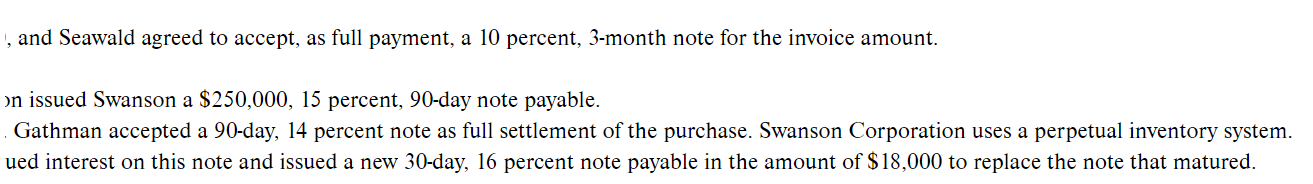

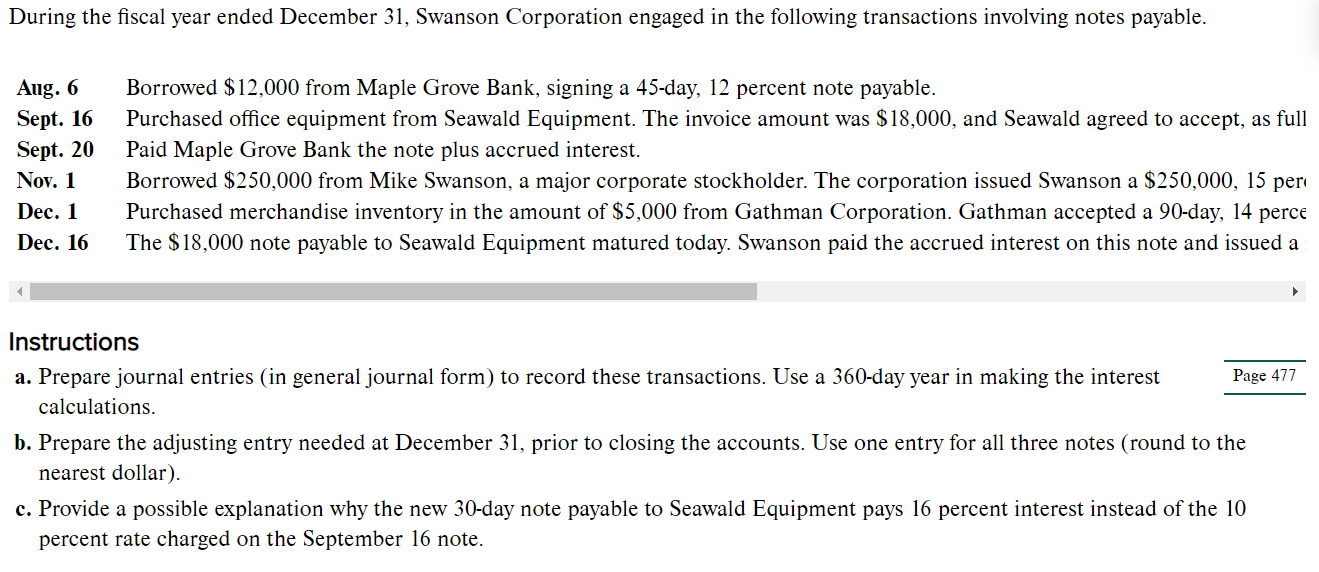

, and Seawald agreed to accept, as full payment, a 10 percent, 3-month note for the invoice amount. on issued Swanson a $250,000, 15 percent, 90-day note payable. Gathman accepted a 90-day, 14 percent note as full settlement of the purchase. Swanson Corporation uses a perpetual inventory system. ued interest on this note and issued a new 30-day, 16 percent note payable in the amount of $18,000 to replace the note that matured. During the fiscal year ended December 31, Swanson Corporation engaged in the following transactions involving notes payable. Aug. 6 Sept. 16 Sept. 20 Borrowed $12,000 from Maple Grove Bank, signing a 45-day, 12 percent note payable. Purchased office equipment from Seawald Equipment. The invoice amount was $18,000, and Seawald agreed to accept, as full Paid Maple Grove Bank the note plus accrued interest. Borrowed $250,000 from Mike Swanson, a major corporate stockholder. The corporation issued Swanson a $250,000, 15 per Purchased merchandise inventory in the amount of $5,000 from Gathman Corporation. Gathman accepted a 90-day, 14 perce The $18,000 note payable to Seawald Equipment matured today. Swanson paid the accrued interest on this note and issued a Nov. 1 Dec. 1 Dec. 16 Instructions a. Prepare journal entries (in general journal form) to record these transactions. Use a 360-day year in making the interest Page 477 calculations. b. Prepare the adjusting entry needed at December 31, prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar). c. Provide a possible explanation why the new 30-day note payable to Seawald Equipment pays 16 percent interest instead of the 10 percent rate charged on the September 16 note. , and Seawald agreed to accept, as full payment, a 10 percent, 3-month note for the invoice amount. on issued Swanson a $250,000, 15 percent, 90-day note payable. Gathman accepted a 90-day, 14 percent note as full settlement of the purchase. Swanson Corporation uses a perpetual inventory system. ued interest on this note and issued a new 30-day, 16 percent note payable in the amount of $18,000 to replace the note that matured. During the fiscal year ended December 31, Swanson Corporation engaged in the following transactions involving notes payable. Aug. 6 Sept. 16 Sept. 20 Borrowed $12,000 from Maple Grove Bank, signing a 45-day, 12 percent note payable. Purchased office equipment from Seawald Equipment. The invoice amount was $18,000, and Seawald agreed to accept, as full Paid Maple Grove Bank the note plus accrued interest. Borrowed $250,000 from Mike Swanson, a major corporate stockholder. The corporation issued Swanson a $250,000, 15 per Purchased merchandise inventory in the amount of $5,000 from Gathman Corporation. Gathman accepted a 90-day, 14 perce The $18,000 note payable to Seawald Equipment matured today. Swanson paid the accrued interest on this note and issued a Nov. 1 Dec. 1 Dec. 16 Instructions a. Prepare journal entries (in general journal form) to record these transactions. Use a 360-day year in making the interest Page 477 calculations. b. Prepare the adjusting entry needed at December 31, prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar). c. Provide a possible explanation why the new 30-day note payable to Seawald Equipment pays 16 percent interest instead of the 10 percent rate charged on the September 16