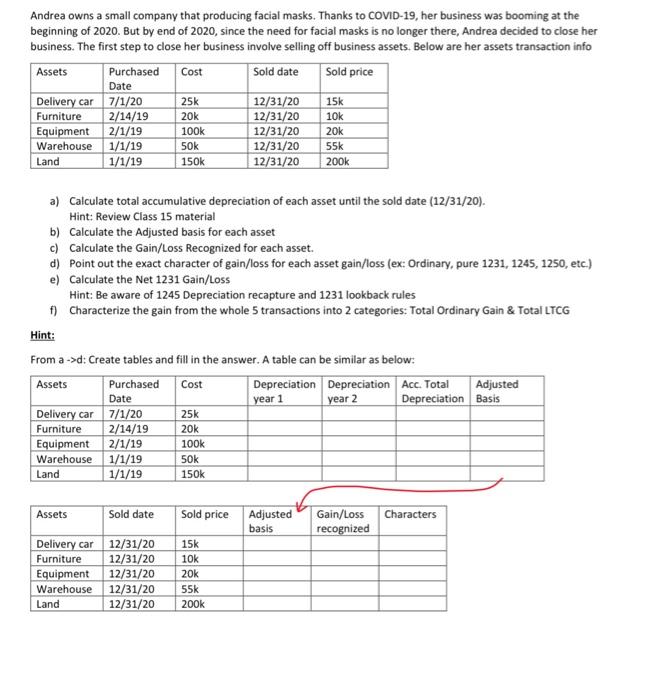

Andrea owns a small company that producing facial masks. Thanks to COVID-19, her business was booming at the beginning of 2020. But by end of 2020, since the need for facial masks is no longer there, Andrea decided to close her business. The first step to close her business involve selling off business assets. Below are her assets transaction info Assets Purchased Cost Sold date Sold price Date Delivery car 7/1/20 12/31/20 Furniture 2/14/19 20k 12/31/20 10k Equipment 2/1/19 100k 12/31/20 20k Warehouse 1/1/19 50k 12/31/20 55k Land 1/1/19 12/31/20 200k 25k 15k 150k a) Calculate total accumulative depreciation of each asset until the sold date (12/31/20). Hint: Review Class 15 material b) Calculate the Adjusted basis for each asset c) Calculate the Gain/Loss Recognized for each asset. d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules f) Characterize the gain from the whole 5 transactions into 2 categories: Total Ordinary Gain & Total LTCG Hint: From a ->d: Create tables and fill in the answer. A table can be similar as below: Assets Purchased Cost Depreciation Depreciation Acc. Total Adjusted Date year 1 year 2 Depreciation Basis Delivery car 7/1/20 25k Furniture 2/14/19 20k Equipment 2/1/19 100k Warehouse 1/1/19 50k Land 1/1/19 150k Assets Sold date Sold price Characters Adjusted basis Gain/Loss recognized Delivery car 12/31/20 Furniture 12/31/20 Equipment 12/31/20 Warehouse 12/31/20 Land 12/31/20 15k 10k 20k 55k 200k Andrea owns a small company that producing facial masks. Thanks to COVID-19, her business was booming at the beginning of 2020. But by end of 2020, since the need for facial masks is no longer there, Andrea decided to close her business. The first step to close her business involve selling off business assets. Below are her assets transaction info Assets Purchased Cost Sold date Sold price Date Delivery car 7/1/20 12/31/20 Furniture 2/14/19 20k 12/31/20 10k Equipment 2/1/19 100k 12/31/20 20k Warehouse 1/1/19 50k 12/31/20 55k Land 1/1/19 12/31/20 200k 25k 15k 150k a) Calculate total accumulative depreciation of each asset until the sold date (12/31/20). Hint: Review Class 15 material b) Calculate the Adjusted basis for each asset c) Calculate the Gain/Loss Recognized for each asset. d) Point out the exact character of gain/loss for each asset gain/loss (ex: Ordinary, pure 1231, 1245, 1250, etc.) e) Calculate the Net 1231 Gain/Loss Hint: Be aware of 1245 Depreciation recapture and 1231 lookback rules f) Characterize the gain from the whole 5 transactions into 2 categories: Total Ordinary Gain & Total LTCG Hint: From a ->d: Create tables and fill in the answer. A table can be similar as below: Assets Purchased Cost Depreciation Depreciation Acc. Total Adjusted Date year 1 year 2 Depreciation Basis Delivery car 7/1/20 25k Furniture 2/14/19 20k Equipment 2/1/19 100k Warehouse 1/1/19 50k Land 1/1/19 150k Assets Sold date Sold price Characters Adjusted basis Gain/Loss recognized Delivery car 12/31/20 Furniture 12/31/20 Equipment 12/31/20 Warehouse 12/31/20 Land 12/31/20 15k 10k 20k 55k 200k