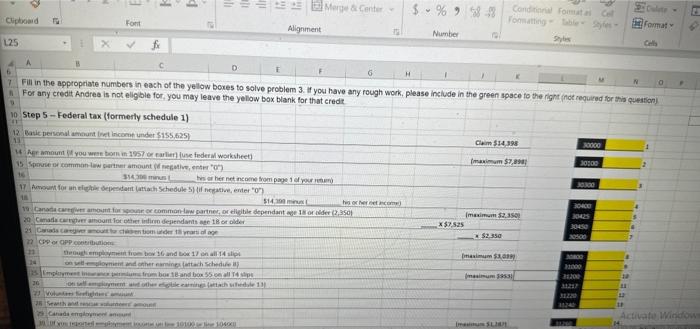

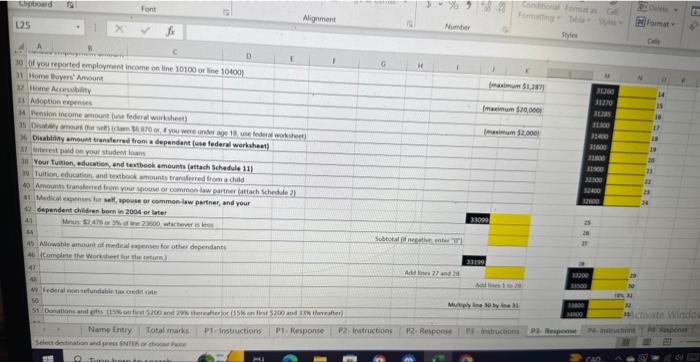

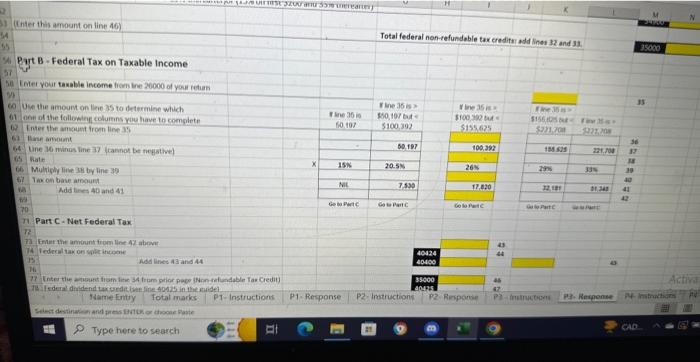

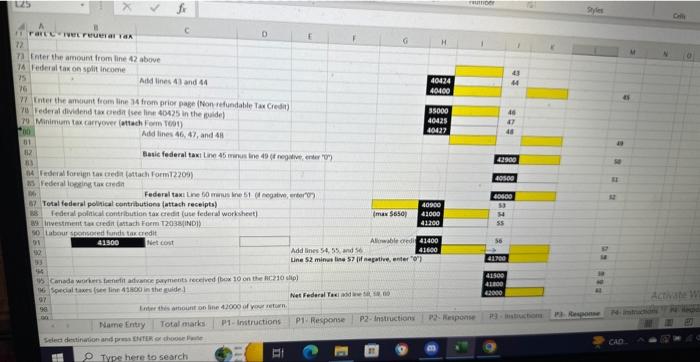

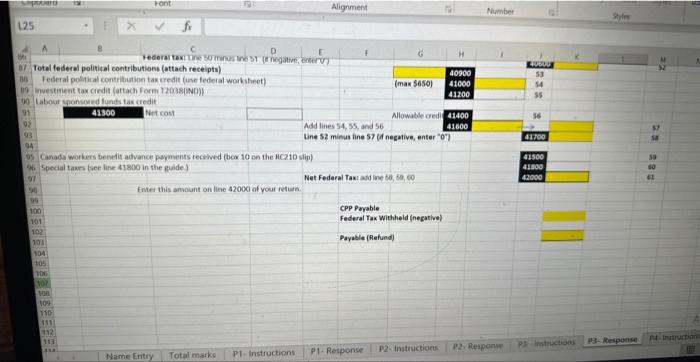

Andrea works for Short Line Limited as an engineer. She has 2022 taxable income of $105,000, which is 100% employment income. The maximum CPP and EI was withheld from her paycheque during the year, plus $10000 in federal income taxes. Her common law partner, Jamie, has a net income of $3000. Andrea is also a volunteer firefighter and volunteered for 600 hours for the local fire department in 2022 . She also bought a house this year for $440,000. Neither her nor her common law partner had owned and lived in another home in the last 5 yeazs medical expenses for their child, plus $2,000 in medical expenses for herself and $500 for Jamie. Andrea donated $4000 to the Canadian Mental Health Association during the year. She also made political contributions of $1,200 to a registered federal political party in 2022 . Required: Determine Andrea's federal tax payable or refundable for 2022. Answer on the "P3- Response" tab, in the yellow boxes. For any credit she is not eligible for, you may leave the yellow box blank. Fill in the appropriate numbers in each of the yellow boxes to solve problem 3 . If you have any rough work, please inciude in the green space fo the right finot required for this cuistion). For any credit Andree is not eligble for, you may leave the yeliow box blank for that credt. Step 5 - Federal tax (formerly schedule 1) cos or app consitinationit. (inter this amount on tine 46) Total federal non-refundable tax credita add lines 32 and 33. Part B - Federal Tax on Taxable Income bie I met your taxable income fiom ine 20000 of youl return 6) Use the amoun on lewe 35 to determine which. 61. anif of the follosing colurens you have to complete 6. Inter the amsuent from line 3 6. (tine ansount 64. Uine 10 munnas line 37 (rannot be negstive) 64. hate 6. Mulniphy line 38 by line 39 67. Tha con base arnound 70. Part C - Net federal Tax. 13. Finutr the anount from Hoe 47 above T4. Iederal tak on splicincicone \begin{tabular}{|l|l|l|} \hline 40424 & 43 \\ 40490 \end{tabular} 4 Isame Entiy Fotal marks P1-Instructions P1-Response P2. Pratructions 11) ratce- weine retuerat tax 7. 1) Eeter the arnoum from line 42 above is lederal tax on split income is 15 Pederat tas onspoit income Aide lines 41 and 44 . 11 Inter the amount from line 14 from prior page (Non refundable Tar Creda) 18 lederal dividend tax ovedit (see line 40425 in the guide) 4. Minimim tax carryower (atrech Form 1001) (1). Irsecial forvign tas aedat (attach formiz209) 63 federal loteing tas caedin 37. Total federal polinical contritutions (attach receipts) sis. Iedeal polakal contribution tax ceeda (use federal workheet) 90. Labeur sponsesed funds tak credit 01 a. 41300 14. Sorcal takes (ien line 418000 in the evide 1 16 94 99 93 Lither thes ariount on line 42000 of voer retion. Name fntry Totalmarks | P1-Imtructions P1- Response P2-Instructions | P2. Reiponise 125 (6.) A Bi) Totel federal political contributions (ottach receipts) 1in. Lederal politiral contritustion tas coedit (ise fedecal work aheet) (i9) Investment tax cerdit (attach form 12038(1NO) ) 00. Labour ynonsered funds tas credit. 91. 41300 fineticost 93 94 94 95. Canads workers benelit advance porments recelved (bor 10 on the HC210 silip) Q. Special tases (see line 41800 in the puide) 97 (iner this amount on line 42000 of your return. Net federal Taxt asd ine in, 59,60 \begin{tabular}{|l|l|} \hline 415004330043000 \\ \hline \end{tabular} CPP Payable Federal Tax Withheld (negative) Payable (Refund)