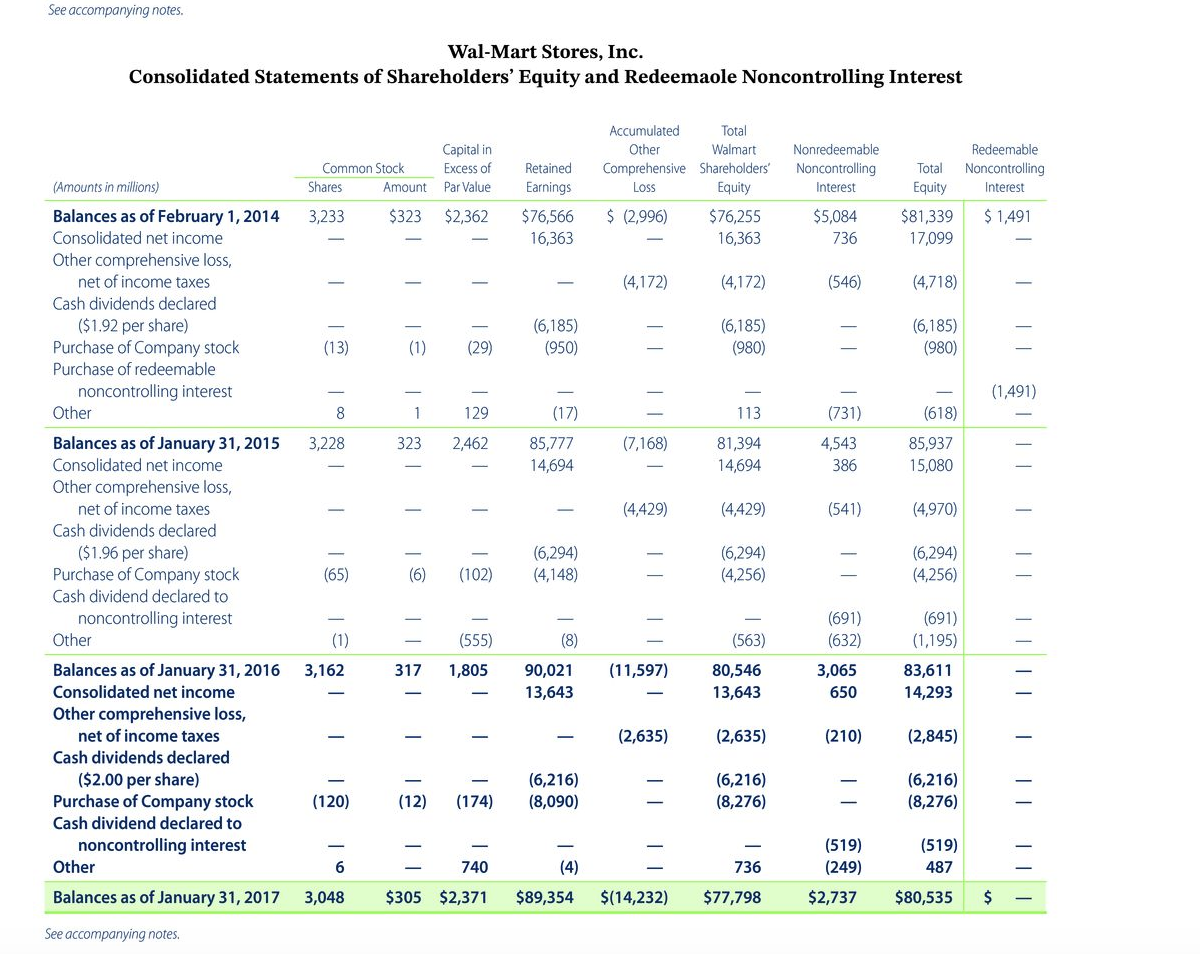

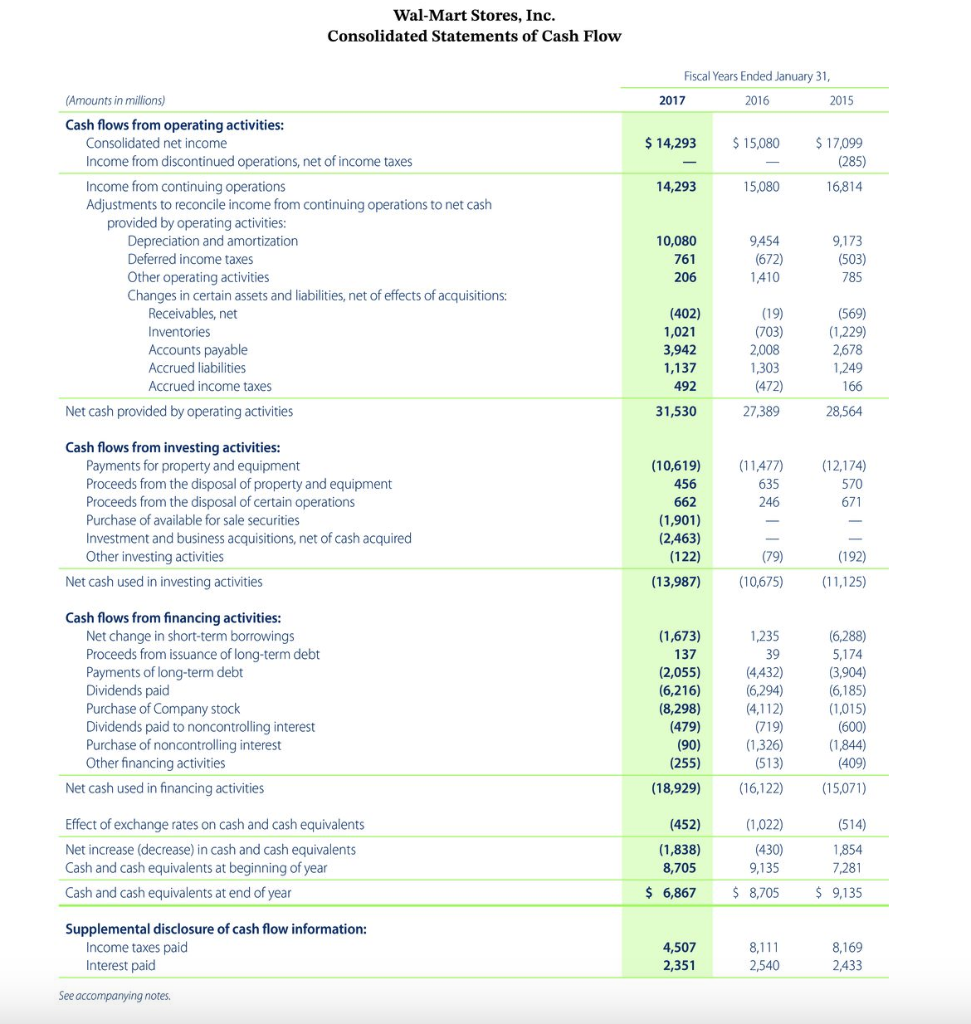

The financial statements of Amazon.com, Inc. are presented in Appendix D. Click here to view Appendix D. Financial statements of Wal-Mart Stores, Inc. are presented in Appendix E. Based on the information in the financial statements, determine each of the following for each company: (a1) The percentage increase (i) in net sales and (ii) in net income between the two most recent years provided. (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at January 31, 2017.) (Round answers to 1 decimal places, e.g. 15.2%. Enter negative amounts using either a negative sign preceding the number e.g. 15.2% or parentheses e.g. (15.2)\%.) (a2) The percentage increase (i) in total assets and (ii) in total stockholders' equity between the two most recent years provided. (Use the financial statements for Amazon as at December 31, 2016 and Wal-Mart as at January 31, 2017.) (Round answers to 1 decimal place, e.g. 15.2\%. Enter negative amounts using either a negative sign preceding the number e.g. 15.2% or parentheses e.g. (15.2)\%.) (a) The basic earnings per share for the most recent year provided. (Use the financial statements for Amazon as at December 31,2016 and Wal-Mart as at January 31, 2017.) (Round answers to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. 15.2% or parentheses e.g. (15.2)\%.) AMAZON,COM, INC. CONSOLIDNTED STATEMENTS OF CASH FLOWS AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) (expense) vity, net of tax n computation of earnings per share: See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (in millions) AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS Current assets: Cash and cash equivalents Marketable securities Inventories Accounts receivable, net and other Total current assets Property and equipment, net Goodwill Other assets Total assets \begin{tabular}{rlr} $15,890 & $ & 19,334 \\ 3,918 & & 6,647 \\ 10,243 & & 11,461 \\ 5,654 & & 8,339 \\ & & 45,781 \\ 21,838 & & 29,114 \\ 3,759 & & 3,784 \\ 3,445 & & 4,723 \\ \hline & 64,747 \\ $ & 83,402 \\ \hline \end{tabular} LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses and other Unearned revenue Total current liabilities Long-term debt Other long-term liabilities $20,39710,3723,11833,8878,2279,249$25,30913,7394,76843,8167,69412,607 Commitments and contingencies (Note 7) Stockholders' equity: Preferred stock, $0.01 par value: Authorized shares 500 Issued and outstanding shares none Common stock, $0.01 par value: Authorized shares - 5,000 Issued shares - 494 and 500 Outstanding shares 471 and 477 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained earnings Total stockholders' equity Total liabilities and stockholders' equity See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) See accompanying notes to consolidated financial statements. Specimen Financial Statements: Wal-Mart Stores, Inc. Wal-Mart Stores, Inc. Consolidated Statement of Comprehensive Income Wal-Mart Stores, Inc. Consolidated Balance Sheets Wal-Mart Stores, Inc. Consolidated Statements of Shareholders' Equity and Redeemaole Noncontrolling Interest TXT1_nnt Ctmed Tnn