Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrea works for Short Line Limited as an engineer. She has 2020 taxable income of $100,000, which is 100% employment income. The maximum CPP

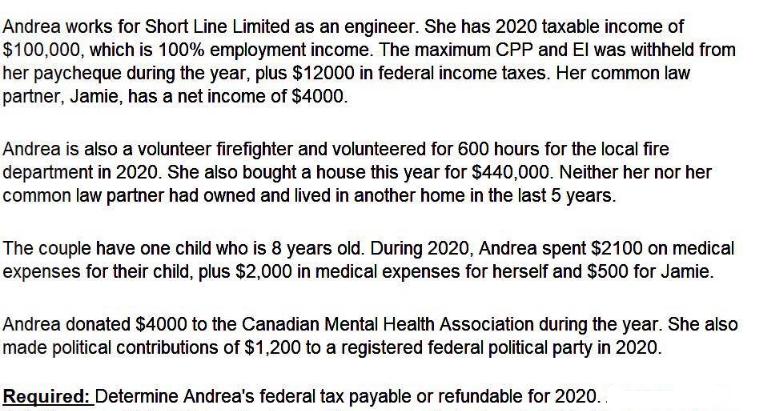

Andrea works for Short Line Limited as an engineer. She has 2020 taxable income of $100,000, which is 100% employment income. The maximum CPP and El was withheld from her paycheque during the year, plus $12000 in federal income taxes. Her common law partner, Jamie, has a net income of $4000. Andrea is also a volunteer firefighter and volunteered for 600 hours for the local fire department in 2020. She also bought a house this year for $440,000. Neither her nor her common law partner had owned and lived in another home in the last 5 years. The couple have one child who is 8 years old. During 2020, Andrea spent $2100 on medical expenses for their child, plus $2,000 in medical expenses for herself and $500 for Jamie. Andrea donated $4000 to the Canadian Mental Health Association during the year. She also made political contributions of $1,200 to a registered federal political party in 2020. Required: Determine Andrea's federal tax payable or refundable for 2020..

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To determine Andreas federal tax payable or refundable for 2020 we need to calculate her total income deductions and credits Lets break down the calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started