Answered step by step

Verified Expert Solution

Question

1 Approved Answer

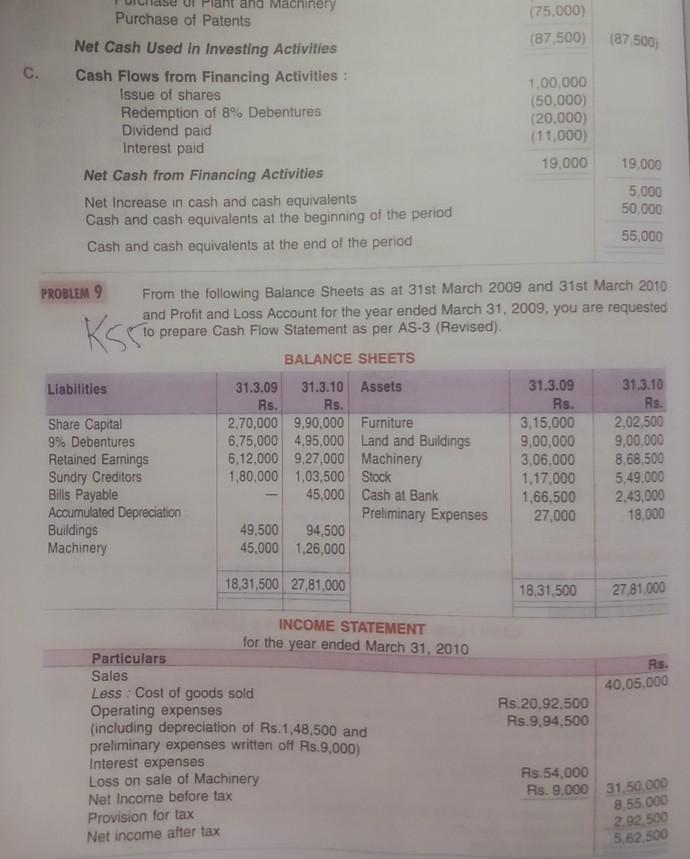

and Machinery Purchase of Patents 175.000) (87.500) 187.500 C. Net Cash Used In Investing Activities Cash Flows from Financing Activities : Issue of shares Redemption

and Machinery Purchase of Patents 175.000) (87.500) 187.500 C. Net Cash Used In Investing Activities Cash Flows from Financing Activities : Issue of shares Redemption of 8% Debentures Dividend paid Interest paid Net Cash from Financing Activities Net Increase in cash and cash equivalents Cash and cash equivalents at the beginning of the period Cash and cash equivalents at the end of the period 1,00.000 (50,000) (20,000) (11.000) 19.000 19.000 5,000 50.000 55,000 PROBLEM 9 Ksro From the following Balance Sheets as at 31st March 2009 and 31st March 2010 and Profit and Loss Account for the year ended March 31, 2009, you are requested to prepare Cash Flow Statement as per AS-3 (Revised). BALANCE SHEETS Liabilities Share Capital 9% Debentures Retained Earnings Sundry Creditors Bills Payable Accumulated Depreciation Buildings Machinery 31.3.09 31.3.10 Assets Rs. Rs. 2,70,000 9.90,000 Furniture 6.75,000 4,95,000 Land and Buildings 6.12.000 9.27,000 Machinery 1.80,000 1,03,500 Stock 45,000 Cash at Bank Preliminary Expenses 49.500 94,500 45.000 1.26,000 31.3.09 Rs. 3,15,000 9,00.000 3.06.000 1.17.000 1.66,500 27,000 31.3.10 Rs. 2,02,500 9,00,000 8,68,500 5,49,000 2.43,000 18.000 18,31,500 27,81,000 18,31,500 27 81.000 Rs. 40,05.000 Rs.20.92,500 Rs.9.94,500 INCOME STATEMENT for the year ended March 31, 2010 Particulars Sales Less Cost of goods sold Operating expenses (including depreciation of Rs.1.48,500 and preliminary expenses written off Rs.9.000) Interest expenses Loss on sale of Machinery Net Income before tax Provision for tax Net income after tax Rs 54.000 Rs. 9,000 31,50,000 8.55.000 2.92 500 5.62 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started