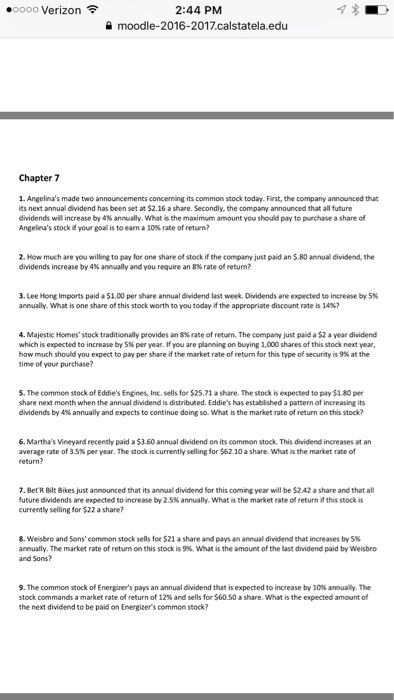

Angelna's mode two announcements concerning common stock today. First, the company announced that its next annual dividend has been set at $2.16 a share. Secondly, the company announced that all future dividends will increase by 4% annually. What is the maximum amount you should pay to purchase a share of Angelina's stock if your goal is to earn a 10% rate of return? How much are you willing to pay for one share of stock if the company just paid an $.80 annual dividend, the dividends increase by 4% annually and you require an 8% rate of return? Lee Hong imports paid a $1.00 per share annual dividend last week. Dividends are expected to increase by 5% annually. What is one share of this stock worth to you today if the appropriate discount rate is 14%? Majestic Homes' stock traditionally provides an 8% rate of return. The company just paid $2 a year dividend which is expected to increase by 5% per year. If you are planning on buying 1,000 shares of this stock next year, how much should you expect to pay per share if the market rate of return for this type of security is 9% at the time of your purchase? The common stock of Eddie's Engines. Inc, sells for $25.71 a share. The stock is expected to pay $1.80 per share next month when the annual dividend is distributed Eddie's has established a pattern of increasing its dividends by 4% annually and exprects to continue doing so. What is the market rate of return on this stock? Martha s Vineyard recently paid a $3.60 annual dividend on its common stock. This dividend increases at an average rate of 3.5% per year. The stock is currently selling for $62.10 a share. What is the market rate of return? Bet R Silt Bikes just announced that its annual dividend for this coming year will be $2.42 a share and that all future dividends are expected to increase by 2.5% annually. What is the market rate of return if this stock is currently selling for $22 a share? Weisbro and Sons' common stock sells for $21 a share and pays an annual dividend that increases by 5% annually. The market rate of return on this stock is 9%. What is the amount of the last dividend paid by Weisbro and Sons? The common stock of Energiner's pays an annual dividend that is expected to increase by 10% annually. The stock commands a market rate of return of 12% and sells for $60.50 a share. What is the expected amount of the next dividend be pad on Energiern's common stock