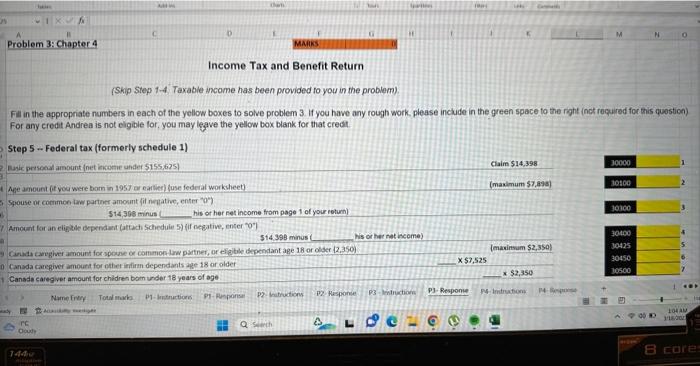

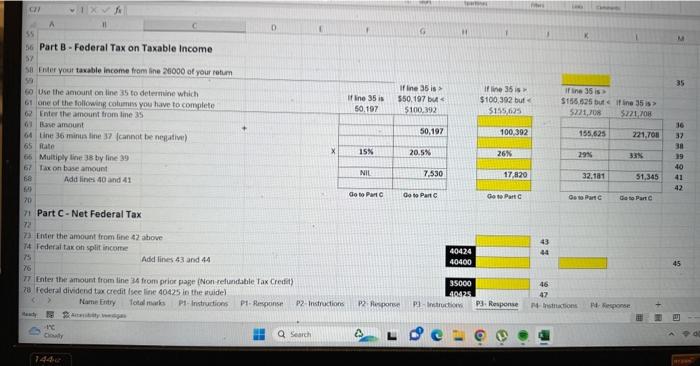

Andrea works for Short Line Limited as an engineer. She has 2022 taxable income of $105,000, which is 100% employment income. The maximum CP and El was withheld from her paycheque during the year, plus $12000 in federal income taxes. Her common law partner, Jamie, has a net income of $5000.

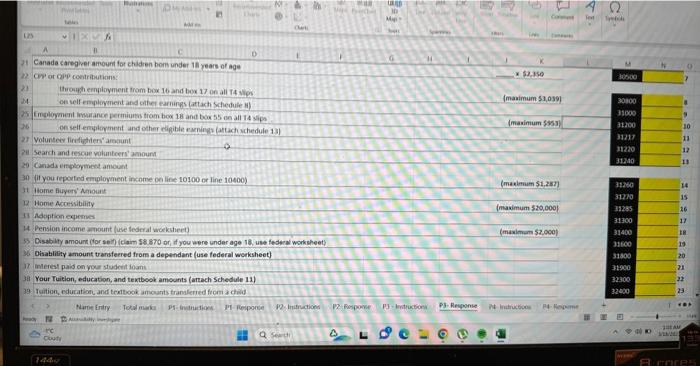

Andrea is also a volunteer firefighter and volunteered for 600 hours for the local fire department in 2022. She also bought a house this year for $440,000. Neither her nor her common law partner had owned and lived in another home in the last 5 years.

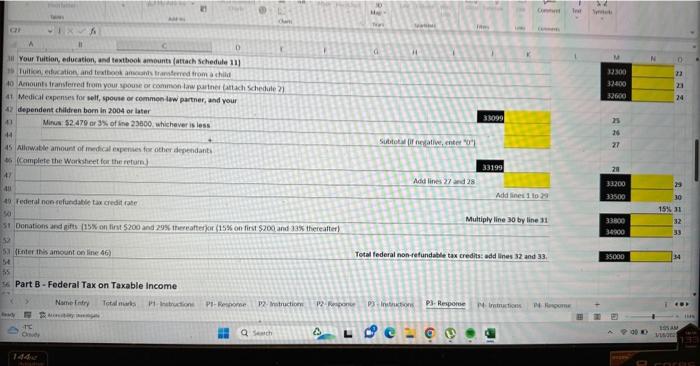

medical expenses for their child, plus $2,000 in medical expenses for herself and $500 for Jamie.

Andrea donated $5000 to the Canadian Mental Health Association during the year. She also made political contributions of $1,200 to a registered federal political party in 2022.

Required: Determine Andrea's federal tax payable or refundable for 2022. Answer on the "P3- Response" tab, in the yellow boxes. For any credit she is not eligible for, you may leave the yellow box blank.

now fill this yellow boxes

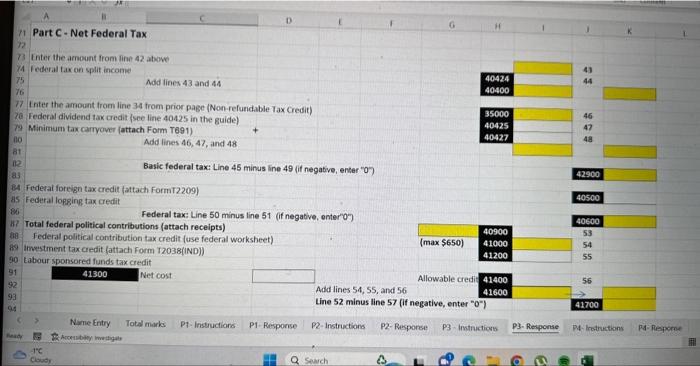

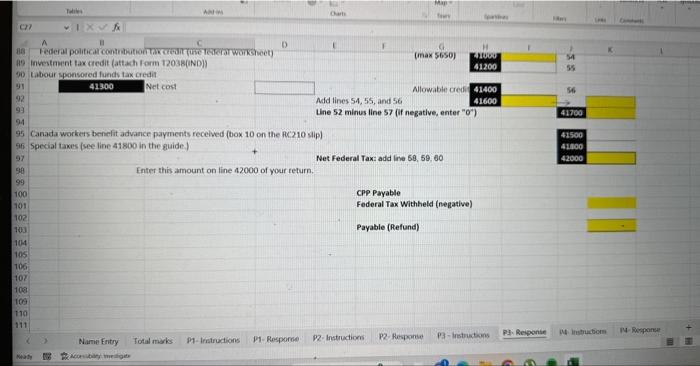

Income Tax and Benefit Return (Skip step 1-4. Taxable income has been provided fo you in the problem). Fill in the appropriate numbers in each of the yellow boxes to solve problem 3 . If you have any rough work. please include in the green space to the right (nct repuired for this questice) For any credit Andrea is not eigible for, you may leave the yellow box blank for that credt IiI Your fuition, education, and textbook amounts (attach Schedule 11) (10) Aenount i fransleired from your spouse or common law parine (aktach schedule ?f At Medical capernses for self, spouse or commen twe partner, and your dependent children born in 2004 or later Mirus 52.479 or 33 of ine 23100 whichever is less Aliowatse amourst of inedical evenies for ocher dependanti. (Gamplete the Warkheet for the renure) Fecteral non refuratate tax credit rate Muttiply line 30 by line 11 Donations ard gift: [15\% on firs 5200 and 29% thereafterkir (15\% on first 5200 and 135 thereafter) (Enter this amosint on line 46 ) Total tederal non-refundable tax credits: add lines 32 and 33. Part B - Federal Tax on Taxable Income Part B - Federal Tax on Taxable Income I Iner your tavable income from ine 26000 ot your refam Part C - Net Federal Tax Inter the amount from line 42 abowe federal tax on split income Mad lines 43 and 44 \begin{tabular}{|l|l|l|l|} \hline 40424 & 43 \\ \hline 40400 & 44 \\ \hline \end{tabular} 17 Inter the amount from line 34 from prior page (Non-refundable Tax credit) 20. Federal dividend tax credit (see line 40425 in the guide) 79 Minimum tax carryouer (attach Form T691) Ao Add lines 46,47 , and 48 b1 i2 a3 Basic federal tax: Line 45 minus line 49 (it negative, enter 07 \begin{tabular}{|l|l|l|} \hline 35000 & 46 \\ \hline 40425 & 47 \\ 40427 & 48 \\ \hline \end{tabular} 42900 84. Federal foreign tax credit (attach form 2209) as Federal lopging tax redit 40500 86. Federal tax: Line 50 minus line 51 (if negative, enter 07 if) Total federal political contributions (attach receipts) 28. Federal political contribution tax credit (use federal worksheet) 89. imestinent tax credit fattach form 12038(IND)) 90 tabour sponsored funds tax credit 9141300 Net cost Add lines 54, 55, and 56 Line 52 minus line 57 (if negative, enter "0) (19) investanent tax credit (attach form 12038(0ND)) 99) Labour sponsored funds tax credit 91 4.41300 Net cont Canada workers benefit advance payments recelved (box 10 on the AC:210 slip) 96 Special tanes (see line 41800 in the guide) Net Federal Tax: add lne 68, 59, 00 Enter this amount on line 42000 of your teturn. CPP Pryable Federal Tax withheld (negative) Payable (Refund) Income Tax and Benefit Return (Skip step 1-4. Taxable income has been provided fo you in the problem). Fill in the appropriate numbers in each of the yellow boxes to solve problem 3 . If you have any rough work. please include in the green space to the right (nct repuired for this questice) For any credit Andrea is not eigible for, you may leave the yellow box blank for that credt IiI Your fuition, education, and textbook amounts (attach Schedule 11) (10) Aenount i fransleired from your spouse or common law parine (aktach schedule ?f At Medical capernses for self, spouse or commen twe partner, and your dependent children born in 2004 or later Mirus 52.479 or 33 of ine 23100 whichever is less Aliowatse amourst of inedical evenies for ocher dependanti. (Gamplete the Warkheet for the renure) Fecteral non refuratate tax credit rate Muttiply line 30 by line 11 Donations ard gift: [15\% on firs 5200 and 29% thereafterkir (15\% on first 5200 and 135 thereafter) (Enter this amosint on line 46 ) Total tederal non-refundable tax credits: add lines 32 and 33. Part B - Federal Tax on Taxable Income Part B - Federal Tax on Taxable Income I Iner your tavable income from ine 26000 ot your refam Part C - Net Federal Tax Inter the amount from line 42 abowe federal tax on split income Mad lines 43 and 44 \begin{tabular}{|l|l|l|l|} \hline 40424 & 43 \\ \hline 40400 & 44 \\ \hline \end{tabular} 17 Inter the amount from line 34 from prior page (Non-refundable Tax credit) 20. Federal dividend tax credit (see line 40425 in the guide) 79 Minimum tax carryouer (attach Form T691) Ao Add lines 46,47 , and 48 b1 i2 a3 Basic federal tax: Line 45 minus line 49 (it negative, enter 07 \begin{tabular}{|l|l|l|} \hline 35000 & 46 \\ \hline 40425 & 47 \\ 40427 & 48 \\ \hline \end{tabular} 42900 84. Federal foreign tax credit (attach form 2209) as Federal lopging tax redit 40500 86. Federal tax: Line 50 minus line 51 (if negative, enter 07 if) Total federal political contributions (attach receipts) 28. Federal political contribution tax credit (use federal worksheet) 89. imestinent tax credit fattach form 12038(IND)) 90 tabour sponsored funds tax credit 9141300 Net cost Add lines 54, 55, and 56 Line 52 minus line 57 (if negative, enter "0) (19) investanent tax credit (attach form 12038(0ND)) 99) Labour sponsored funds tax credit 91 4.41300 Net cont Canada workers benefit advance payments recelved (box 10 on the AC:210 slip) 96 Special tanes (see line 41800 in the guide) Net Federal Tax: add lne 68, 59, 00 Enter this amount on line 42000 of your teturn. CPP Pryable Federal Tax withheld (negative) Payable (Refund)