Answered step by step

Verified Expert Solution

Question

1 Approved Answer

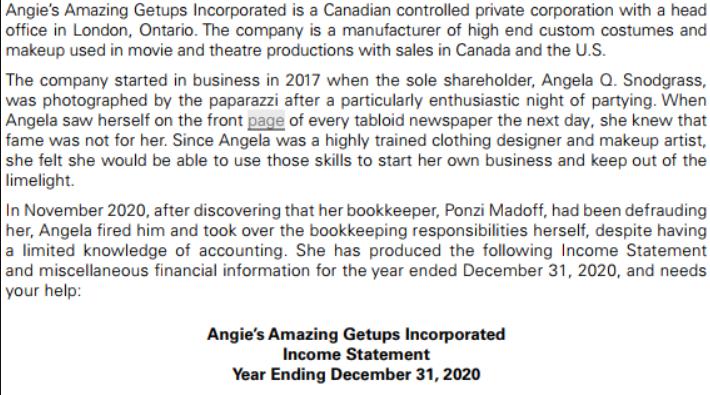

Angie's Amazing Getups Incorporated is a Canadian controlled private corporation with a head office in London, Ontario. The company is a manufacturer of high

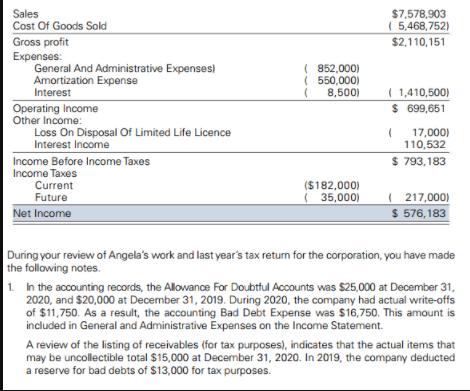

Angie's Amazing Getups Incorporated is a Canadian controlled private corporation with a head office in London, Ontario. The company is a manufacturer of high end custom costumes and makeup used in movie and theatre productions with sales in Canada and the U.S. The company started in business in 2017 when the sole shareholder, Angela Q. Snodgrass, was photographed by the paparazzi after a particularly enthusiastic night of partying. When Angela saw herself on the front page of every tabloid newspaper the next day, she knew that fame was not for her. Since Angela was a highly trained clothing designer and makeup artist, she felt she would be able to use those skills to start her own business and keep out of the limelight. In November 2020, after discovering that her bookkeeper, Ponzi Madoff, had been defrauding her, Angela fired him and took over the bookkeeping responsibilities herself, despite having a limited knowledge of accounting. She has produced the following Income Statement and miscellaneous financial information for the year ended December 31, 2020, and needs your help: Angie's Amazing Getups Incorporated Income Statement Year Ending December 31, 2020 Sales Cost Of Goods Sold $7,578,903 ( 5,468,752) Gross profit Expenses: General And Administrative Expensesi Amortization Expense Interest $2.110,151 ( 852,000) ( 550,000) 8,500) ( 1,410,500) $ 699,651 Operating Income Other Income: Loss On Disposal Of Limited Life Licence Interest Income ( 17,000) 110,532 $ 793,183 Income Before Income Taxes Income Taxes Current Future ($182,000) ( 217,000) $ 576,183 ( 35,000) Net Income During your review of Angela's work and last year's tax retun for the corporation, you have made the following notes. 1. In the accounting records, the Allowance For Doubtful Accounts was $25,000 at December 31, 2020, and $20,000 at December 31, 2019. During 2020, the company had actual write-offs of $11,750. As a result, the accounting Bad Debt Expense was $16,750. This amount is included in General and Administrative Expenses on the Income Statement. A review of the listing of receivables (for tax purposes), indicates that the actual items that may be uncollectible total $15,000 at December 31, 2020. In 2019, the company deducted a reserve for bad debts of $13,000 for tax purposes.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculation of Business Income Taxable Working notes in calculation of Income Amortization calculation 2 Calculation of Taxable income from Capital gains 4 Net Taxable income of Angies Incorp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started