Answered step by step

Verified Expert Solution

Question

1 Approved Answer

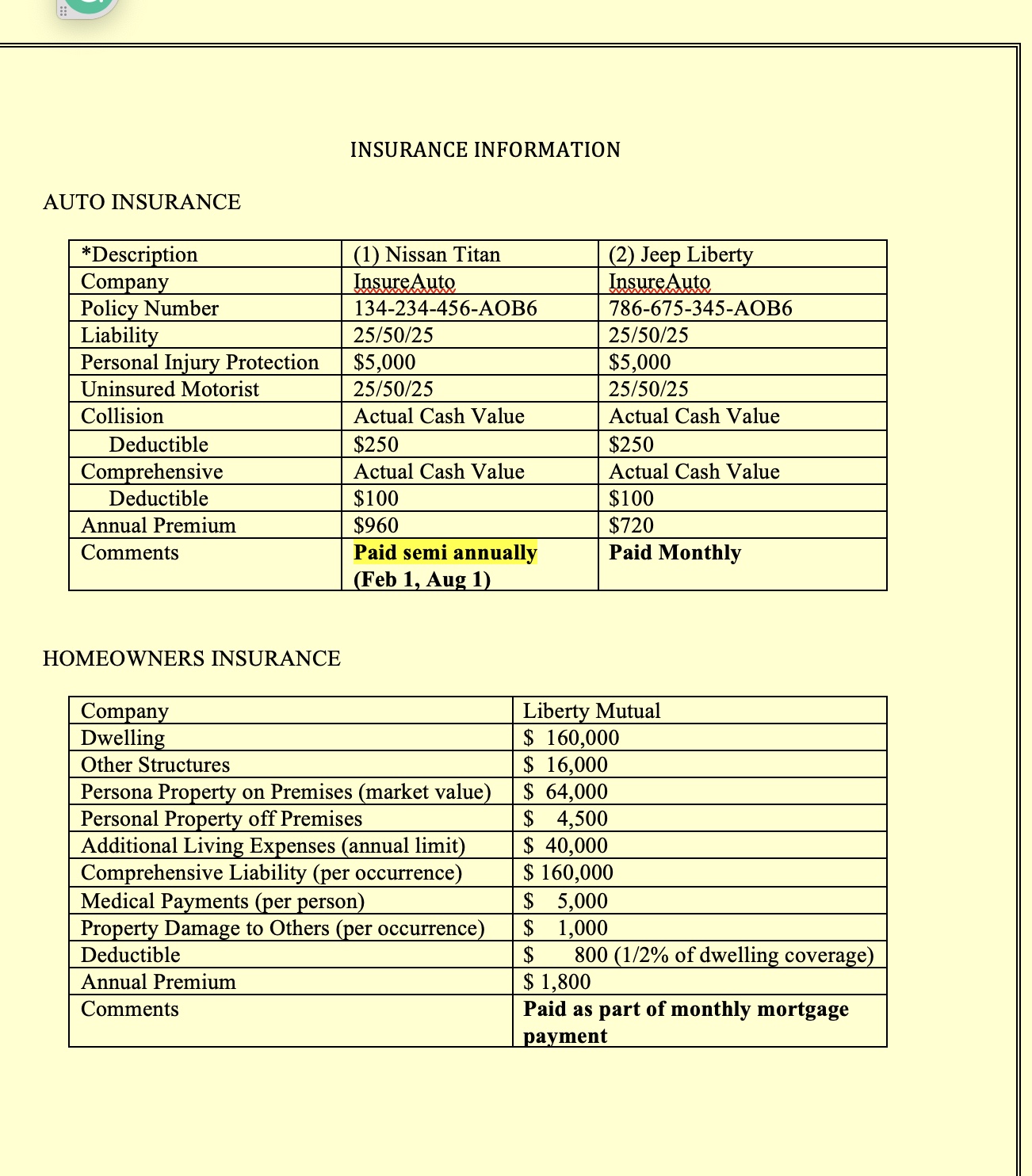

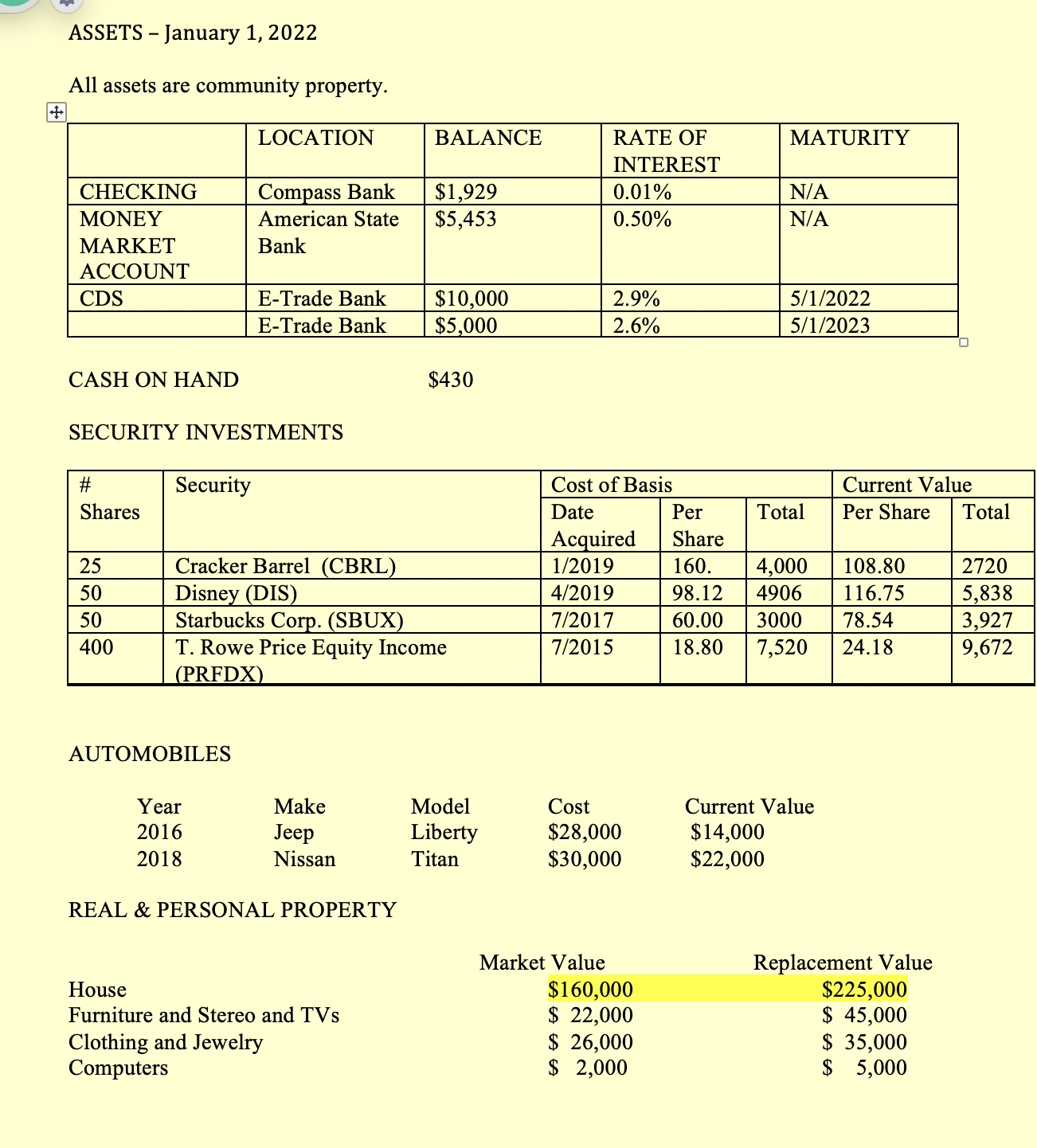

? Andrew and Cynthia Bates would like your help in starting their financial plan. Review their financial and personal information before answering the following questions.

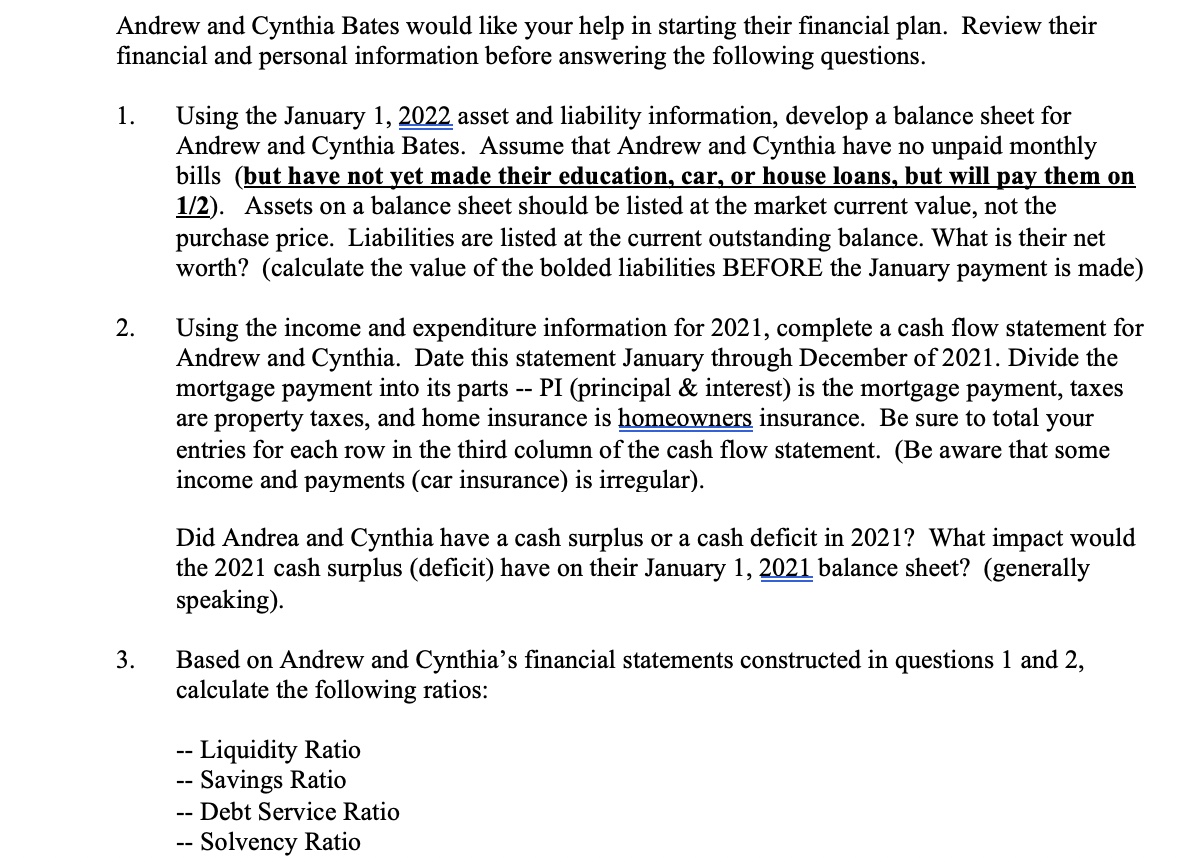

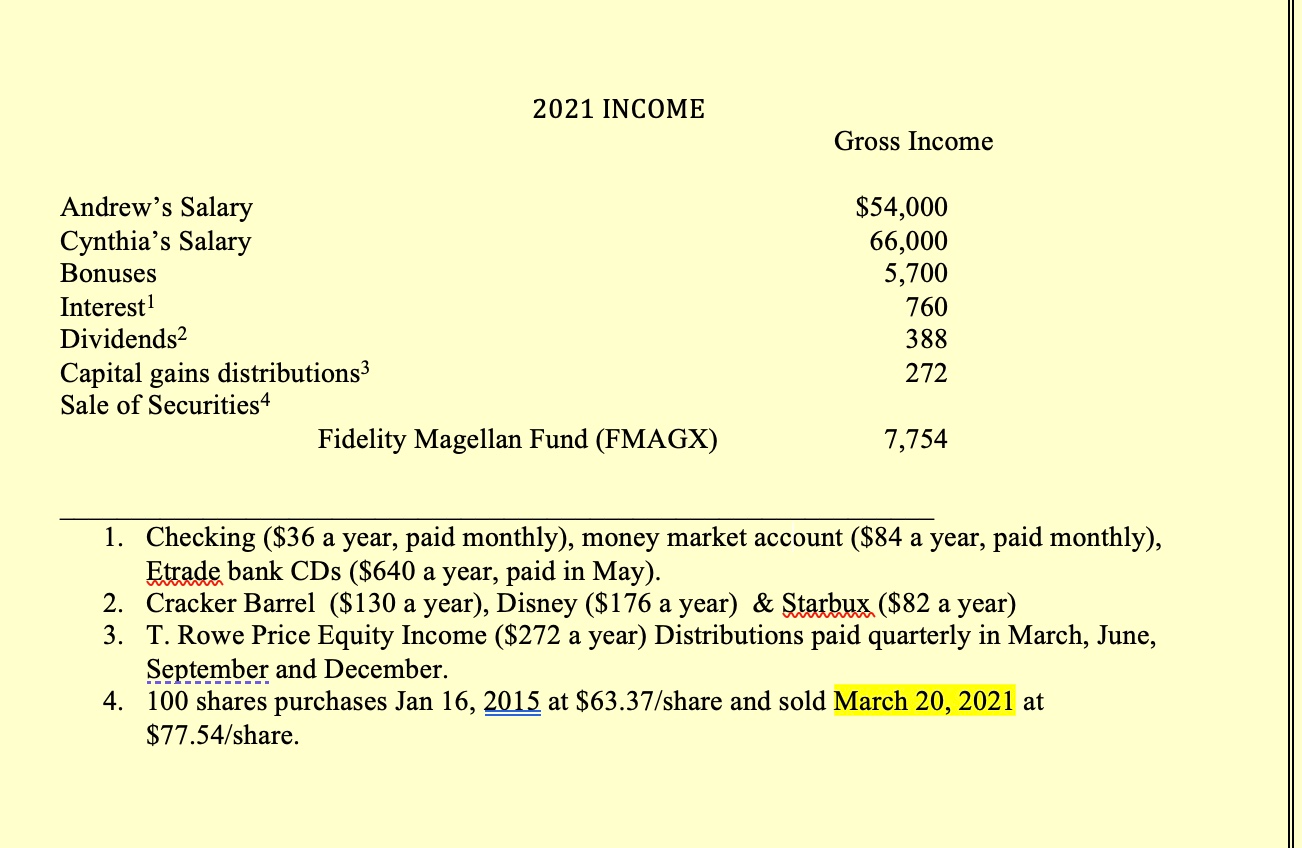

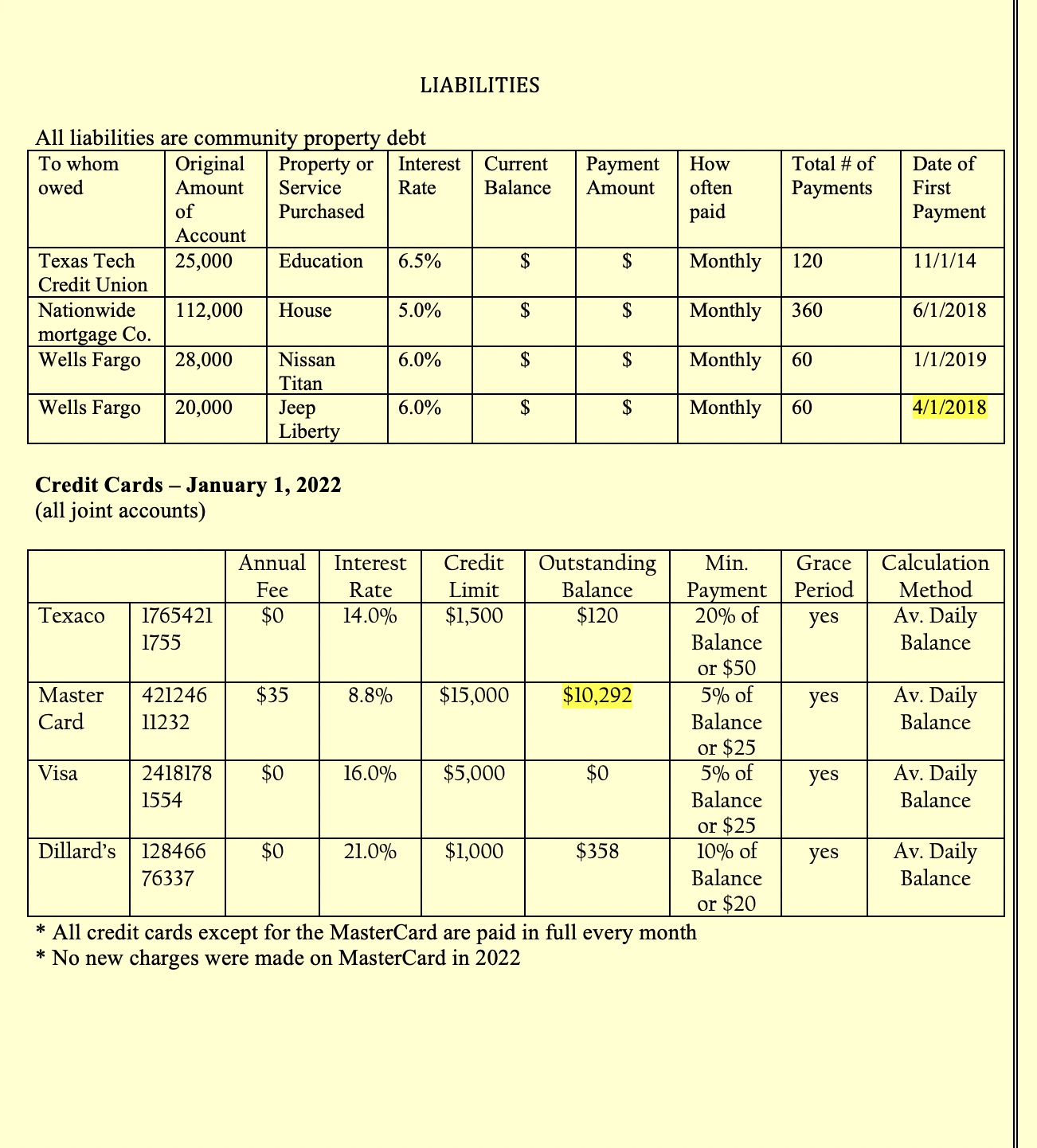

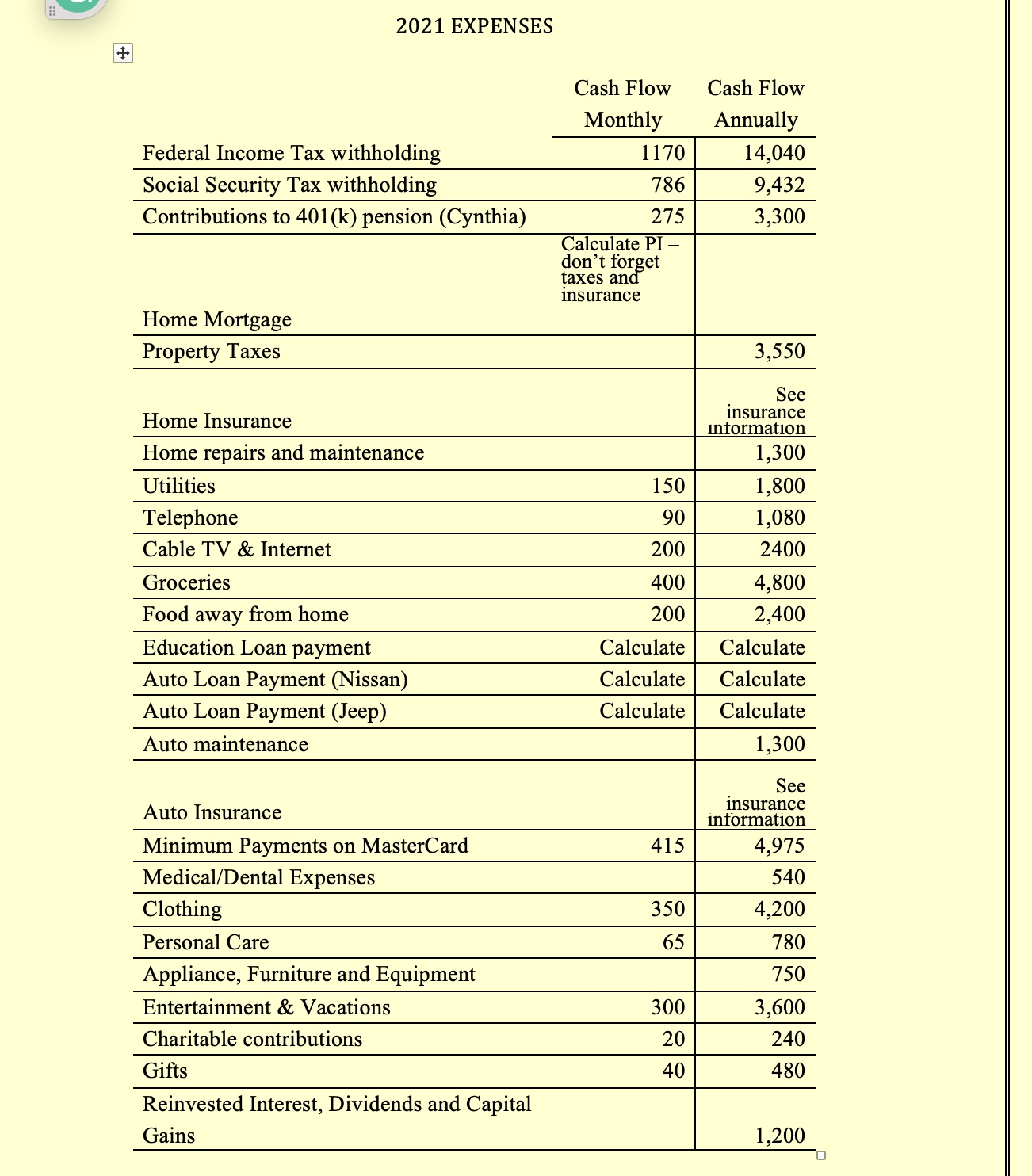

Andrew and Cynthia Bates would like your help in starting their financial plan. Review their financial and personal information before answering the following questions. 1. 2. 3. Using the January 1, 2022 asset and liability information, develop a balance sheet for Andrew and Cynthia Bates. Assume that Andrew and Cynthia have no unpaid monthly bills (but have not yet made their education, car, or house loans, but will pay them on 1/2). Assets on a balance sheet should be listed at the market current value, not the purchase price. Liabilities are listed at the current outstanding balance. What is their net worth? (calculate the value of the bolded liabilities BEFORE the January payment is made) Using the income and expenditure information for 2021, complete a cash flow statement for Andrew and Cynthia. Date this statement January through December of 2021. Divide the mortgage payment into its parts PI (principal & interest) is the mortgage payment, taxes are property taxes, and home insurance is homeowners insurance. Be sure to total your entries for each row in the third column of the cash flow statement. (Be aware that some income and payments (car insurance) is irregular). Did Andrea and Cynthia have a cash surplus or a cash deficit in 2021? What impact would the 2021 cash surplus (deficit) have on their January 1, 2021 balance sheet? (generally speaking). Based on Andrew and Cynthia's financial statements constructed in questions 1 and 2, calculate the following ratios: -- Liquidity Ratio -- Savings Ratio -- Debt Service Ratio Solvency Ratio

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Using the January 1 2022 asset and liability information develop a balance sheet for Andrew and Cynthia Bates Assume that Andrew and Cynthia have no unpaid monthly bills but have not yet made their ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started