Answered step by step

Verified Expert Solution

Question

1 Approved Answer

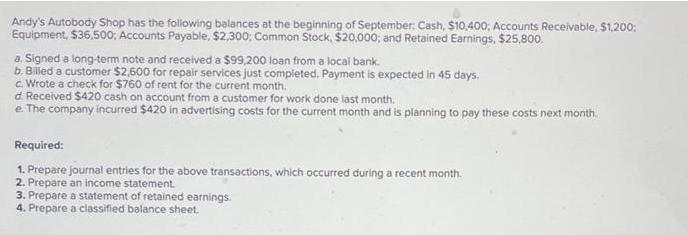

Andy's Autobody Shop has the following balances at the beginning of September: Cash, $10,400; Accounts Receivable, $1,200; Equipment, $36,500; Accounts Payable, $2,300; Common Stock,

Andy's Autobody Shop has the following balances at the beginning of September: Cash, $10,400; Accounts Receivable, $1,200; Equipment, $36,500; Accounts Payable, $2,300; Common Stock, $20,000; and Retained Earnings, $25,800. a. Signed a long-term note and received a $99,200 loan from a local bank. b. Billed a customer $2,600 for repair services just completed. Payment is expected in 45 days. c. Wrote a check for $760 of rent for the current month. d. Received $420 cash on account from a customer for work done last month. e. The company incurred $420 in advertising costs for the current month and is planning to pay these costs next month. Required: 1. Prepare journal entries for the above transactions, which occurred during a recent month. 2. Prepare an income statement. 3. Prepare a statement of retained earnings. 4. Prepare a classified balance sheet.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Entries Date Account Debit Credit Beginning Balances 20230901 Cash 10400 Accounts Receivab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started