Answered step by step

Verified Expert Solution

Question

1 Approved Answer

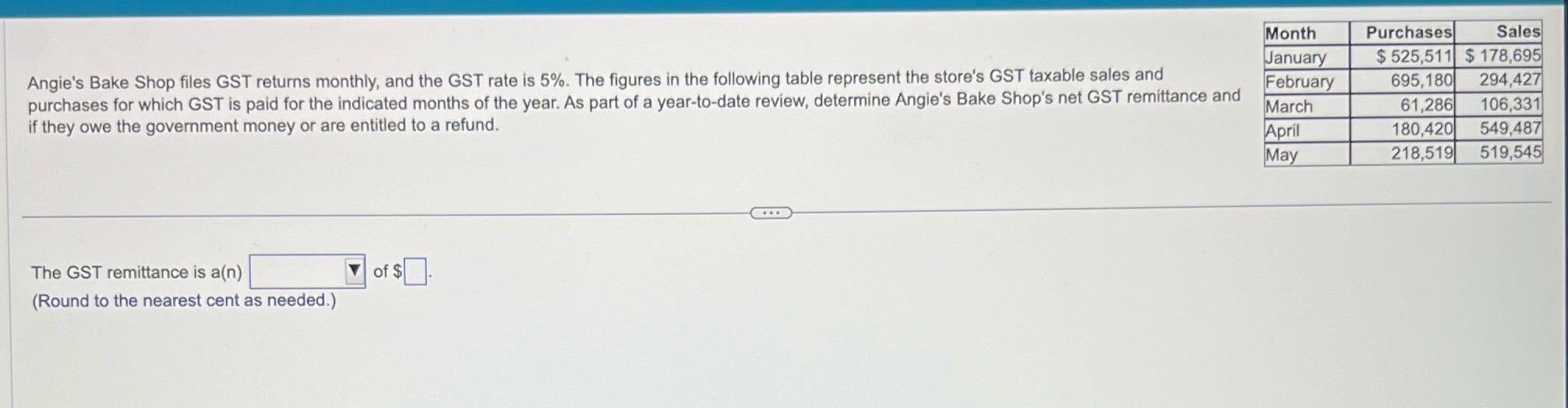

Angie's Bake Shop files GST returns monthly, and the GST rate is 5%. The figures in the following table represent the store's GST taxable

Angie's Bake Shop files GST returns monthly, and the GST rate is 5%. The figures in the following table represent the store's GST taxable sales and purchases for which GST is paid for the indicated months of the year. As part of a year-to-date review, determine Angie's Bake Shop's net GST remittance and if they owe the government money or are entitled to a refund. The GST remittance is a(n) (Round to the nearest cent as needed.) of $0. ww. Month January February March April May Purchases Sales $525,511 $178,695 695,180 294,427 61,286 106,331 180,420 549,487 218,519 519,545

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net GST remittance we need to subtract the GST paid on purchases from the GST colle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started