Answered step by step

Verified Expert Solution

Question

1 Approved Answer

And if you could explain how got your answers that would be great! Thank you so much! accounting records up to date. $ 10,200.00 direct

And if you could explain how got your answers that would be great! Thank you so much!

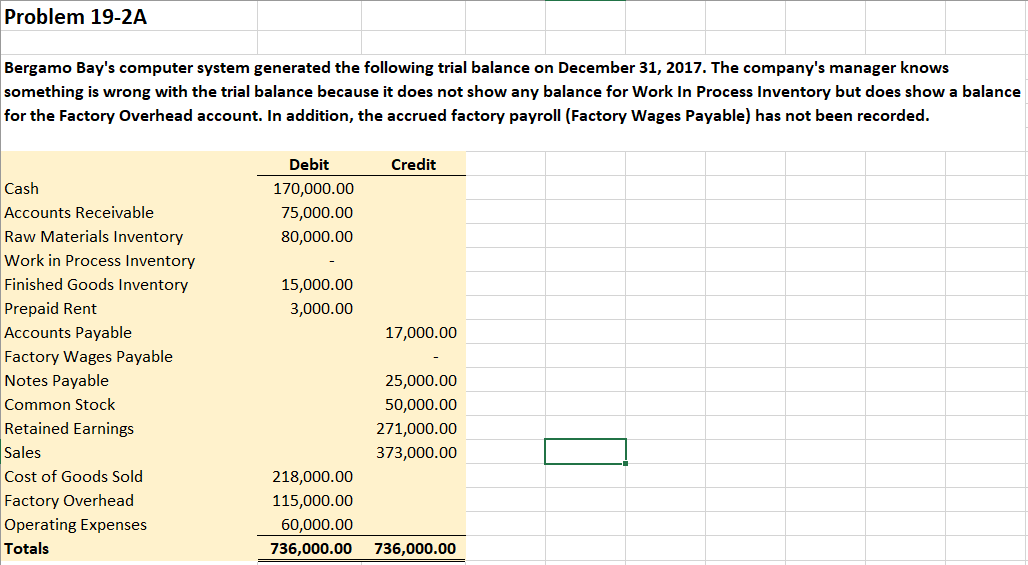

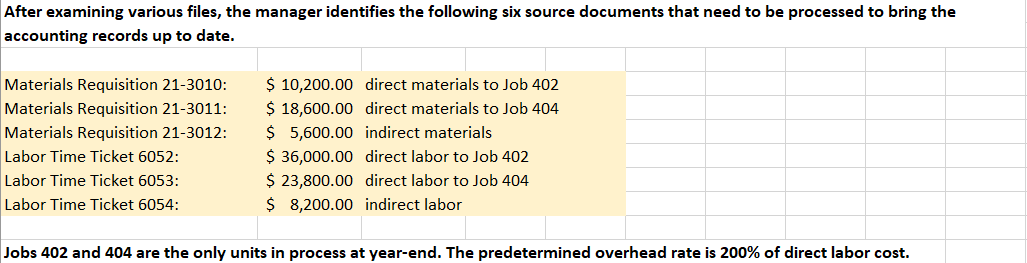

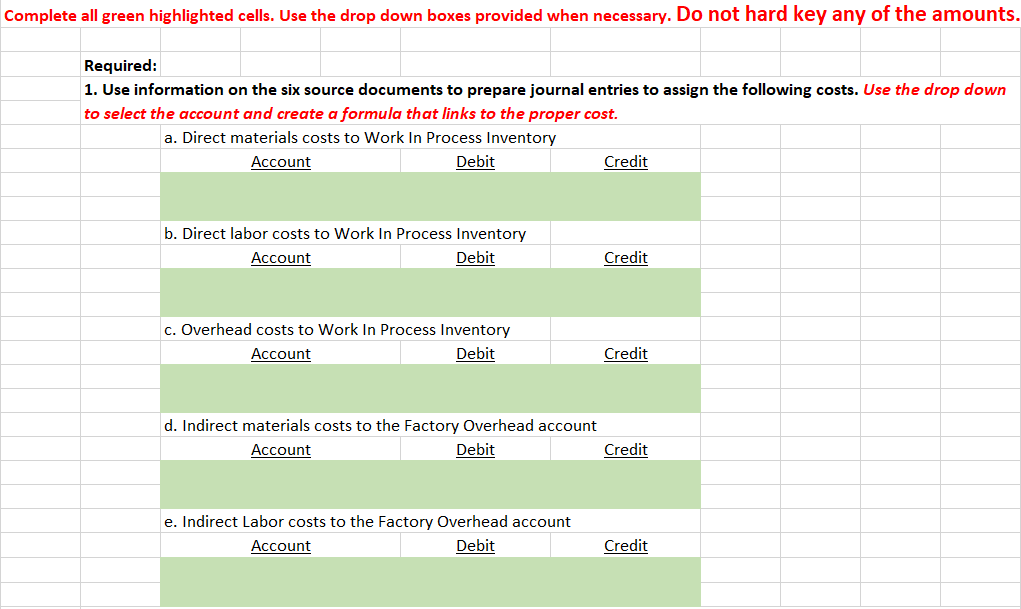

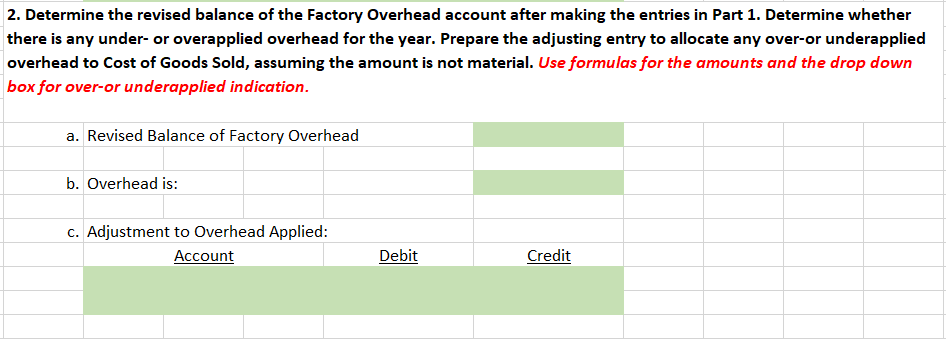

accounting records up to date. $ 10,200.00 direct materials to Job 402 Materials Requisition 21-3010: Materials Requisition 21-3011: Materials Requisition 21-3012: Labor Time Ticket 6052: Labor Time Ticket 6053: Labor Time Ticket 6054: $ 5,600.00 indirect materials $ 36,000.00 direct labor to Job 402 $ 23,800.00 direct labor to Job 404 $ 8,200.00 indirect labor Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 200% of direct labor cost. Complete all green highlighted cells. Use the drop down boxes provided when necessary. Do not hard key any of the amounts. Required: 1. Use information on the six source documents to prepare journal entries to assign the following costs. Use the drop down to select the account and create a formula that links to the proper cost. a. Direct materials costs to Work In Process Inventory Account Credit b. Direct labor costs to Work In Process Inventory Account Debit Credit c. Overhead costs to Work In Process Inventory Account Debit Credit Account Debit Credit e. Indirect Labor costs to the Factory Overhead account Account Debit Credit there is any under- or overapplied overhead for the year. Prepare the adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. Use formulas for the amounts and the drop down box for over-or underapplied indication. a. Revised Balance of Factory Overhead b. Overhead is: Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started