Question

Angela Corporation (a private company) acquired all of the for $9,000,000 in cash. At the acquisition date, Eddy Tech $3,000,000. At the acquisition date,

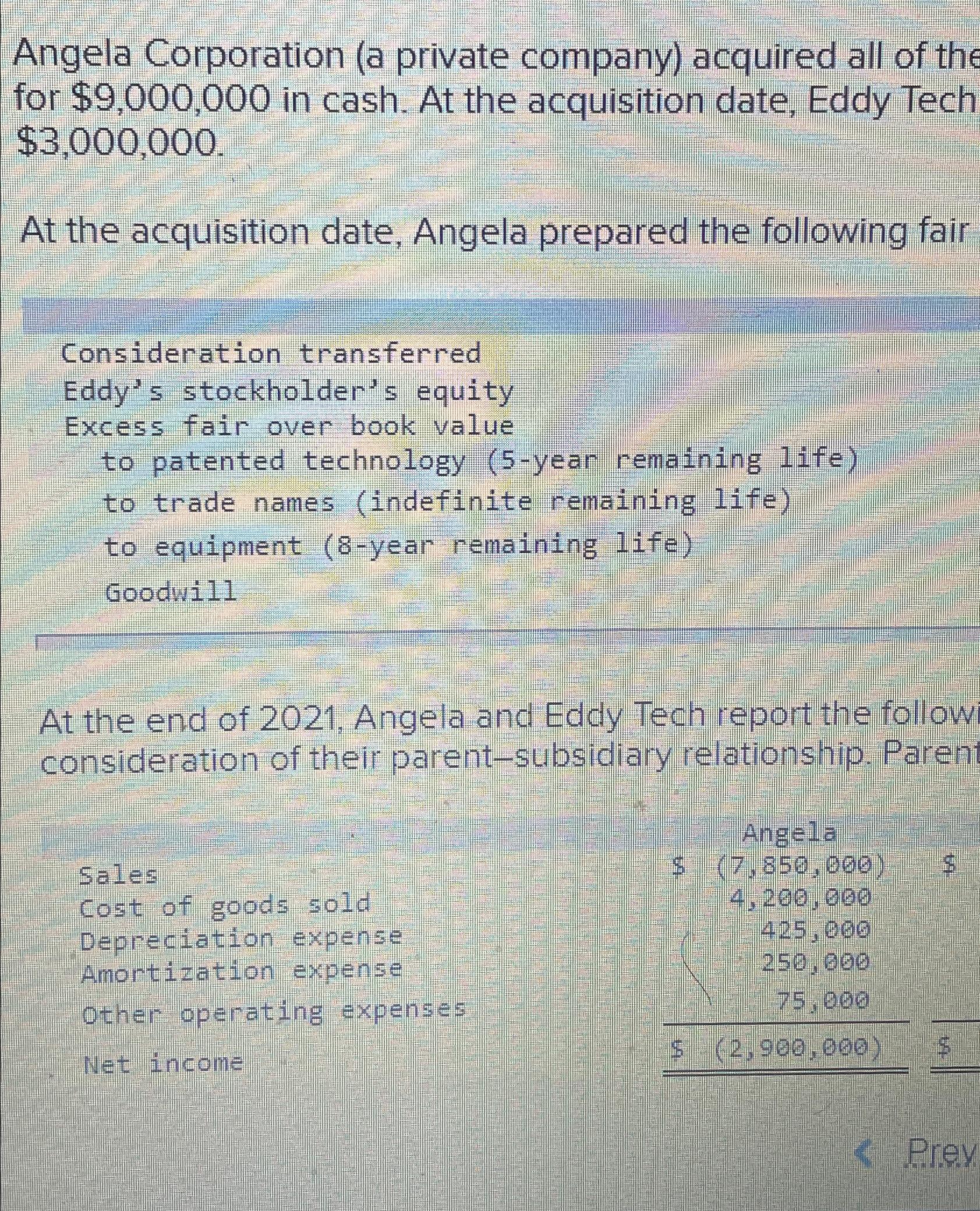

Angela Corporation (a private company) acquired all of the for $9,000,000 in cash. At the acquisition date, Eddy Tech $3,000,000. At the acquisition date, Angela prepared the following fair Consideration transferred Eddy's stockholder's equity Excess fair over book value to patented technology (5-year remaining life) to trade names (indefinite remaining life) to equipment (8-year remaining life) Goodwill At the end of 2021, Angela and Eddy Tech report the follow consideration of their parent-subsidiary relationship. Parent Sales Cost of goods sold Depreciation expense Amortization expense Other operating expenses Net income Angela $ (7,850,000) 4,200,000 425,000 250,000 75,000 $ (2,900,000) $ $ < Prev

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupni

13th edition

1259444953, 978-1259444951

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App