Question

Andys Autobody Shop has the following balances at the beginning of September: Cash, $10,400; Accounts Receivable, $1,200; Equipment, $36,900; Accounts Payable, $2,100; Common Stock, $20,000;

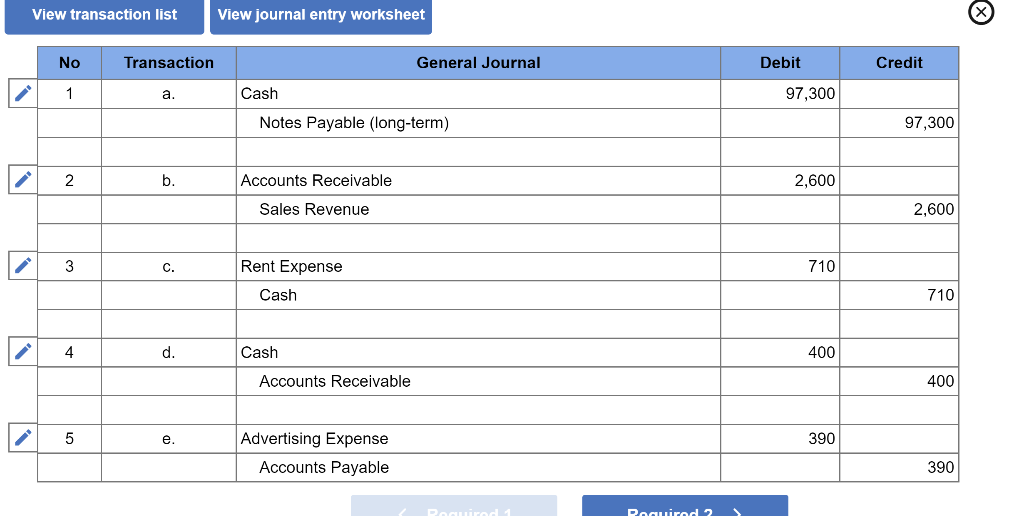

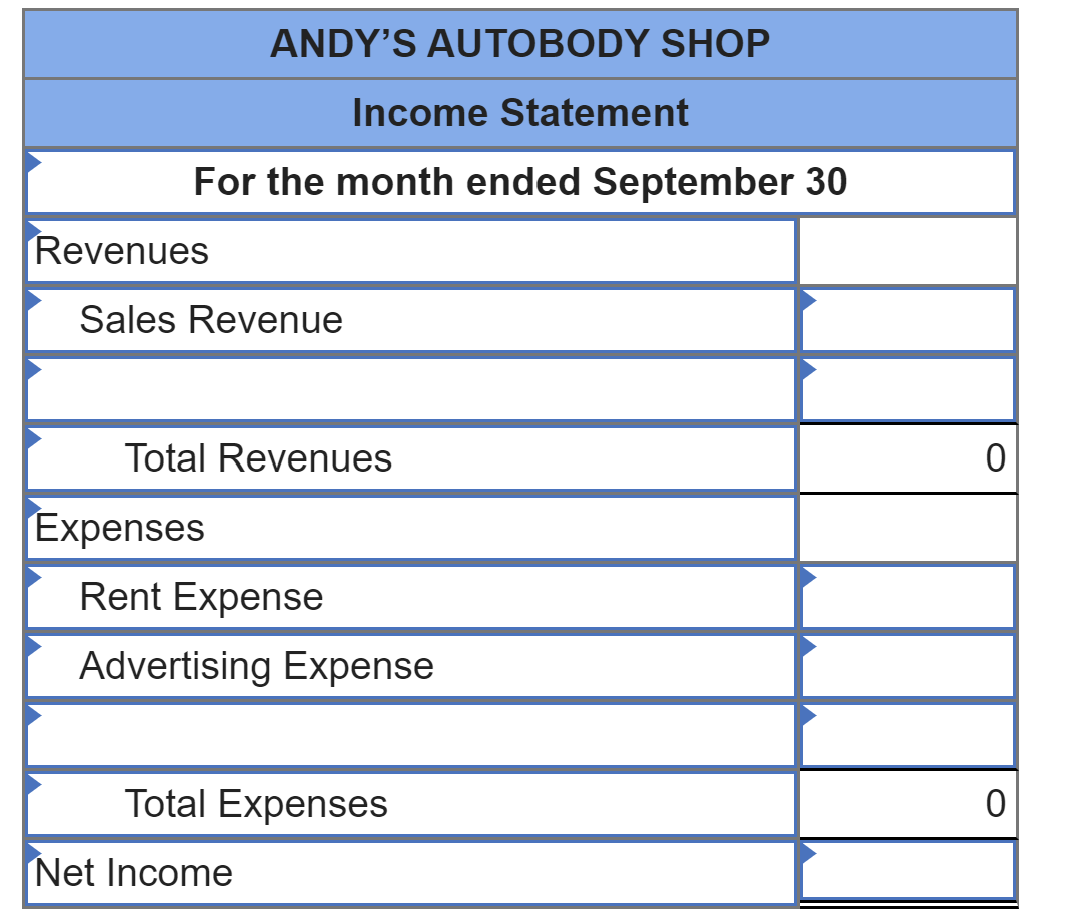

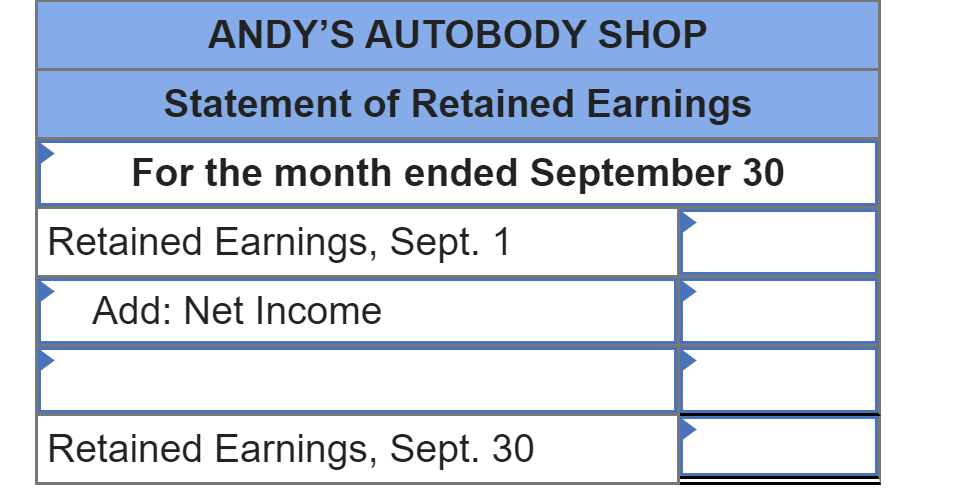

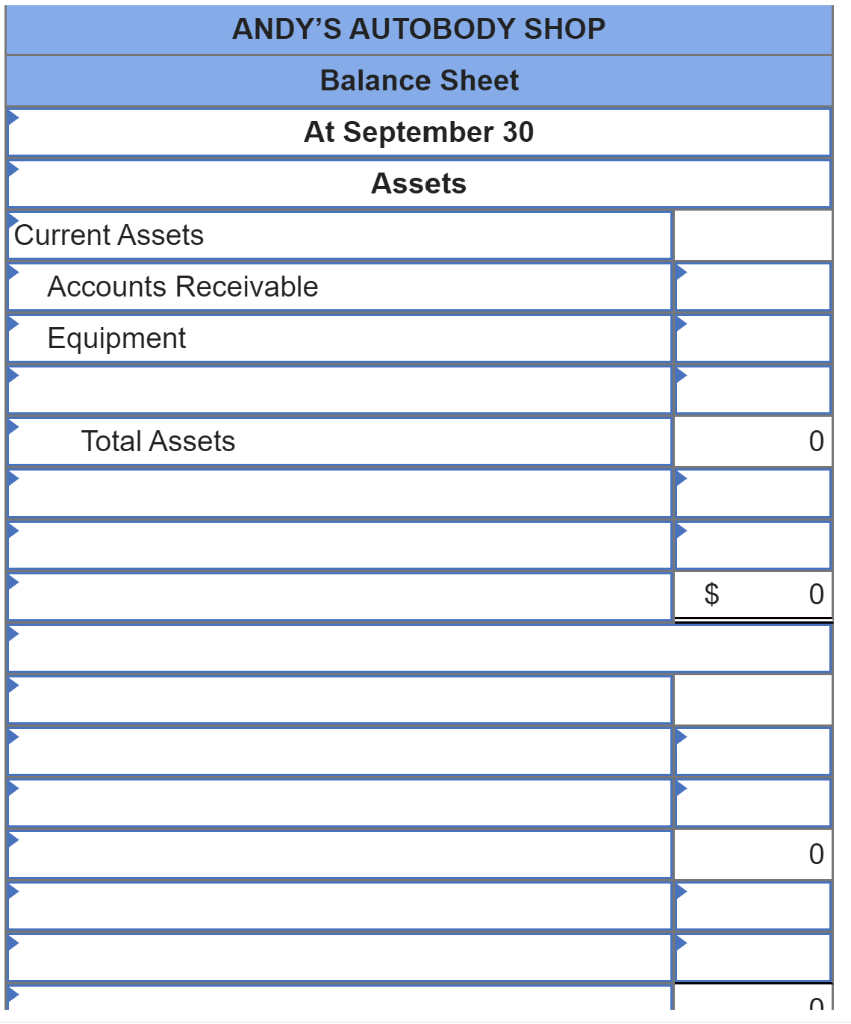

Andys Autobody Shop has the following balances at the beginning of September: Cash, $10,400; Accounts Receivable, $1,200; Equipment, $36,900; Accounts Payable, $2,100; Common Stock, $20,000; and Retained Earnings, $26,400. Signed a long-term note and received a $97,300 loan from a local bank. Billed a customer $2,600 for repair services just completed. Payment is expected in 45 days. Wrote a check for $710 of rent for the current month. Received $400 cash on account from a customer for work done last month. The company incurred $390 in advertising costs for the current month and is planning to pay these costs next month. Required: Prepare journal entries for the above transactions, which occurred during a recent month. Prepare an income statement. Prepare a statement of retained earnings. Prepare a classified balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started