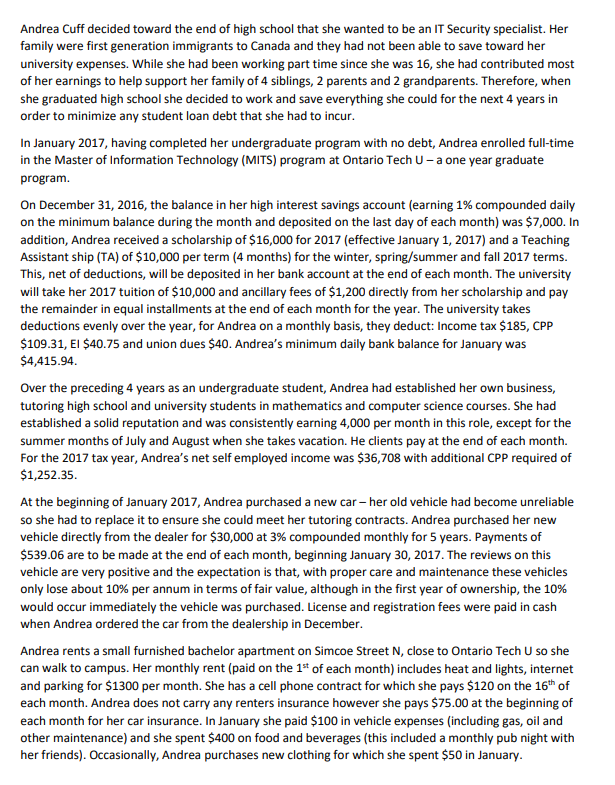

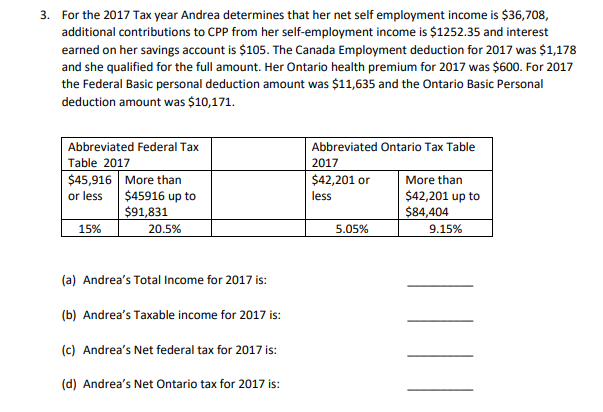

Andrea Cuff decided toward the end of high school that she wanted to be an IT Security specialist. Her family were first generation immigrants to Canada and they had not been able to save toward her university expenses. While she had been working part time since she was 16, she had contributed most of her earnings to help support her family of 4 siblings, 2 parents and 2 grandparents. Therefore, when she graduated high school she decided to work and save everything she could for the next 4 years in order to minimize any student loan debt that she had to incur. In January 2017, having completed her undergraduate program with no debt, Andrea enrolled full-time in the Master of Information Technology (MITS) program at Ontario Tech U-a one year graduate program On December 31, 2016, the balance in her high interest savings account (earning 1% compounded daily on the minimum balance during the month and deposited on the last day of each month) was $7,000. In addition, Andrea received a scholarship of $16,000 for 2017 (effective January 1, 2017) and a Teaching Assistant ship (TA) of $10,000 per term (4 months) for the winter, spring/Summer and fall 2017 terms. This, net of deductions, will be deposited in her bank account at the end of each month. The university will take her 2017 tuition of $10,000 and ancillary fees of $1,200 directly from her scholarship and pay the remainder in equal installments at the end of each month for the year. The university takes deductions evenly over the year, for Andrea on a monthly basis, they deduct: Income tax $185, CPP $109.31, EI $40.75 and union dues $40. Andrea's minimum daily bank balance for January was $4,415.94. Over the preceding 4 years as an undergraduate student, Andrea had established her own business, tutoring high school and university students in mathematics and computer science courses. She had established a solid reputation and was consistently earning 4,000 per month in this role, except for the summer months of July and August when she takes vacation. He clients pay at the end of each month. For the 2017 tax year, Andrea's net self employed income was $36,708 with additional CPP required of $1,252.35. At the beginning of January 2017, Andrea purchased a new car - her old vehicle had become unreliable so she had to replace it to ensure she could meet her tutoring contracts. Andrea purchased her new vehicle directly from the dealer for $30,000 at 3% compounded monthly for 5 years. Payments of $539.06 are to be made at the end of each month, beginning January 30, 2017. The reviews on this vehicle are very positive and the expectation is that, with proper care and maintenance these vehicles only lose about 10% per annum in terms of fair value, although in the first year of ownership, the 10% would occur immediately the vehicle was purchased. License and registration fees were paid in cash when Andrea ordered the car from the dealership in December. Andrea rents a small furnished bachelor apartment on Simcoe Street N, close to Ontario Tech U so she can walk to campus. Her monthly rent (paid on the 1* of each month) includes heat and lights, internet and parking for $1300 per month. She has a cell phone contract for which she pays $120 on the 16th of each month. Andrea does not carry any renters insurance however she pays $75.00 at the beginning of each month for her car insurance. In January she paid $100 in vehicle expenses (including gas, oil and other maintenance) and she spent $400 on food and beverages (this included a monthly pub night with her friends). Occasionally, Andrea purchases new clothing for which she spent $50 in January. 3. For the 2017 Tax year Andrea determines that her net self employment income is $36,708, additional contributions to CPP from her self-employment income is $1252.35 and interest earned on her savings account is $105. The Canada Employment deduction for 2017 was $1,178 and she qualified for the full amount. Her Ontario health premium for 2017 was $600. For 2017 the Federal Basic personal deduction amount was $11,635 and the Ontario Basic Personal deduction amount was $10,171. Abbreviated Federal Tax Table 2017 $45,916 More than or less $45916 up to $91,831 15% 20.5% Abbreviated Ontario Tax Table 2017 $42,201 or More than $42,201 up to $84,404 5.05% 9.15% less (a) Andrea's Total Income for 2017 is: (b) Andrea's Taxable income for 2017 is: (c) Andrea's Net federal tax for 2017 is: (d) Andrea's Net Ontario tax for 2017 is: Andrea Cuff decided toward the end of high school that she wanted to be an IT Security specialist. Her family were first generation immigrants to Canada and they had not been able to save toward her university expenses. While she had been working part time since she was 16, she had contributed most of her earnings to help support her family of 4 siblings, 2 parents and 2 grandparents. Therefore, when she graduated high school she decided to work and save everything she could for the next 4 years in order to minimize any student loan debt that she had to incur. In January 2017, having completed her undergraduate program with no debt, Andrea enrolled full-time in the Master of Information Technology (MITS) program at Ontario Tech U-a one year graduate program On December 31, 2016, the balance in her high interest savings account (earning 1% compounded daily on the minimum balance during the month and deposited on the last day of each month) was $7,000. In addition, Andrea received a scholarship of $16,000 for 2017 (effective January 1, 2017) and a Teaching Assistant ship (TA) of $10,000 per term (4 months) for the winter, spring/Summer and fall 2017 terms. This, net of deductions, will be deposited in her bank account at the end of each month. The university will take her 2017 tuition of $10,000 and ancillary fees of $1,200 directly from her scholarship and pay the remainder in equal installments at the end of each month for the year. The university takes deductions evenly over the year, for Andrea on a monthly basis, they deduct: Income tax $185, CPP $109.31, EI $40.75 and union dues $40. Andrea's minimum daily bank balance for January was $4,415.94. Over the preceding 4 years as an undergraduate student, Andrea had established her own business, tutoring high school and university students in mathematics and computer science courses. She had established a solid reputation and was consistently earning 4,000 per month in this role, except for the summer months of July and August when she takes vacation. He clients pay at the end of each month. For the 2017 tax year, Andrea's net self employed income was $36,708 with additional CPP required of $1,252.35. At the beginning of January 2017, Andrea purchased a new car - her old vehicle had become unreliable so she had to replace it to ensure she could meet her tutoring contracts. Andrea purchased her new vehicle directly from the dealer for $30,000 at 3% compounded monthly for 5 years. Payments of $539.06 are to be made at the end of each month, beginning January 30, 2017. The reviews on this vehicle are very positive and the expectation is that, with proper care and maintenance these vehicles only lose about 10% per annum in terms of fair value, although in the first year of ownership, the 10% would occur immediately the vehicle was purchased. License and registration fees were paid in cash when Andrea ordered the car from the dealership in December. Andrea rents a small furnished bachelor apartment on Simcoe Street N, close to Ontario Tech U so she can walk to campus. Her monthly rent (paid on the 1* of each month) includes heat and lights, internet and parking for $1300 per month. She has a cell phone contract for which she pays $120 on the 16th of each month. Andrea does not carry any renters insurance however she pays $75.00 at the beginning of each month for her car insurance. In January she paid $100 in vehicle expenses (including gas, oil and other maintenance) and she spent $400 on food and beverages (this included a monthly pub night with her friends). Occasionally, Andrea purchases new clothing for which she spent $50 in January. 3. For the 2017 Tax year Andrea determines that her net self employment income is $36,708, additional contributions to CPP from her self-employment income is $1252.35 and interest earned on her savings account is $105. The Canada Employment deduction for 2017 was $1,178 and she qualified for the full amount. Her Ontario health premium for 2017 was $600. For 2017 the Federal Basic personal deduction amount was $11,635 and the Ontario Basic Personal deduction amount was $10,171. Abbreviated Federal Tax Table 2017 $45,916 More than or less $45916 up to $91,831 15% 20.5% Abbreviated Ontario Tax Table 2017 $42,201 or More than $42,201 up to $84,404 5.05% 9.15% less (a) Andrea's Total Income for 2017 is: (b) Andrea's Taxable income for 2017 is: (c) Andrea's Net federal tax for 2017 is: (d) Andrea's Net Ontario tax for 2017 is