Answered step by step

Verified Expert Solution

Question

1 Approved Answer

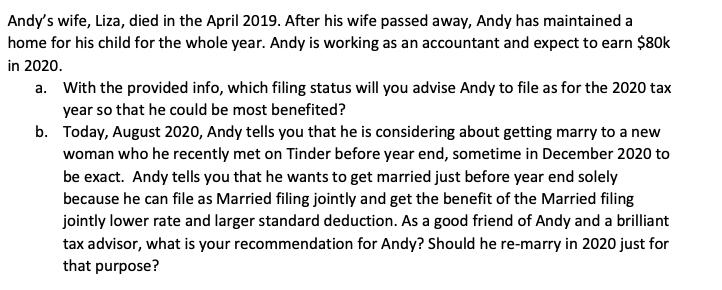

Andy's wife, Liza, died in the April 2019. After his wife passed away, Andy has maintained a home for his child for the whole

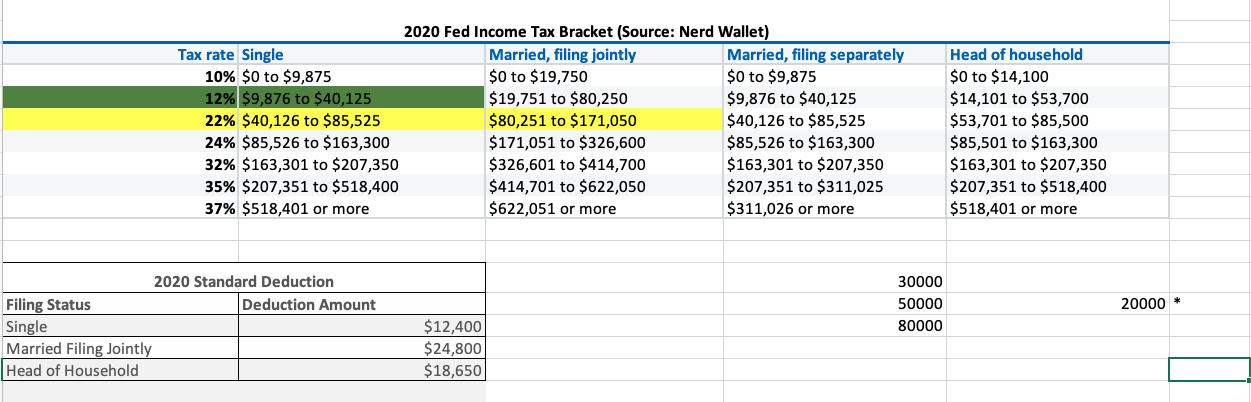

Andy's wife, Liza, died in the April 2019. After his wife passed away, Andy has maintained a home for his child for the whole year. Andy is working as an accountant and expect to earn $80k in 2020. a. With the provided info, which filing status will you advise Andy to file as for the 2020 tax year so that he could be most benefited? b. Today, August 2020, Andy tells you that he is considering about getting marry to a new woman who he recently met on Tinder before year end, sometime in December 2020 to be exact. Andy tells you that he wants to get married just before year end solely because he can file as Married filing jointly and get the benefit of the Married filing jointly lower rate and larger standard deduction. As a good friend of Andy and a brilliant tax advisor, what is your recommendation for Andy? Should he re-marry in 2020 just for that purpose? 2020 Fed Income Tax Bracket (Source: Nerd Wallet) Tax rate Single 10% $0 to $9875 12% $9,876 to $40,125 22% $40,126 to $85,525 24% $85,526 to $163,300 32% $163,301 to $207,350 35% $207,351 to $518,400 Married, filing jointly $0 to $19,750 $19,751 to $80,250 $80,251 to $171,050 $171,051 to $326,600 $326,601 to $414,700 Married, filing separately $0 to $9,875 Head of household $0 to $14,100 $14,101 to $53,700 $53,701 to $85,500 $85,501 to $163,300 $163,301 to $207,350 $207,351 to $518,400 $518,401 or more $9,876 to $40,125 $40,126 to $85,525 $85,526 to $163,300 $163,301 to $207,350 $414,701 to $622,050 $622,051 or more $207,351 to $311,025 $311,026 or more 37% $518,401 or more 2020 Standard Deduction 30000 Filing Status Deduction Amount 50000 20000 * $12,400 Single Married Filing Jointly Head of Household 80000 $24,800 $18,650

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a With the given info Andy should file return claiming as Head o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started