Question

Anderson Enterprises currently has $800 in cash. The company owes $2,400 to suppliers for merchandise and $9,000 to the bank for a long-term loan.

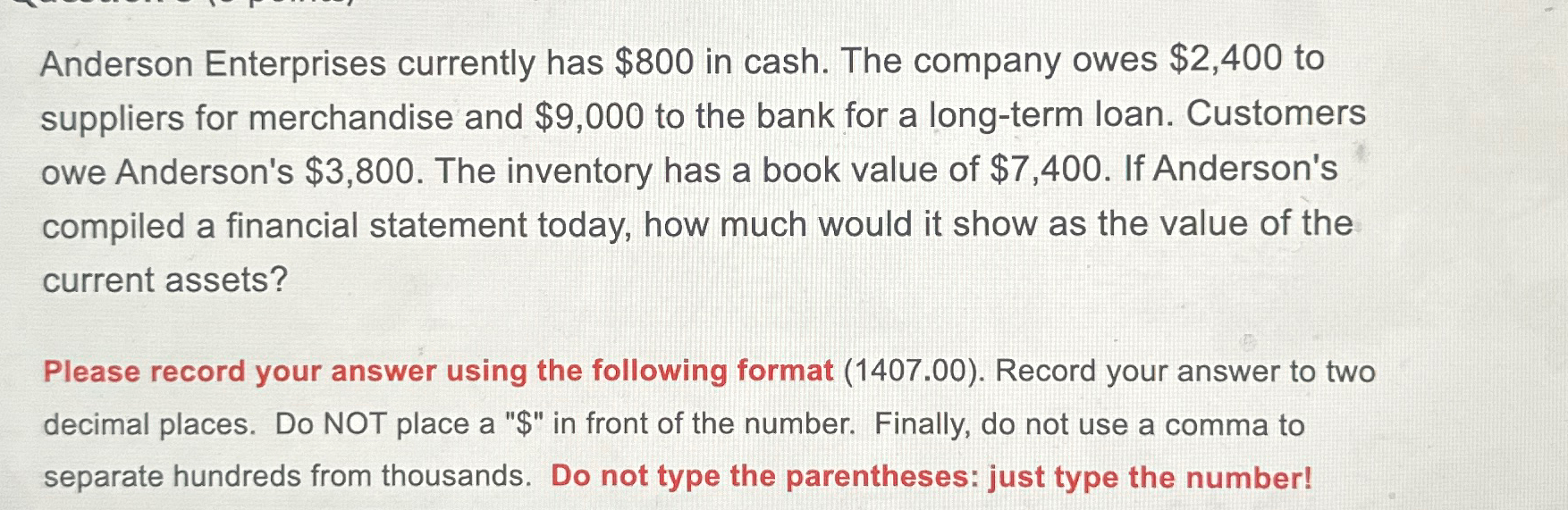

Anderson Enterprises currently has $800 in cash. The company owes $2,400 to suppliers for merchandise and $9,000 to the bank for a long-term loan. Customers owe Anderson's $3,800. The inventory has a book value of $7,400. If Anderson's compiled a financial statement today, how much would it show as the value of the current assets? Please record your answer using the following format (1407.00). Record your answer to two decimal places. Do NOT place a "$" in front of the number. Finally, do not use a comma to separate hundreds from thousands. Do not type the parentheses: just type the number!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the value of current assets we need to consi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A User Perspective

Authors: Robert E Hoskin, Maureen R Fizzell, Donald C Cherry

6th Canadian Edition

470676604, 978-0470676608

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App