Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Andrew died in April of this year at the age of 74 and is survived by his wife Kim who is 69 years old.

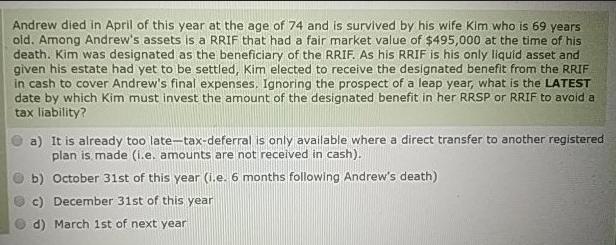

Andrew died in April of this year at the age of 74 and is survived by his wife Kim who is 69 years old. Among Andrew's assets is a RRIF that had a fair market value of $495,000 at the time of his death. Kim was designated as the beneficiary of the RRIF. As his RRIF is his only liquid asset and given his estate had yet to be settled, Kim elected to receive the designated benefit from the RRIF in cash to cover Andrew's final expenses. Ignoring the prospect of a leap year, what is the LATEST date by which Kim must invest the amount of the designated benefit in her RRSP or RRIF to avoid a tax liability? a) It is already too late-tax-deferral is only available where a direct transfer to another registered plan is made (i.e. amounts are not received in cash). b) October 31st of this year (i.e. 6 months following Andrew's death) c) December 31st of this year d) March 1st of next year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In Canada when an individual dies and the surviving spouse is named as the beneficiary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started