Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and the % of business use. Assume the residential rental and business office activities are owned by The following items of business property are

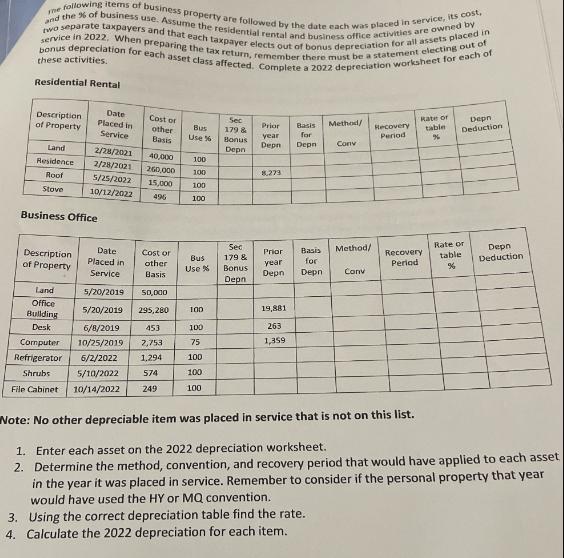

and the % of business use. Assume the residential rental and business office activities are owned by The following items of business property are followed by the date each was placed in service, its cost, two separate taxpayers and that each taxpayer elects out of bonus depreciation for all assets placed in service in 2022. When preparing the tax return, remember there must be a statement electing out of bonus depreciation for each asset class affected. Complete a 2022 depreciation worksheet for each of these activities. Residential Rental Description of Property Land Residence Roof Stove Business Office Date Placed in Service 2/28/2021 40,000 2/28/2021 260,000 5/25/2022 15,000 10/12/2022 496 Description of Property Date Placed in Service 5/20/2019 50,000 5/20/2019 295,280 6/8/2019 453 Computer 10/25/2019 2,753- Refrigerator 6/2/2022 1,294 Shrubs 5/10/2022 574 File Cabinet 10/14/2022 249 Land Office Building Desk Cost of other Basis Cost or other Basis Bus Use % 100 100 100 100 Bus Use % 100 100 75 100 100 100 Sec 179 & Bonus Depn Sec 179 & Bonus Depn Prior Basis for Depn Depn year 8,273 Prior year Depn 19,881 263 1,359 Basis for Depn Method/ 3. Using the correct depreciation table find the rate. 4. Calculate the 2022 depreciation for each item. Conv Method/ Conv Recovery Period Rate of table % Recovery Period Depn Deduction Rate or table % Depn Deduction Note: No other depreciable item was placed in service that is not on this list. 1. Enter each asset on the 2022 depreciation worksheet. 2. Determine the method, convention, and recovery period that would have applied to each asset in the year it was placed in service. Remember to consider if the personal property that year would have used the HY or MQ convention.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER To address this task well follow the steps provided Enter each asset on the 2022 depreciation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started