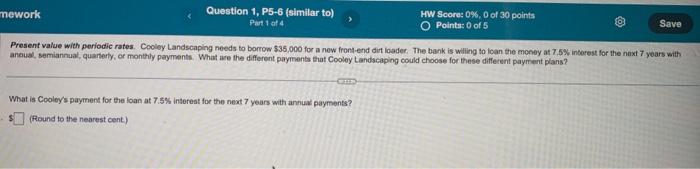

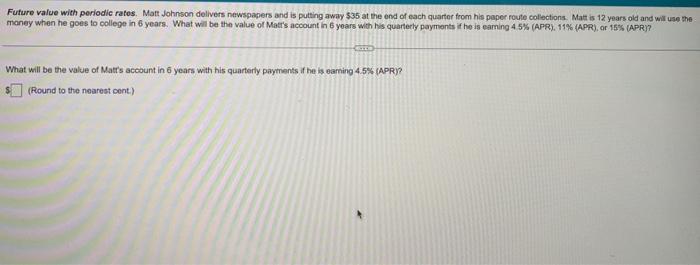

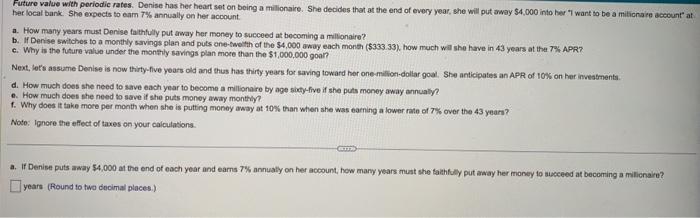

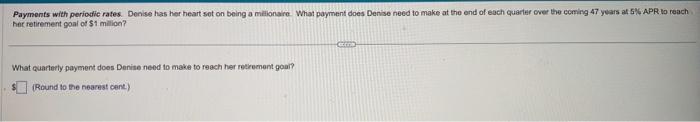

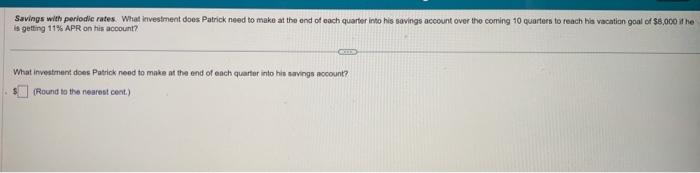

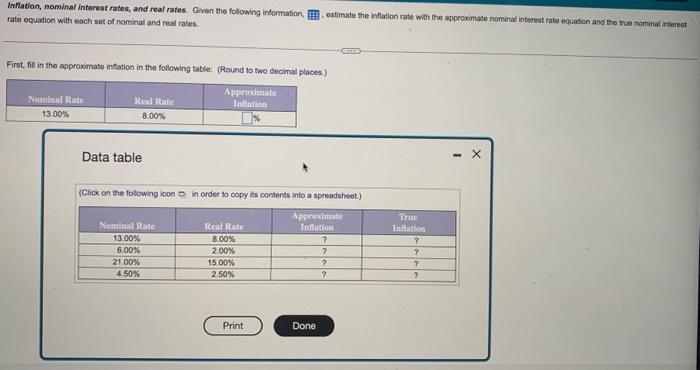

aneual, semiannual, quarterfy, of monthly payments, What are the different pityments that Cooley tandscaping could choose for these different payment plans? What is Cooley's payment for the loan at 7.5% insereat for the next 7 years with annuak payments? (Fiound to the nearest cent) What will be the value of Matr's account in 6 years with his quarterly paytnents if he is 0aming4.5% (APR)? (Round to the nearest cent.) Futuro value with periodic rates. Denise has her heart set on being a milionaire. Sine decides that at the end of every year, she will put away $4,000 into her "I want to be a miticnaies account" a her local bank. She expects to eam T\% annually on her account. a. How many years must Denise fathfully put arway her money to succeed at becoming a millonaire? c. Why is the future wilue under the monthly savings plan moce than the $1,000,000 goal? Next, lets assume Denise is now thirty-five yoars old and thus has thirty years for saving toward her one-milifor-dollar goal, Stse anticipates an ApR of toss on her investmenta. d. How much does she need to save each year to become a millionaire by age sick-five if she puts money away annualy? 6. How much does she need to save if she puts monoy away monthly? f. Why does it take more per month when she is putting money away at 10% than when she was earning a lower rate of 7% over the 43 years? Note: Ignore the effect of taxes on your calculations. a. If Denise puts away 54,000 at the end of each year and earns 7% annuaty on her account, how many years must she tathfuly put axay her money to auceed at becoming a milionaire? years (Riound to two decimal places) het retirement goal of 51 milion? What quarterly payment does Denise need to make to reach her retrement goar? (Round to the nearest cent) Savings with periodle rates. What itvestment does Patrick need to make at the end of each quarter into his savings account over tho coming 10 quarters to teach ha vacatian goal of $5,000 it he is getting 11\% APR on his account? What investment does Patick need to make at the end of each quarter into his navings nccocunt? (Round to the nearest cent.) Inflation, nominal interest rates, and real rates. Given the folowing information, , ostimate the inflation rate with the approximate nominal interest rate equasion and the troe nominal inierest rate equation with each set of nominal and real rates. First, fill in the approximate intation in the following table:. (Round to two decimal places) Data table (Click on the following ioon p in order to copy is contents into a spreadsheet)