Answered step by step

Verified Expert Solution

Question

1 Approved Answer

and will pay $3800 in one year. What is the rate of return of this opportunity? You have an investment opportunity that requires an

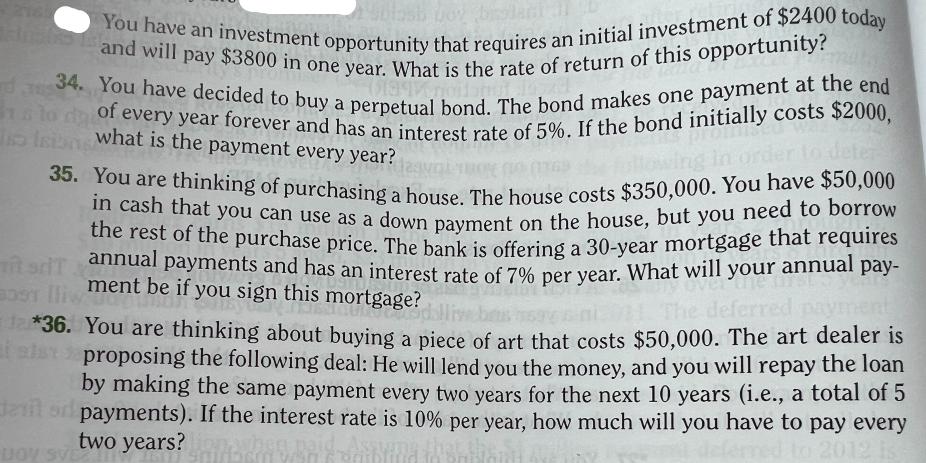

and will pay $3800 in one year. What is the rate of return of this opportunity? You have an investment opportunity that requires an initial investment of $2400 today 34. You have decided to buy a perpetual bond. The bond makes one payment at the end I every year forever and has an interest rate of 5%. If the bond initially costs $2000, to da what is the payment every year? following in order to dete 35. You are thinking of purchasing a house. The house costs $350,000. You have $50,000 in cash that you can use as a down payment on the house, but you need to borrow the rest of the purchase price. The bank is offering a 30-year mortgage that requires annual payments and has an interest rate of 7% per year. What will your annual pay- ment be if you sign this mortgage? The deferred payment 12*36. You are thinking about buying a piece of art that costs $50,000. The art dealer is proposing the following deal: He will lend you the money, and you will repay the loan by making the same payment every two years for the next 10 years (i.e., a total of 5 payments). If the interest rate is 10% per year, how much will you have to pay every two years? to 2012 is DOY SVE ard 115 lain Tit BOST Iliw

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

34 The payment on a perpetual bond can be calculated using the formula Payment Interest rate x Bond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started